Women and Investing

The traditional social paradigm in urban India has been males are bread winners and women are home makers. Over the last several decades, this paradigm has been changing with increasing participation of women in the workforce. In the early 50s, the percentage of working women in urban female population was around 12% and it rose to around 16% in 2018-19 (source: NSSO). While the growth in percentage terms may seem modest, if we take into account the population growth over the last 7 decades, then it will be evident that many more women are working today compared to previous generations. The percentage of urban working women in middle income and upper income groups is still much compared to lower income groups, but this is expected to change in the future. With greater number of middle and upper income group women in the workforce, we are likely to see more women investing.

Women and investing - Changing social environment

In the previous generations, a middle or upper income group urban woman going to work was seen more as matter of her personal choice rather than being driven by necessity. Now, more women choose to get married at a later age or remain single and therefore need to become financially independent. The number of single mothers is also rising; these women need to work to raise their kids. More and more married women are going to work so that the family can keep up with higher living expenses and improving lifestyles.

Even in families where women are not working, there is increasing involvement of women in personal finances of the household. This is a very encouraging development for the well being of families and our society as whole. However, we still have a long way to go as far as women involvement in investments is concerned. In the changing social conditions, it is very important for women to take an interest in financial education and start making financial decisions which ensures their and their families’ financial security and success in financial goals.

Misconceptions about women investing

In our society there are several misconceptions about women and money. These misconceptions are largely a result of biases of a patriarchal society. These misconceptions have been perpetuated through several mediums and need to be corrected.

- Men are better savers than women. This is a wrong perception. A survey conducted by Bank of Baroda, shows that average balances of women in Jan Dhan Yojana is more than average balances of men (source: Times of India, August 2021). This shows that women can save more than men.

- Men are financially more prudent than women. Debt reduces your capacity to save since you have to pay interest on debt. It has been seen that men are likely to take on more debt compared to women (source: bankrate.com, November 2022). In most families, men usually make the big ticket purchases e.g. vehicles, properties etc; these purchases are financed by debt. Even if we compare an average middle income young single man with a young single woman, the man is likely to spend more on a vehicle e.g. the man buying a motorcycle and the woman buying a scooter. Higher cost means more debt and interest expense – less savings.

- Men are better investors than women. Studies in the US have shown women usually think more long term in investments, whereas men tend to short term investment decisions. Men trade much more than women; while women tend to make long term (buy and hold) investment decisions (source: Motley Fool, March 2023). This means men are likely to take more risks than women.

- Women are not interested in personal finance and investments. In a patriarchal, male dominated society, men are supposed to take care of money matters, while women take care of the family. With societal changes taking place in India e.g. shift from joint to nuclear families, women choosing to remain single, greater career growth opportunities for women, more and more women are seeking financial independence. Since the COVID-19 pandemic women are saving and investing more than men (source: Outlook India, November 2022).

Women are as capable as men, if not more in saving and investing. However, there are some common investing mistakes which women should avoid.

Young and single working women investing

- Avoid debt as much as possible: As per RBI data, households debt rose by Rs 6 trillion in FY 2021-22 to Rs 83.65 trillion (source: RBI Bulletin, September 2022). While women in general have a cautious attitude towards debt, you should ensure that your spending does not exceed your income. You should avoid purchasing expensive items on EMI, since these schemes usually have interest costs associated with them. Interest payments will reduce your savings capacity.

- Be disciplined in your spending and saving: Make a list of your regular expenses e.g. food, rent, utilities, fuel etc and discretionary expenses e.g. clothes, accessories, dining out, entertainment etc. You should set yourself a monthly savings target and stick to it. You should be prepared to cut down on some discretionary expenses if required to increase your savings.

- Saving is not enough: You should invest your savings to create wealth for your long term financial goals. If you keep your savings in your savings bank account or park them in low interest rate fixed deposits, your post tax return may be lower than the inflation rate. Your post tax returns should be higher than the inflation rate (inflation adjusted returns) if you want to create wealth.

- Start investing through SIP: You may start investing from your regular savings through mutual fund systematic investment plan (SIP). Through SIP, you can invest fixed amounts every month (or any other interval). You can invest over long investment tenures and may benefit from the power of compounding.

- Invest in your personal development: Most of the time, we get so involved in our work and social life that we do not find time for our personal development. Investing in your personal development is as important as investing in Bank FDs, mutual funds and shares. In the modern age, you need to up-skill yourself continuously to create career growth opportunities for yourself. You may enrol in a professional skills development or soft skills course. You may engage with a career coach, who can give unbiased guidance on development. If you invest in your personal development, you will progress in your career. With career growth, your income and savings will also increase.

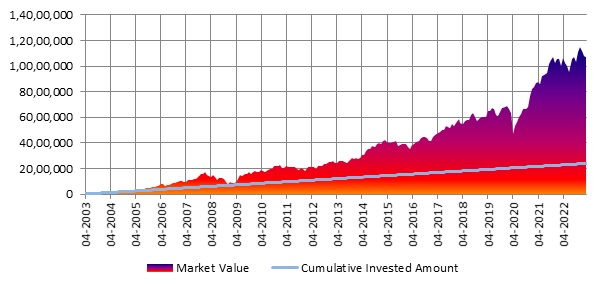

The chart below shows the wealth through a monthly SIP of Rs 10,000 in Nifty 50 TRI over the last 20 years. With a cumulative investment of Rs 24 lakhs over 20 years, corpus of nearly Rs 1.1 crores (as on 31st March 2022).

Source: National Stock Exchange, Advisorkhoj Research. Period: 01.04.2003 to 31.03.2022. Disclaimer: Past performance may or may not be sustained in the future.

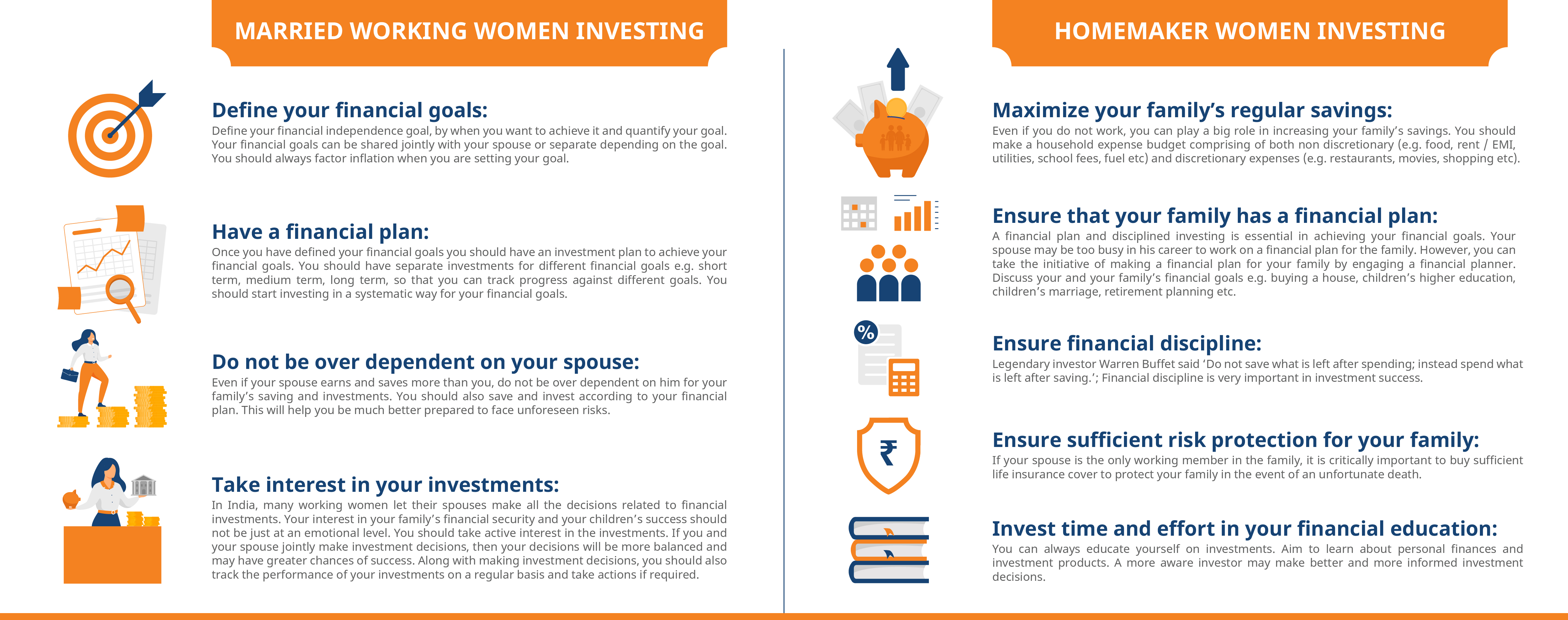

Married working women investing

- Define your financial goals: Define your financial independence goal, by when you want to achieve it and quantify your goal. Your financial goals can be buying a house, children’s higher education, children’s marriage, retirement planning, wealth creation etc. Your financial goals can be shared jointly with your spouse or separate depending on the goal. You should always factor inflation when you are setting your goal. You can take the help of a certified financial planner or a financial advisor if you need help in goal setting

- Have a financial plan: Once you have defined your financial goals you should have an investment plan to achieve your financial goals. You should have separate investments for different financial goals e.g. short term, medium term, long term, so that you can track progress against different goals. You should start investing in a systematic way for your financial goals.

- Do not be over dependent on your spouse: Even if your spouse earns and saves more than you, do not be over dependent on him for your family’s saving and investments. You should also save and invest according to your financial plan. This will help you be much better prepared to face unforeseen risks like serious illnesses, involuntary loss of employment, unfortunate death etc.

- Take interest in your investments: In India, many working women let their spouses make all the decisions related to financial investments. Your interest in your family’s financial security and your children’s success should not be just at an emotional level. You should take active interest in the investments. Anatomies of male and female brains reveal that men are more task-oriented while women can think about multiple priorities at the same time. If you and your spouse jointly make investment decisions, then your decisions will be more balanced and may have greater chances of success. Along with making investment decisions, you should also track the performance of your investments on a regular basis and take actions if required.

Homemaker women investing

In India, many homemakers do not have much involvement in the family’s finances and investments. Whether you are working or not, your interest in your family’s financial security is high.

- Maximize your family’s regular savings: Even if you do not work, you can play a big role in increasing your family’s savings. You should make a household expense budget comprising of both non discretionary (e.g. food, rent / EMI, utilities, school fees, fuel etc) and discretionary expenses (e.g. restaurants, movies, shopping etc). Try to cut down on discretionary expenses to increase your savings.

- Ensure that your family has a financial plan: A financial plan and disciplined investing is essential in achieving your financial goals. Your spouse may be too busy in his career to work on a financial plan for the family. However, you can take the initiative of making a financial plan for your family by engaging a financial planner. Discuss your and your family’s financial goals e.g. buying a house, children’s higher education, children’s marriage, retirement planning etc. Provide other inputs to your financial planners which will enable him / her to make a financial plan for your family. Discuss the financial plan with your spouse and have an actionable investment plan.

- Ensure financial discipline: Legendary investor Warren Buffet said 'Do not save what is left after spending; instead spend what is left after saving.' Financial discipline is very important in investment success. For example, you should try to ensure that you have sufficient balance in your savings bank account for your SIP investments. You should avoid emotional biases in investing. For example, you should resist the urge to redeem your investments when the market is falling because it will harm your financial interests in the long term.

- Invest time and effort in your financial education: You can always educate yourself on investments. Aim to learn about personal finances and investment products. A more aware investor may make better and more informed investment decisions.

Investors should consult with their mutual fund distributors/ financial advisors to know what is flexi cap mutual funds and if it is suitable for their investment needs basis their risk profile.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.