View Performance of the funds managed by the Fund Manager

The investment objective of the scheme is to provide income and capital appreciation by investing predominantly in AA+ and above rated corporate bonds. The Scheme does not guarantee or assure any returns.

Relative Safety: Relatively safe as atleast 80% exposure is in AA+ and above rated corporate bonds.

Liquidity : Being heavy on top rated papers boosts the liquidity aspect

Returns : Endeavour to provide better risk adjusted returns

SIP : Suitable for making SIP (Systematic Investment Plan)

Instrument Profile : Investment will primarily be made in AA+ and above rated corporate bonds and in some in Government Securities and other Debt and Money Market Instruments.

Duration Management : Investment across the yield curve but target Macaulay Duration will be within range of 2-5 years.

Risk Management : The endeavour will be to have a portfolio of high quality and not invest in instruments below AA. This is the current investment framework, please refer SID for Investment Strategies.

An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds. A relatively high interest rate risk and moderate credit risk.

Ms. Kruti Chheta

CRISIL Corporate Debt A-II Index

₹ 5,000/- and in multiples of ₹ 1/- thereafter.

Regular Plan and Direct Plan

₹ 1,000/- per application and in multiples of ₹ 1/- thereafter.

Growth Option and IDCW (Payout / Reinvestment)

Monthly and Quarterly: ₹1000/- (multiples of ₹ 1/- thereafter), minimum 5 installments

Click here to view

3+ years

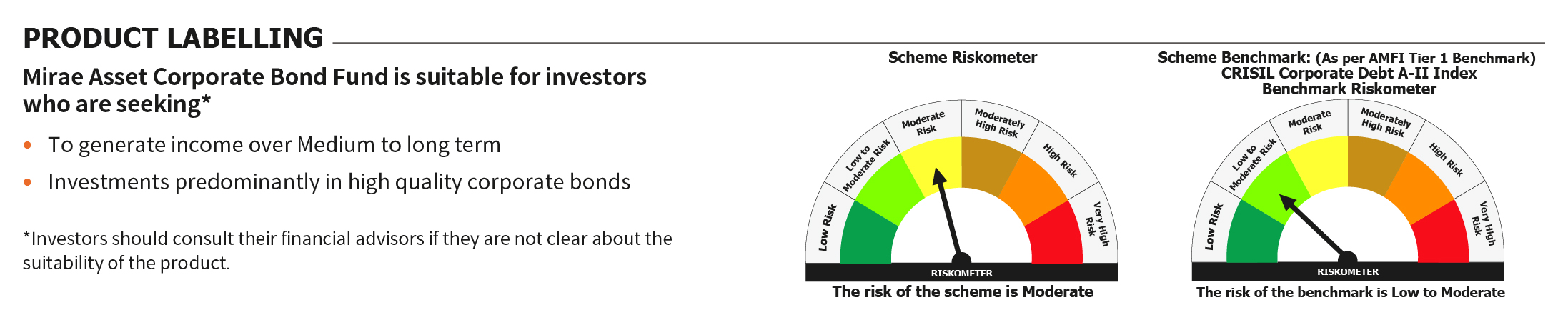

Moderate

Wealth creation

Mirae Asset Debt Investment Process and Philosophy

Corporate Bond Funds are fixed income funds which need to invest at least 80% of their assets in AA+ and above rated corporate bonds.

There are rating agency such as CRISIL, CARE and ICRA which access the credit risk and gives rating to each instrument or fund based on the financial strength of their issuer.

| Long Term Rating | Short Term Rating | ||

|---|---|---|---|

| CRISIL / CARE / ICRA | Rating scale | CRISIL / CARE / ICRA | Rating scale |

| AAA | Highest safety | A1 | Highest safety |

| AA | High safety | A2 | High safety |

| A | Adequate Safety | A3 | Moderate Safety |

| BBB | Moderate Safety | A4 | High Risk |

| BB | Moderate Risk | D | Default |

| B | High Risk | ||

| C | Very high Risk | ||

| D | Default |

Rating agency apply '+' (plus) or '-' (minus) signs for ratings from AA to C and A1 to A4 to reflect comparative standing within the category.

As per the SEBI mandate, they need to invest at least 80% of their assets in AA+ and above rated corporate bonds and rest 20% can be invested in other debt and money market instruments including REITS.

Recommended investment tenure of Corporate Bond Funds is 3+ years.

Corporate Bond Funds usually have Moderate risk profile. As these funds are required to take atleast 80% of their exposure in top rated corporate bonds, they are high on safety as compared with most other debt fund categories.

The investment objective of the scheme is to provide income and capital appreciation by investing predominantly in AA+ and above rated corporate bonds.

The Scheme does not guarantee or assure any returns.

The Fund will invest minimum of 80% in AA+ and above rated corporate bonds along with some exposure to Government Securities and Treasury bills and other money market instruments.

The AMCs are required to disclose full portfolios of each scheme on a monthly basis on their website and also in their monthly fact sheet. The scheme portfolio shows investment made in each security i.e. equity, equity related instruments and other instruments as per the scheme mandate, along with the respective quantities, market value and % weightage to the NAV.

| Returns | FD | Debt MF |

|---|---|---|

| Investment | 5,00,000 | 5,00,000 |

| Interest/ Returns (% p.a.) | 8% | 8% |

| Total Pre-Tax Returns | 1,29,856 | 1,29,856 |

| Indexed cost (Assuming 5% inflation) | 5,00,000 | 5,62,432 |

| Pre-Tax Returns (For tax computation purpose) | 1,29,856 | 67,424 |

| Tax (assuming 30% tax rate) | 38,957 | 13,485 |

| Post-Tax Returns | 90,899 | 1,16,371 |

Potential Risk Class Matrix (PRC)

| Credit Risk → Interest Rate Risk↓ | Relatively Low (Class A) | Moderate (Class B) | Relatively High (Class C) |

|---|---|---|---|

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | B-III |

| Name | Allocation | |

| CORPORATE BOND | ||

| 1 | National Housing Bank | 10.10% |

| 2 | Indian Railway Finance Corporation Limited | 7.94% |

| 3 | Larsen & Toubro Limited | 5.15% |

| 4 | Reliance Industries Limited | 5.10% |

| 5 | REC Limited | 5.09% |

| 6 | Tata Capital Financial Services Limited | 5.06% |

| 7 | Power Finance Corporation Limited | 5.05% |

| 8 | L&T Finance Limited | 5.05% |

| 9 | Sikka Ports and Terminals Limited | 5.05% |

| 10 | Housing Development Finance Corporation Limited | 5.04% |

| GOVERNMENT BOND | ||

| 1 | 5.74% GOI (MD 15/11/2026) | 4.96% |

| 2 | 5.63% GOI (MD 12/04/2026) | 0.99% |

*Data as on 31st March, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.