View Performance of the funds managed by the Fund Manager

Market Volatility or a flock of

birds?

About the fund

The investment objective of the scheme is to capitalize on the potential upside of equities while attempting to limit the downside by dynamically managing the portfolio through investment in equity & equity related instruments and active use of debt, money market instruments and derivatives. However, there is no assurance or guarantee that the investment objective of the scheme will be realized.

INVESTMENT FRAMEWORK

The Scheme may utilise internal proprietary model to monitor the market so as to ascertain the asset allocation opportunities from time to time. This model may provide broad guidance regarding the relative valuation levels and scope of the market opportunities as may be relevant towards investing. While the Fund manager may utilise this model as a broad indicator; the Fund manager shall have the final prerogative to apply his/her own discretion and judgement while determining the allocation percentage, the allocation interval and the allocation approach as may be appropriate to pursue the investment objective of the fund.

The Scheme will seek to measure the market valuation levels by simultaneously gauging both the Price to Earnings and the Price to Book levels of the Nifty 50 Index over periodic intervals. These two measures will be normalised vis-à-vis their long-term historical observations and would be aggregated together into a composite score. This score may be applied to indicate the percentage deviation from the long-term historical average assuming a bell-curve distribution. The size of this deviation from the average in turn may guide the net equity allocation in the scheme. However, the fund manager would hold the final prerogative to further calibrate/increase/decrease the allocation depending on the emergent macro view and assessment.

WHY INVEST IN THE FUND :

- The fund follows a fundamental approach to assess equity market valuations at any given point of time to ascertain the desired net equity position of the fund.

- The fund therefore endeavors to provide an optimum equity market participation for an investor. The net equity and arbitrage position exposure helps to achieve equity capital gains taxation for the investor at all points of time. The debt exposure endeavors to provide an income approach to the fund.

- The fund attempts to provide a risk adjusted return experience while smoothening the volatility by actively managing the net equity position in the fund.

Fund facts

Type of Scheme:

(An open ended dynamic asset allocation fund)

fund manager:

Harshad Borawake (Equity portion)

Mahendra Kumar Jajoo (Debt portion)

benchmark index:

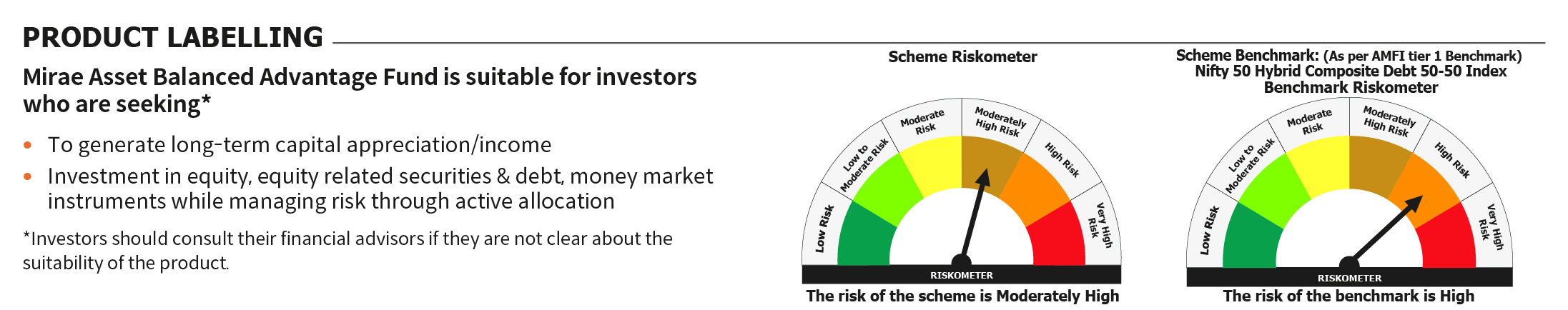

Nifty 50 Hybrid Composite Debt 50:50 Index

minimum investment amount:

Rs. 5000/- & in multiples of Re. 1/- thereafter

Plan & Options:

Plans - Regular Plan and Direct Plan.

Options - Growth Option & Income Distribution cum Capital Withdrawal option (IDCW) – Payout & Reinvestment option

Applicable Loads*:

Entry Load – Nil

Exit load:

Click here to View

Post NFO:

Minimum Additional Purchase Amount - Rs. 1000/- and in multiples of Re. 1/- thereafter.

Redemption:

T+3 Business days

Minimum SIP Amount:

Monthly and Quarterly: Rs. 1000/- (in multiples of Re. 1/- thereafter)

Taxation:

Click here to View

TER ( Total Expense Ratio)

Click here to view the latest TER.

*: For investors who have opted for Systematic Withdrawal Plan (SWP) Facility, please refer SID for applicable exit load

Investment Horizon

3+ Years

Equity taxation

Net asset value

For Historic NAV Click here

Returns with asset class

TOTAL NO. OF HOLDING

35

Holdings

| Name | Allocation | |

| Equity Holdings | ||

| 1 | Axis Bank Limited | 5.25% |

| 2 | Adani Ports and Special Economic Zone Limited | 4.16% |

| 8 | AU Small Finance Bank Limited | 3.58% |

| 4 | Sun TV Network Limited | 3.30% |

| 10 | HDFC Bank Limited | 2.97% |

| 7 | State Bank of India | 2.90% |

| 7 | Tech Mahindra Limited | 2.87% |

| 3 | Escorts Limited | 2.86% |

| 5 | Maruti Suzuki India Limited | 2.85% |

| 6 | InterGlobe Aviation Limited | 2.76% |

| 6 | InterGlobe Aviation Limited | 2.76% |

| 11 | Others | 30.46% |

Allocation

16.73%

16.73% 9.62%

9.62% 6.51%

6.51% 6.29%

6.29% 4.46%

4.46% 3.30%

3.30% 2.69%

2.69% 2.54%

2.54% 2.20%

2.20% 1.68%

1.68% 7.95%

7.95%Sector allocation historic

Diversified: flexibility to invest across sectors, themes & stylesAsset Allocation

Rating Profile

*Data as on 30th September, 2021.

Downloads

Thank you

for showing interest

Our representative will get in touch with you shortly.

Thank you

for showing interest

Our representative will get in touch with you shortly.

Thank you

for submitting your request

Our representative will get in touch with you shortly.

Our Calculation Formula

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Our Calculation Formula

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

Redirecting...

Thank you sharing your details.

We will email you the cobranding collateral shortly.