Hybrid Fund

Hybrid Fund

Hybrid funds invest across two or more asset classes (usually a mix of stocks and bonds). These funds aspire to strike a balance between risk and returns by aiming to generate income in the short-run and achieve wealth-appreciation in the long-run.

What are hybrid funds?

Hybrid funds are mutual fund schemes that are characterized by diversification within two or more asset classes. The term ‘hybrid’ itself indicates that the portfolio invests in multiple asset classes.

As these funds typically invest in a mix of equity, debt and other products, they are also known as asset allocation funds. As hybrid funds invest in a mix of assets, it offers investors a diversified portfolio. Therefore, through a single fund, the investors have an option for investing in multiple asset classes.

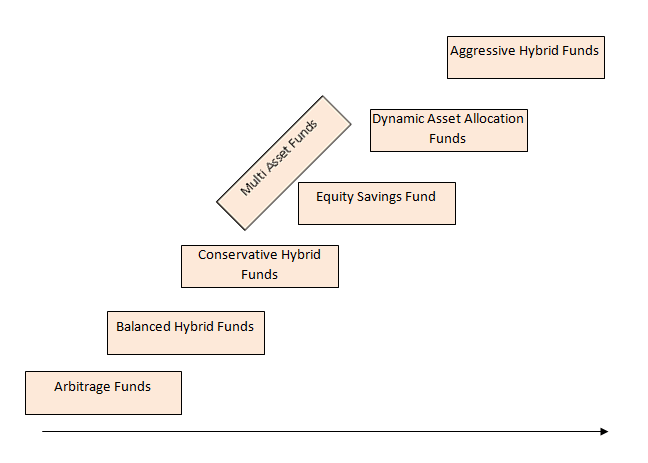

These funds offer schemes for varying levels of risk tolerance ranging from conservative to moderate, to moderately high and aggressive.

Features and Benefits

Hybrid mutual funds enjoy the flexibility of investing in both equities and debt securities simultaneously along with other asset classes like gold. Therefore, the portfolio may generate higher returns in the long term through the equity component while aiming to resisting the market volatility through the debt component.

Conservative investors can invest in hybrid funds which has higher debt component while aggressive investors can invest in hybrid fund with higher equity component. A number of studies have proven that investing according to asset allocation principles and rebalancing the portfolio on a regular basis, has given good returns and may be an effective way of meeting the investors financial goals. By maintaining a balance between different asset classes based on the scheme mandate, hybrid funds may help investors accomplish their respective short and long term financial goals.

- One of the crucial aspects of investors financial planning for achieving various financial goals is asset allocation. Hybrid funds offer a basket of asset allocation solutions for various investment needs and risk appetites through different type of funds.

- One of the important benefits of hybrid funds is that it provides automatic rebalancing of assets. Rebalancing of assets ensures that the asset allocation of your investments do not deviate from the targeted asset allocation as mandated by the scheme owing to market movements. Portfolio rebalancing is utmost important since different assets have different rates of returns and over a period of time the asset allocation may deviate from the targeted asset allocation. So from time to time, the fund manager rebalances the scheme portfolio in order to align it with the targeted asset allocation.

- Hybrid funds are relatively less volatile compared to pure equity funds as they invest in other asset classes too, like debt and gold etc.

- Hybrid funds investment is suitable for first time investors who are not exposed to the volatility of the equity markets.

- While hybrid equity funds funds enjoy lower taxation in the long term, the debt oriented hybrid funds enjoy the benefits of indexation for the long term capital gains.

Hybrid Fund Categories

Hybrid schemes

Hybrid mutual funds offer various types of funds suiting investors risk profile, investment time horizon and financial goals.

- Aggressive Hybrid funds: Also known as hybrid equity funds, these schemes invest 65 to 80% of their assets in equity or equity related securities and 20 to 35% in debt and money market instruments. Investors with moderately high risk taking ability may find this suitable for their investments. The investment objective of these schemes is capital appreciation and it enjoys taxation like equity funds.

- Conservative Hybrid funds: These schemes invest 10 to 25% of their assets in equity or equity related securities and 75 to 90% in debt and money market instruments. While the primary investment objective of these schemes is income generation, it may provide slightly higher returns in the long term due to the equity component of the scheme. Ideal for investors with moderately low risk appetites, these schemes are taxed like non-equity funds.

- Dynamic Asset Allocation funds: Also known as Balanced Advantage Funds, these schemes manage the fund portfolio asset allocation dynamically. Most of these funds increase equity allocation and reduce debt allocation when valuations of equity markets are low and vice versa. Suitable for investors who want to avoid high volatility and have moderately high risk appetites, may consider this fund for 4-5 years of investment time frame. These funds aim for both, income generation and capital appreciation, while minimising downside risk in volatile markets. These schemes usually enjoy taxation like equity funds. Investors should check scheme information document (SID) to know the taxation of the scheme before investments.

- Equity Savings funds: These funds invest minimum 65% of their assets in equity or equity related securities including derivatives and minimum 10% in various debt securities including money market instruments. These funds are allowed to hedge their equity exposure by using derivatives, thereby reducing the portfolio risk. Suitable for investors with moderate risk appetite, these funds aim for both, capital appreciation and income generation and are taxed as equity funds.

- Multi Asset funds: These funds invest at least 10% each in minimum 3 asset classes (e.g. equity, debt, gold, real estate etc.). Different assets may perform differently depending upon the changing market conditions, therefore, these funds help in risk diversification. Investors looking for exposure to asset classes like gold etc. over and above debt and equities, may consider investing in these funds.

- Arbitrage funds: These funds follow arbitrage strategy by exploiting the price differences of the same underlying security in the cash and derivative markets. These funds invest minimum 65% in equities and the rest in debt instruments. Among all hybrid funds, Arbitrage funds have the lowest risk profile and thus it is compared to liquid or ultra-short duration debt funds. These funds are suitable for conservative investors who are looking to invest for very short tenures. Arbitrage funds enjoy equity taxation.

Why invest in hybrid funds

Relatively Safer bet – Hybrid fund investments are considered relatively safer than pure equity funds as they invest in multiple assets like, equity, debt and gold etc. The presence of equities in the portfolio offers the potential to earn higher returns while debt or gold may provide cushion during the market volatility.

Fund for all risk profile – Hybrid funds has different category of funds which helps the investor choose one which suits his risk profile. For example – the conservative investors can invest in arbitrage funds or equity savings funds, moderate profile investors can invest in conservative hybrid fund and investors with moderately high risk profile can invest in hybrid equity funds, dynamic asset allocation funds or multi assets funds.

Fund for various investment needs – Hybrid funds offer a range of funds suiting your various short term and long term investments needs. For example – you can invest in arbitrage funds for few days to few months, equity savings funds for a year or two and hybrid aggressive funds, multi asset funds and dynamic asset allocation funds for meeting your long term investment needs.

Risk diversification: By investing in a hybrid fund, you invest in a diversified basket of equity, debt, gold and other securities which may save you from sector and company specific risks to a greater extent.

Small investments for bigger corpus: You can invest in hybrid mutual funds through systematic investment plans (SIP) mode also. Through SIPs you can conveniently invest small amounts at a set frequency and date in a disciplined way. The SIP amount decided by you, get debited automatically from your bank account on the specified date and invested in the hybrid fund of your choice.

Tax Advantage: Hybrid funds enjoy tax advantage. Funds which have 65% equity component in its portfolio are taxed as equity funds and those with less than 65% equity component are taxed as debt funds. Long term (investments held for greater than 1 year) capital gains from equity oriented hybrid funds are tax free upto Rs 1 Lakh in a financial year. Long term capital gain over Rs 1 Lakh is taxed at 10%. Short term (investments held for less than 1 year) capital gains are taxed at 15% for equity oriented hybrid funds.

Long term (investments held for more than 3 years) capital gains from debt oriented hybrid funds are taxed at 20% after allowing indexation. Short term (investments held for less than 3 years) capital gains are clubbed with investors total income and taxed according to the slab applicable for debt oriented hybrid funds.

FAQs

Hybrid mutual funds may charge a percentage of NAV for entry or exit. The load structure of the scheme has to be disclosed in its offer documents by the AMC. Suppose the NAV per unit is INR 30 and if the entry as well as exit load charged is 1%, then the investor buying the units would be required to pay Rs 30.30 (Rs 30 + 1% of Rs 30 i.e. 0.30 Paise) per unit. Likewise, those who redeem their units on the same day and the exit load are applied, will get only INR 29.70 (Rs 30 – 1% of Rs 30 i.e. 0.30 Paise) per unit. Currently, there is no entry load in mutual funds that means the investors can enter the fund at the NAV on the investment date and no additional charges are payable.

The exit load charged to the investor is credited to the scheme. The investors should take the exit load into consideration while investing as well as redeeming funds as these can affect their investment returns.

Effective January 01, 2013, SEBI has mandated all AMCs to compulsorily launch a direct plan for direct investments for all categories of funds. Direct plans are investments which are not routed through a mutual fund distributor. Direct plans generally have a lower expense ratio and no commission is paid to any intermediary. Direct plans also have a separate NAV.

The AMCs are required to disclose full portfolios of each scheme on a monthly basis on their website and also on their monthly fact sheet. The scheme portfolio shows investment made in each security i.e. equity, equity related instruments, debentures and government securities, etc. along with the respective quantities, market value and % weightage to the NAV.

With effect from this financial year (2020-21), dividends are taxable in the hands of the investor. The dividend received from hybrid mutual funds has to be added to the total income of the investor and taxed at the income tax rate applicable to the investor. TDS at the rate of 10% will be deducted by AMC, if the dividend from hybrid funds or any other mutual funds exceeds Rs 5,000 in a financial year (FY).

| Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

|---|---|---|

| Conservative Hybrid Fund | Investment in equity & equity related instruments- between 10% and 25% of total assets; Investment in Debt instruments-between 75% and 90% of total assets | An open ended hybrid scheme investing predominantly in debt instruments |

| Balanced Hybrid Fund @ | Equity & Equity related instruments- between 40% and 60% of total assets; Debt instruments- between 40% and 60% of total assets No Arbitrage would be permitted in this scheme | An open ended balanced scheme investing in equity and debt instruments |

| Aggressive Hybrid Fund @ | Equity & Equity related instruments- between 65% and 80% of total assets; Debt instruments- between 20% 35% of total assets | An open ended hybrid scheme investing predominantly in equity and equity related instruments |

| Dynamic Asset Allocation or Balanced Advantage Fund | Investment in equity/ debt that is managed dynamically | An open ended dynamic asset allocation fund |

| Multi Asset Allocation ## Fund | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes | An open ended scheme investing in , , (mention the three different asset classes) |

| Arbitrage Fund | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments-65% of total assets | An open ended scheme investing in arbitrage opportunities |

| Equity Savings Fund | Minimum investment in equity & equity related instruments- 65% of total assets and minimum investment in debt- 10% of total assets Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document. | An open ended scheme investing in equity, arbitrage and debt |