View Performance of the funds managed by the Fund Manager

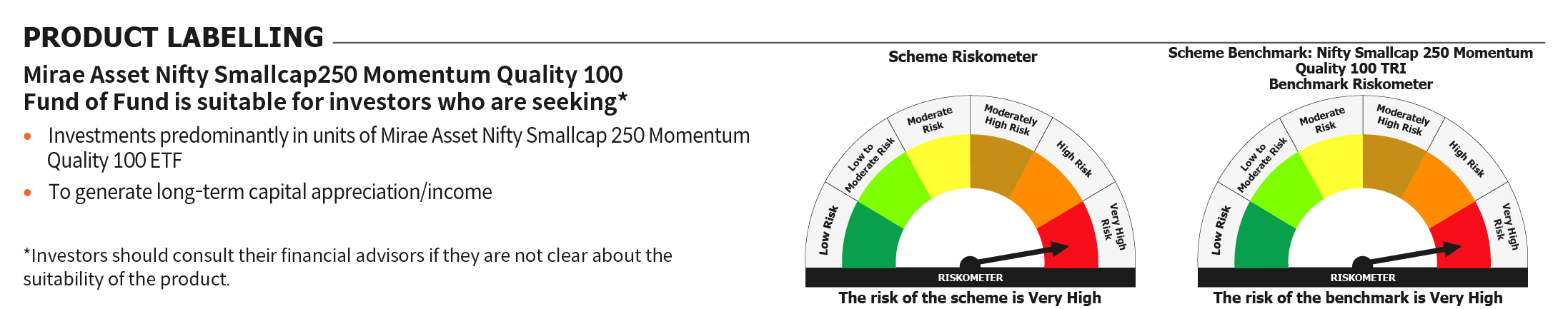

The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing in units of Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF. There is no assurance that the investment objective of the Scheme will be realized.

An open-ended fund of fund scheme investing in units of Mirae Asset Nifty Smallcap 250 Momentum Quality 100 ETF

Ms. Ekta Gala

Mr. Akshay Udeshi

Nifty Smallcap 250 Momentum Quality 100 TRI (Total Return Index)

Regular Plan and Direct Plan. Each of the above Regular and Direct Plan under the scheme will have the following Options / Sub-options:

(1) Growth Option and

(2) Income Distribution cum Capital Withdrawal

(IDCW) Option.

Investors can invest under the Scheme with a minimum investment of Rs. 5000/- and in multiples of Re. 1/- thereafter. Units will be allotted in the whole figures and the balance amount will be refunded, Even if it is falls below the minimum amount

Mini amount of Rs. 1,000/- and in multiples of Re. 1/- thereafter

Rs. 99/- and in multiples of Re. 1 thereafter.

Monthly and Quarterly: Rs. 1000/-(and in multiples of Re. 1/-)

if redeemed or switched out within 15 days from the date of allotment: 0.05%

if redeemed or switched out after 15 days from date of allotment: Nil

Not Applicable

Click here to view

Recommended Investment Horizon

3+ Years

Replicating Nifty Smallcap250 Momentum Quality 100 Index

Wealth Creation

*Data as on 31st May, 2022.

51

42

78

| Name | Allocation |

27.60%

27.60%

15.71%

15.71% 11.85%

11.85%

11.72%

11.72%

9.06%

9.06% 5.62%

5.62%

3.20%

3.20%

2.78%

2.78%

2.44%

2.44% 2.13%

2.13%

7.75%

7.75%*Data as on 28th February, 2021.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.