View Performance of the funds managed by the Fund Manager

The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing in equity and equity related securities, Debt and money market instruments, *Gold ETFs, Silver ETFs and

Exchange Traded Commodity Derivatives.

However, there is no assurance that the investment objective of the Scheme will be realized.

Equity: The equity portion of the scheme will be in a mix of pure equity and arbitrage opportunities with a minimum of 65% of the overall portfolio. Net equity levels will be managed dynamically within a range of 40% to 75% based on the internal framework. Further, stock selection will be a blend of top down and bottom up approach. The equity portfolio will be diversified across sectors and market capitalization, with a large cap bias.

Debt:The scheme will mainly follow a buy and hold strategy and investments will be made across debt instruments. The debt portion of the scheme will be kept within short to medium duration based on directional movement of interest rates.

Commodities: The core part of the commodity investment will be in Gold with tactical allocation to Silver and other ETCDs.

REITs /InVITs & Foreign Equity: The scheme also has the provision to invest in REITs and InVITs which adds flavour of a distinct asset class. The scheme also has the flexibility to invest in foreign equity with a view to capitalize on themes and opportunities not available in India. The investment in foreign equity will be made based on relative attractiveness of foreign equity vs domestic equity.

*Commodities include Gold ETFs, Silver ETFs, Exchange Traded Commodity Derivatives (ETCDs). For detailed asset allocation, refer SID.

^The scheme may invest in foreign securities including ADR/GDR/Foreign equity and overseas

ETFs and overseas debt securities subject to regulations. The scheme shall invest in overseas fund/securities upto the headroom available and shall remain capped at the amount as at end of day of February 01, 2022, till any

further clarification/notification is received from RBI/SEBI in this regard. The investment by the scheme in overseas ETFs will be suspended if industry-wide limit for investment in overseas ETFs is breached in future.

Source:

Internal. Investment framework stated above may change from time to time without any notice and shall be in accordance with the strategy as mentioned in the Scheme Information Document.

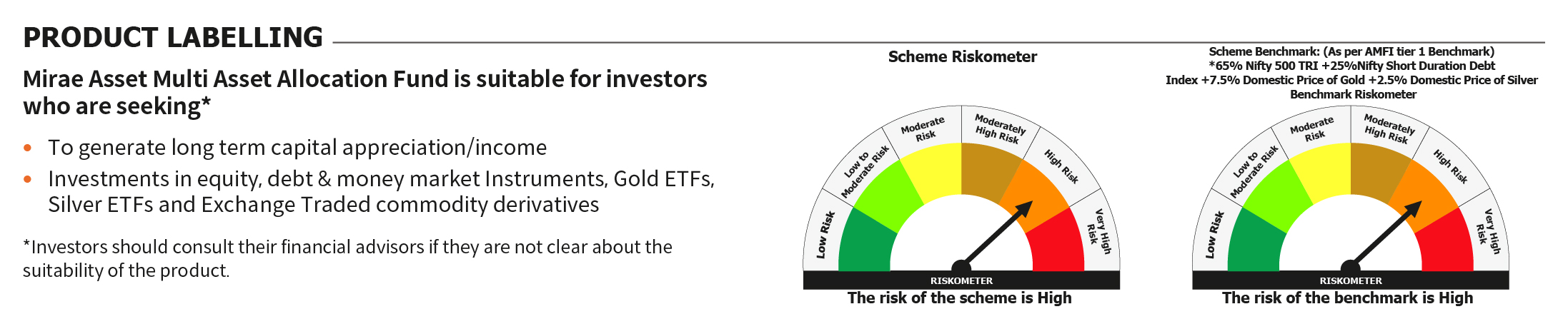

An open-ended scheme investing in equity, debt & money market instruments, Gold ETFs, Silver ETFs and exchange traded commodity derivatives

Mr. Harshad Borawake

(Equity portion),

Mr. Basant Bafna

(Debt Portion),

Mr. Siddharth Srivastava

(Dedicated Fund Manager for Overseas Investments),

Mr. Ritesh Patel

(Dedicated

Fund Manager for Commodity Investments)

65% BSE 200 TRI + 20% NIFTY Short Duration Debt Index + 10% Domestic Price of Gold + 5% Domestic Price of Silver

31st January 2024

Minimum investment of Rs 5000/- and in multiples of Re 1/- thereafter

Minimum Additional Purchase Amount - 1000/- and in multiples of 1/- thereafter.

Not Applicable

If redeemed within 1 year (365 days) from the date of allotment: 1%

If redeemed after 1 year (365 days) from the date of allotment: NIL.

Monthly and Quarterly: Rs. 99/- (in multiples of Re. 1/- thereafter)

Regular and Direct Plan

Growth Option & Income Distribution cum Capital Withdrawal option (IDCW) – Payout & Reinvestment option

Click here to View

T+3 Business days

Recommended Investment Horizon

3+ Years

Portfolio mix of equity, fixed income and commodities*. (*Gold ETFs, Silver ETFs, Exchange Traded Commodity Derivatives (ETCDs))

Wealth creation with relatively lower volatility

Mirae Asset Equity Investment philosophy

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.