View Performance of the funds managed by the Fund Manager

Mirae Asset Equity Allocator Fund of Fund

Mirae Asset Equity Allocator Fund of Fund

(An open ended fund of fund scheme predominantly investing in units of domestic equity ETFs)About the fund

The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in units of domestic equity ETFs. There is no assurance that the investment objective of the Scheme will be realized.

Investment strategy

The scheme will predominantly invest in the units of domestic equity ETFs, the portfolio of which shall mostly be based on stocks from large cap and/or midcap equity segment. The selection of stocks for the portfolio of underlying ETFs may be based on market cap range, sector, theme, strategy etc. or a combination of one or more of these styles.

Fund facts

Type

(An open ended fund of fund scheme predominantly investing in units of domestic equity ETFs)

fund manager

Ms. Bharti Sawant (since Inception)

allotment date

21st Sept 2020

benchmark index

NIFTY 200 Index (TRI)

Minimum Investment amount

Rs. 5,000 & in multiples of Re. 1 thereafter

Exit Load

Click here to View

Plans Available

The Scheme will have Regular Plan and Direct Plan** with a common portfolio and separate NAVs.

Options Available

Growth Option and IDCW (Payout / Reinvestment)

Taxation

Click here to view

Ideal Investment Horizon

Recommended Investment Horizon

3+ Years

The scheme will predominantly invest in the units of domestic equity ETFs, the portfolio of which is mostly based on large cap and/or midcap equity segment.

Provides the advantage of investing in Exchange Traded Funds through Mutual Fund route.

Net asset value

For Historic NAV Click here

FAQs

Mirae Asset Equity Allocator Fund of Fund is an open ended fund of fund scheme predominantly investing in units of domestic equity ETFs. The fund invests in domestic equity Exchange Traded Funds (ETFs) belonging to the large and midcap market segments e.g. Nifty 50 ETF, Nifty Next 50 ETF, Nifty Midcap 150 ETF etc. The fund can invest upto 5% of its assets in money market instruments / debt securities, Instruments and/or units of debt/liquid schemes of domestic Mutual Funds.

Equity Allocator Fund of Fund will mainly invest in Nifty 50 ETF, Nifty Next 50 ETF and Midcap ETF. The indicative asset allocation to the three ETFs will be based around the free float market cap based representation of Nifty 50, Nifty Next 50 and Nifty Midcap 150 stocks. The fund will have flexibility to be overweight / underweight the free float based weights of the ETFs within a limited range based on how much at discount/premium an ETF is trading based on the historical trends of forward P/E. Please note that if opportunity arises, the fund may invest in other ETFs (strategic or tactical) belonging to large and midcap segment.

The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in units of domestic equity ETFs. There is no assurance that the investment objective of the Scheme will be realized.

Suggested investment tenure is 3 years +.

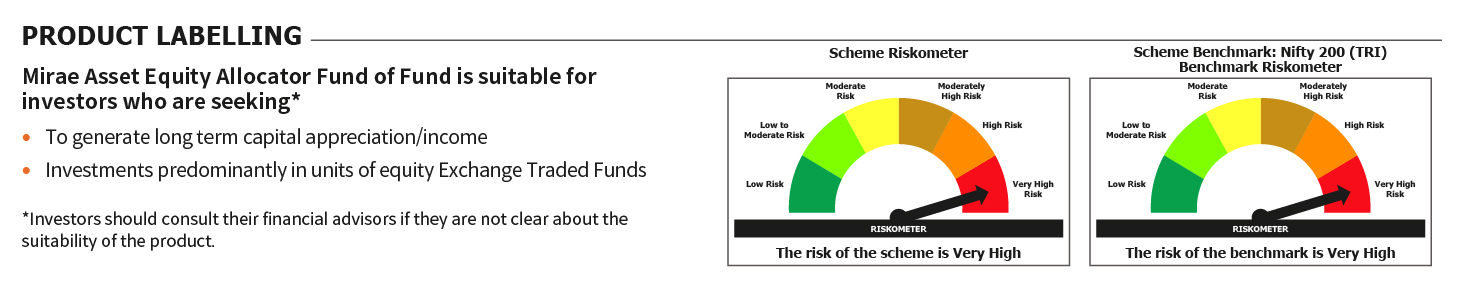

The risk profile of Mirae Asset Equity Allocator Fund of Fund is ‘Moderately High’. Investors should understand that their principal investment in this fund will be at moderately high risk.

The Scheme has Regular Plan and Direct Plan with a common portfolio and separate NAVs. Investors should indicate the Plan for which the subscription is made by indicating the choice in the application form. Each of the above Regular and Direct Plan under the scheme will have the following Options - 1) Growth Option and 2) Dividend Option. Under the dividend Option, there will be 2 sub options -: 1) Dividend Payout and 2) Dividend Reinvestment.

On payment of dividend, the NAV of the units under Dividend option will fall to the extent of the dividend payout and applicable statutory levies, if any. It must be distinctly understood that the actual declaration of dividend and frequency thereof is at the sole discretion of Board of Directors of the Trustee Company.

With effect from Financial Year (2020-21), dividends are taxable in the hands of the investor irrespective of the fund category. The dividend has to be added to the total income of the investor and taxed at the income tax rate applicable to the investor. TDS at the rate of 10% will be deducted by the AMC, if the dividends received exceed Rs 5,000 in a financial year.

- Investors who aim for capital appreciation.

- Investors who prefer passive investing including the benefits of low cost

- Investors with long investment horizons, at least 5 years.

- Investors with moderately high risk appetites

- The FOF will invest in domestic equity ETFs. ETFs usually have lower expense ratios as compared to Index Funds.

- The FOF investing in equity ETFs (>90%) are taxed as equity oriented funds.

- Convenience of multiple ETFs wrapped in one product.

- Possibility to receive additional alpha due to active asset allocation with rebalancing predominantly in the units of large and midcap segment.

- Investors who want to invest in ETFs need to have demat and trading accounts. But for this FOF, you do not need to have a demat and trading account. Anyone can invest, if they are mutual fund KYC compliant.

- You can invest either in lump sum or Systematic Investmemt Plan SIP, depending on your investment needs.

- ETFs can be sold only in stock exchanges unless you are redeeming a lot size (as determined by the AMC). Sometimes liquidity can be an issue when selling some ETFs in exchanges. In case of this FOF, liquidity is assured by the AMC because you can redeem any number of units of this FOF with the AMC at any time like any open ended mutual fund scheme.

- Exposure to entire large cap and midcap segment with single product: This FOF is a unique product in the sense that it aims to give investors the exposure to the entire large cap and midcap space in one product. It combines the benefits of portfolio diversification, asset allocation and possibility of alpha generation in a single scheme.

- No fund manager risk: While actively managed equity funds can create alphas, there is also the possibility of it underperforming due to the investment decisions made by the fund manager. There is no fund manager risk in ETFs since it tracks the benchmark index.

- Low cost: Biggest advantage of investing in ETFs is low cost. Expense ratios of ETFs can be 1.5 to 2% lower than actively managed diversified equity funds. Over long investment tenures, 1.5 to 2% difference in annualized returns can result substantially higher absolute returns due to compounding effect.

- Asset allocation: The FOF will invest in ETFs covering large cap (Nifty 50 and Nifty Next 50 ETFs) and the midcap (Midcap ETF) equity asset classes with active asset allocation. We have discussed that asset allocation reduces volatility, aims to produce greater performance consistency (reduces performance deviations) across different market conditions and also can produce nominal alphas over sufficiently long investment tenures.

The fund’s returns are subject to market risk. The returns of the funds can be volatile and even negative depending on market conditions. Past performance of the fund may or may not be sustained in the future.

How to trade in FOF

Mirae Asset Equity Allocator Fund of Fund

(An open ended fund of fund scheme predominantly investing in units of domestic equity ETFs)Returns with asset class

Mirae Asset Equity Allocator Fund of Fund

(An open ended fund of fund scheme predominantly investing in units of domestic equity ETFs)Holdings

| Name | Allocation | |

| EXCHANGE TRADED FUNDS | ||

| 1 | Mirae Asset Mutual Fund | 100.23% |

Allocation

100.23%

100.23%

-0.23%

-0.23%

Sector allocation historic

Diversified: flexibility to invest across sectors, themes & stylesAsset Allocation

Rating Profile

*Data as on 31st March, 2022.

Downloads

Videos

Thank you

for showing interest

Our representative will get in touch with you shortly.

Thank you

for showing interest

Our representative will get in touch with you shortly.

Thank you

for submitting your request

Our representative will get in touch with you shortly.

Our Calculation Formula

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Our Calculation Formula

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

Redirecting...

Thank you sharing your details.

We will email you the cobranding collateral shortly.