Myth Busters

Myth Buster Series

Myth Buster Series: Equity

Myth 1 : Investing in schemes with lower NAVs can generate gains

Fact : The Net Asset value (NAV) is simply the price at which a unit of particular scheme can be bought or sold. So, investing in schemes having a NAV of Rs. 50 or Rs. 500 is no where related to the gains you can expect from your investments. Some of the factors that may be considered are rate of return , the performance and volatility of the scheme, etc to name a few.

Myth 2 : If a fund announces dividend, then it is a good time to buy.

Fact : Dividends are announced based on the surplus profit collected by the fund from its holdings. This surplus profit is retained within the fund until it is paid out to the unit holders and reflects in the NAV of the scheme. When the dividend is paid out, the NAV drops reflecting that change. Hence, investors don’t gain anything by timing the purchase.

Myth 3: Sell when the NAV is high and invest in schemes with low NAVs

Fact : When you buy a share, you track the share price and sell when it rises to a certain level above the purchase price. Mutual Fund schemes invests the amount collected by the investors in shares The NAV of a mutual fund is the value of the scheme’s assets minus its liabilities, divided by the total number of units. A high NAV does not mean that the fund will offer great returns and neither does a low NAV means otherwise.

Myth 4 : Mutual Fund investments are all about timing

Facts : Most investors fall for this. Attempts to time market are met with disasters and investors are usually advised against it. Investors may Opt for Systematic Investment Plan (SIP) or a Systematic Transfer Plan (STP) and aim to benefit from the Rupee Cost Averaging of your investment.

Myth 5: SIP and STP is same.

Facts : Though they sound same and have similar benefits but the working is a bit different.

In SIP you invest a fix amount at regular intervals. When the market are higher, lesser units are purchased and when they are

low, the number of units purchased is higher. Over a long investment window, the cost averages offering a lower overall purchase price. STP simply means that a fixed amount on a predetermined period as per the mandate submitted

by the investor is transferred from one scheme to another

Myth 6 : Dividend pay-out/Growth is all the same

Fact : No. In a dividend pay-out option the dividend declared by the scheme is paid out to the investor. In the growth option, it is retained in the scheme and is reflected in the Net Asset Value (NAV) of the scheme.

The

dividend pay-out option offers regular cash flow (based on the availability of distributable surplus), while the growth option gives you a compounded benefit through a higher NAV.

Myth 7 : Investment in Mutual Fund carries a higher risk than the stock market

Fact : A mutual fund invests in a wide array of equity and/or debt instruments as defined in its investment objective. The fund manager selects stocks meticulously to minimize the risk and maximise diversity. This makes investment in mutual fund less risky than direct investments in stocks. However, investors are requested to consult their financial advisors before investing.

Myth Buster Series

Myth Buster Series: Debt

Myth 1: Fixed income funds are as risky as equity

Fact: The risk in fixed income schemes is usually less than equity schemes because: Issuer of fixed income instruments is contractually obliged to pay a certain rate of interest and principal on maturity of the instrument. There is a possibility of issuers not being able to meet their debt obligations. If a company goes into bankruptcy and its assets liquidate, bondholders are paid before shareholders. Majority of the underlying instruments in longer duration debt funds are Government Securities, which have probably no credit risk because they have sovereign guarantee.

Myth 2: Fixed deposits usually seek higher returns

Fact: On an average and over a period of time, well managed debt funds have been able to outperform fixed deposits. Fixed deposits are seen as risk free investments and usually risk free investments give the lowest returns. The yields of many fixed income instruments are higher than bank FD interest rates of similar maturities. Yields of AAA rated corporate bonds can be 150 – 200 bps higher than FD interest rates.

Myth 3: Invest in the debt funds aiming highest returns

Fact: Different types of debt funds have different risk characteristics. There are two main risk factors in debt funds – interest rate risk and credit risk. Longer the duration of a fund, higher is its price sensitivity to interest rates, e.g. Gilt and Dynamic bond funds are highly sensitive to interest rate changes while Liquid and Overnight funds have very little sensitivity to interest rate changes. Similarly funds which invest predominantly in Government and highly rated papers have much less credit risk than funds which invest in lower rated papers to capture higher yields.

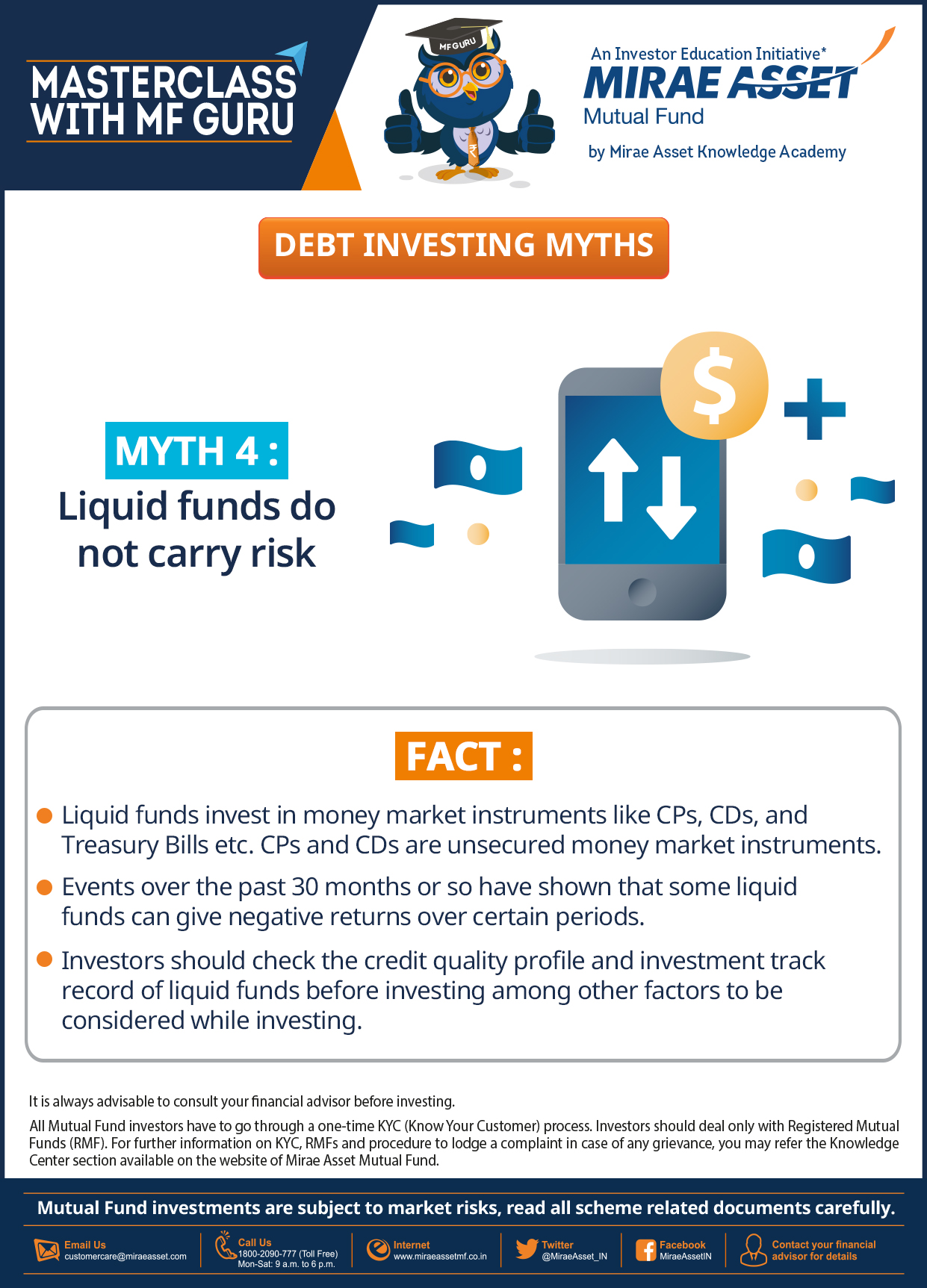

Myth 4: Liquid funds seek positive return

Fact: Liquid funds invest in money market instruments like CPs, CDs, and Treasury Bills etc. CPs and CDs are unsecured money market instruments. Events over the past 30 months or so have shown that some liquid funds can give negative returns over certain periods. Investors should check the credit quality profile and investment track record of liquid funds before investing among other factors to be considered while investing.

Myth 5: Debt funds are meant for corporate and institutions, isn’t it?

Fact : While corporate and institutions account for a very large percentage of debt fund assets under management (AUM), these funds offer excellent investment solutions to retail investors for a variety of investment needs and risk appetites. You do not need huge sums of money to invest in debt funds – you can start with just Rs 5,000. You can also invest in debt funds through SIP. Apart from investing for your short term, medium term and long term investment goals, debt funds are also useful for asset class diversification and reducing the risk profile of your investment portfolio.