View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=e7116076_2)

.jpg?sfvrsn=e7116076_2)

(Erstwhile known as Mirae Asset Short Term Fund )

(An open ended short term debt scheme investing in instruments such that the Macaulay duration* of the portfolio is between 1 year to 3 years (please refer to page no. 35 of SID) A relatively high interest rate risk and moderate credit risk)

An open-ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 year to 3 years (please refer to page no. 34 of the SID). A relatively high interest rate risk and Moderate credit risk

Primarily invest in 1-3 year debt and money market instruments with predominantly in highly rated instruments

Macaulay duration of the portfolio is between 1 year to 3 years

Follows an accrual strategy.

Aims to generate better returns than Bank FD & G-Secs

Will look for opportunities from credit spreads among debt & money market instruments

An open-ended short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 1 year to 3 years (please refer to page no. 34 of the SID). A relatively high interest rate risk and Moderate credit risk.

Mr. Basant Bafna (Since 16th Jan, 2023)

16th March, 2018

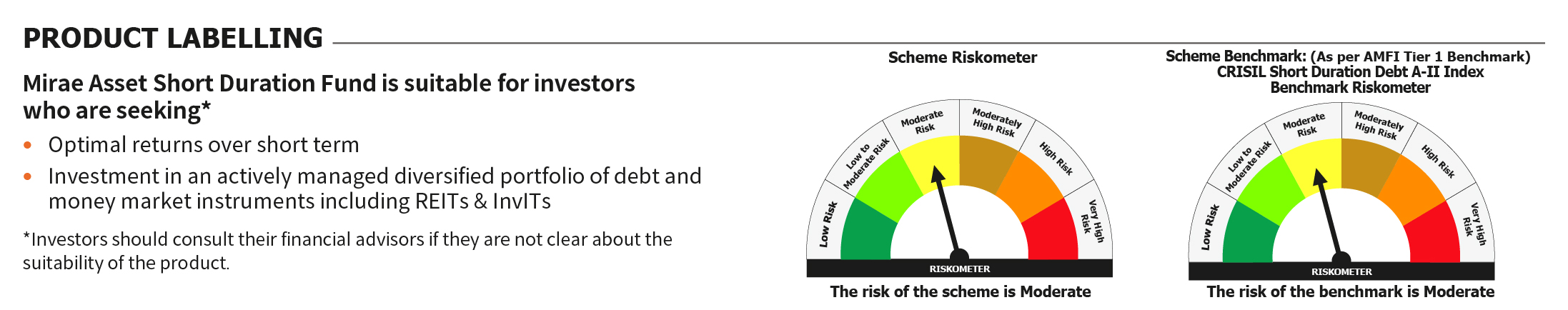

CRISIL Short Duration Debt A-II Index

₹ 5,000/- and in multiples of ₹ 1/-thereafter

₹ 1,000/- per application and in multiples of ₹ 1/- thereafter.

Regular Plan and Direct Plan

Growth Option and IDCW (Payout / Reinvestment)

Click here to view

Recommended Investment Horizon

1-3 Years

Debt instruments and money market instruments with short maturity

Income

For Historic NAV Click here

| Record date | Div. Ind (₹) | Div. Corp (₹) | Cum Nav (₹) |

For Historic Dividend Click here

Mirae Asset Debt Investment Process and Philosophy

Short Duration Funds also known as short duration funds are open ended mutual fund schemes which invest in debt and money market instruments such that the Macaulay Duration of the portfolio is between 1 – 3 years. Due to their relatively short duration profiles, short duration funds have limited interest rate risk. These funds aim to hold the instruments in their portfolio till maturity and earn interest paid by them, aiming to give stable returns in different interest rate scenarios. These funds may also have exposure to credit risk depending on the credit quality profile of the underlying instrument.

Macaulay Duration is the time taken for the price of a bond to repay to investors through cash-flows including both interest payments and principal repayments. Macaulay Duration of a debt fund portfolio is calculated weighted average time period over which the cash-flows from the underlying bonds in the portfolio is received. Price of bond has an inverse relationship with interest rate changes. If interest rate goes up, bond prices fall and vice versa. A bond with longer Macaulay Duration is more sensitive to interest rate changes. Hence it is important for investors to know the Macaulay Duration of the scheme they are investing in.

Short duration funds can invest in debt and money market securities like Non-convertible debentures, corporate bonds, Government Securities, Commercial papers (CPs), Certificate of Deposits (CDs), T-bBills, Cash and cash equivalent. Macaulay duration of Short duration funds has to be between 1 to 3 years. Fund managers can invest in longer duration papers, but the average duration at a portfolio level should be between 1 to 3 years.

Yield to maturity (YTM) is the total returns (interest payments plus maturity amount or face value) expected on a fixed income security if the instrument is held till its maturity. In other words, YTM is the internal rate of return (IRR) of an instrument which is held till maturity and all the interest payments (coupons) are made as per schedule and re-invested at the same rate.

In short duration funds, YTM depends on market yields (generally it is higher than overnight and liquid funds)

Credit rating is a measure of the creditworthiness, in other words, the financial ability of the issuer to meet interest and principal payment obligation. Credit ratings are assigned by specified agencies like CRISIL, ICRA etc. Credit rating of an instrument may change over time, depending on improving or worsening financial strength of the issuer. If the credit rating of an instrument gets downgraded, its price will fall and vice versa.

Suggested investment tenure is 1 year to 3 years.

The risk profile of short duration funds is Moderately Low. Investors should understand that their investment in short duration funds carry moderately low risk.

Short duration funds are ideal for risk-averse investors who seek to enjoy superior tax-adjusted returns that may be better than fixed deposits over a short to medium term tenure of 1 - 3 years.

Short term capital gains (if the units are sold within 3 years) in debt mutual funds are taxed as per applicable tax rate of the investor.

Long term capital gains of debt funds are taxed at 20% with indexation.

Indexation benefits reduce the tax obligation considerably compared to investments in bank FDs and many small savings schemes. The first major advantage of debt mutual funds over bank FDs is regarding taxation during the tenure of the investment. In bank FDs, interest whether paid out or accrued in your FD account is taxable. The bank will deduct 10% TDS on the interest

To calculate capital gains with indexation in debt funds, you should index your purchase cost by multiplying the purchase cost with the ratio of the cost of inflation index of the year of sale and cost of inflation index of the year of purchase, and then subtract the indexed purchasing cost from sales value. Let us see an example -

| Returns | FD | Debt MF |

|---|---|---|

| Investment | 5,00,000 | 5,00,000 |

| Interest/ Returns (% p.a.) | 8% | 8% |

| Total Pre-Tax Returns | 1,29,856 | 1,29,856 |

| Indexed cost (Assuming 5% inflation) | 5,00,000 | 5,62,432 |

| Pre-Tax Returns (For tax computation purpose) | 1,29,856 | 67,424 |

| Tax (assuming 30% tax rate) | 38,957 | 13,485 |

| Post-Tax Returns | 90,899 | 1,16,371 |

The above is only for illustration purposes only.

Short Duration Fund s are subject to interest rate and credit risks. Bond price have inverse relationship with interest rates. Bond prices fall when interest rate goes up and vice versa. The interest rate risk in Short Duration Fund s are moderate because the average duration of these funds are between 1 to 3 years. Bond prices are negatively impacted by credit risks. Bond prices fall when the credit rating is downgraded. If a bond defaults investors may not get the principal amount back. Credit risk of a Short Duration Fund depends on the credit quality of the bond portfolio of the scheme.

Short Duration Fund s are subject to interest rate and credit risks. Bond price have inverse relationship with interest rates. Bond prices fall when interest rate goes up and vice versa. The interest rate risk in Short Duration Fund s are moderate because the average duration of these funds are between 1 to 3 years. Bond prices are negatively impacted by credit risks. Bond prices fall when the credit rating is downgraded. If a bond defaults investors may not get the principal amount back. Credit risk of a Short Duration Fund depends on the credit quality of the bond portfolio of the scheme.

Investors should look at expense ratio (TER), duration and credit quality of a Short Duration Fund before investing. Higher TER will impact scheme returns and hence lower TER is preferable. Longer the duration of a fund, more sensitive (volatile) it will be to interest rate changes. You should select funds according to your risk appetite. Credit quality is one of the most important factors to be considered when investing in Short Duration Fund s. Though lower rated bonds give higher yields, the risk of making a loss is also higher. You should try to invest in funds with high credit quality.

Mirae Asset Short Duration Fund does not assure capital protection and guaranteed returns. The fund is subject to market risk, though the risk is moderately low. Past performance of the fund may or may not sustain in future.

Since 16th Jan, 2023

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | B- III |

(Erstwhile known as Mirae Asset Short Term Fund )

(An open ended short term debt scheme investing in instruments such that the Macaulay duration* of the portfolio is between 1 year to 3 years (please refer to page no. 35 of SID) A relatively high interest rate risk and moderate credit risk)(Erstwhile known as Mirae Asset Short Term Fund )

(An open ended short term debt scheme investing in instruments such that the Macaulay duration* of the portfolio is between 1 year to 3 years (please refer to page no. 35 of SID) A relatively high interest rate risk and moderate credit risk)| Name | Allocation | |

| COMMERCIAL PAPER | ||

| 1 | IndoStar Capital Finance Limited | 3.99% |

| CORPORATE BOND | ||

| 1 | REC Limited | 7.22% |

| 2 | Hindustan Petroleum Corporation Limited | 7.22% |

| 3 | National Bank For Agriculture and Rural Development | 4.10% |

| GOVERNMENT BOND | ||

| 1 | 5.63% GOI (MD 12/04/2026) | 5.67% |

| 2 | 6.54% GOI (MD 17/01/2032) | 1.98% |

| 3 | 6.84% GOI (MD 19/12/2022) | 1.54% |

| STATE GOVERNMENT BOND | ||

| 1 | 7.39% Maharashtra SDL (MD 09/11/2026) | 3.15% |

| ZERO COUPON BOND | ||

| 1 | Axis Finance Limited | 0.76% |

59.97%

59.97%

11.98%

11.98%

10.94%

10.94%

3.99%

3.99%

3.15%

3.15%

2.96%

2.96%

0.76%

0.76%

6.25%

6.25%

*Data as on 31st March, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.