View Performance of the funds managed by the Fund Manager

.jpg?sfvrsn=945e1c2c_2)

.jpg?sfvrsn=945e1c2c_2)

(Erstwhile known as Mirae Asset Emerging Bluechip Fund)

(Large & Mid Cap Fund - An open-ended equity scheme investing in both large cap and mid cap stocks)

Large & Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks.

The fund invests 35-65% in large cap companies (top 100 companies by market capitalization) & 35-65% in mid cap companies (companies not part of top 100 companies but fall within top 250 companies by market capitalization)

The fund gives investors the opportunity to participate in the growth of emerging companies which have the potential to be tomorrow's bluechip companies.

The investment approach is bottoms up approach: driven by value investing, in growth oriented businesses.

The investment approach is aimed at participating in high quality businesses upto a reasonable price and holding the same over an extended period of time.

Large & Mid Cap Fund - An open ended equity scheme investing in both large cap and mid cap stocks

Mr. Neelesh Surana (since inception of the fund)

Mr. Ankit Jain (since January 31, 2019)

9th July, 2010

Nifty Large Midcap 250 (TRI)

Regular Plan and Direct Plan

Rs. 99 & in multiples of Re. 1 thereafter

Growth Option and IDCW (Payout / Reinvestment)

Click here to View

Recommended Investment Horizon

3+ Years

Large & Mid Cap Fund investing atleast 35% in largecap stock and atleast 35% in midcap stocks aiming to provide long term capital appreciation

Wealth Creation

Large and Midcap funds are equity mutual fund schemes which invest at least 35% of their assets each in large cap stocks and midcap stocks. As per SEBI’s definition, the 100 largest stocks by market capitalization are classified as large cap stocks, while the next 150 largest stocks by market capitalization are classified as midcap stocks. According to the category mandate, the minimum allocation to large and midcap stocks in these schemes is 35% each, and the maximum can be 65% each.

SEBI classifies the top 100 stocks by market capitalization as large cap while the next 150 largest stocks by market capitalization are classified as midcap. Large cap stocks are less risky (prices are less volatile) than midcap or small cap stocks. Midcap stocks may be riskier than large cap stocks but has the ability to deliver higher returns in the long term.

The fund can take exposure in stocks other than large and midcap subject to the restrictions for the category mandated by SEBI and in its Scheme Information Document.

SEBI has, vide its circular no. SEBI/HO/IMD/DF3/CIR/P/2017/114 dated 6th October 2017, defined large cap, mid cap and small cap companies in order to ensure uniformity in respect of the investment universe for equity mutual fund schemes. Further, SEBI has also stipulated that AMFI shall prepare the list of stocks in this regard, in accordance with the points specified under para 8 of the circular.

Accordingly, AMFI, in consultation with SEBI and Stock Exchanges, prepares the list of stocks, based on the data provided by Bombay Stock Exchange (BSE), National Stock Exchange (NSE) and Metropolitan Stock Exchange of India (MSEI) and displays on its website https://www.amfiindia.com/research-information/other-data/categorization-of-stocks

The AMCs are required to disclose full portfolios of each scheme on a monthly basis on their website and also on their monthly fact sheet. The scheme portfolio shows investment made in each security i.e. equity, equity related instruments and other instruments as per the scheme mandate, along with the respective quantities, market value and % weightage to the NAV.

The investment objective of the scheme is to generate income and capital appreciation from a portfolio primarily investing in Indian equities and equity related securities of large cap and mid cap companies at the time of investment. From time to time, the fund manager may also seek participation in other Indian equity and equity related securities to achieve optimal Portfolio construction. The Scheme does not guarantee or assure any returns.

Suggested investment tenure is 3– 5 years +.

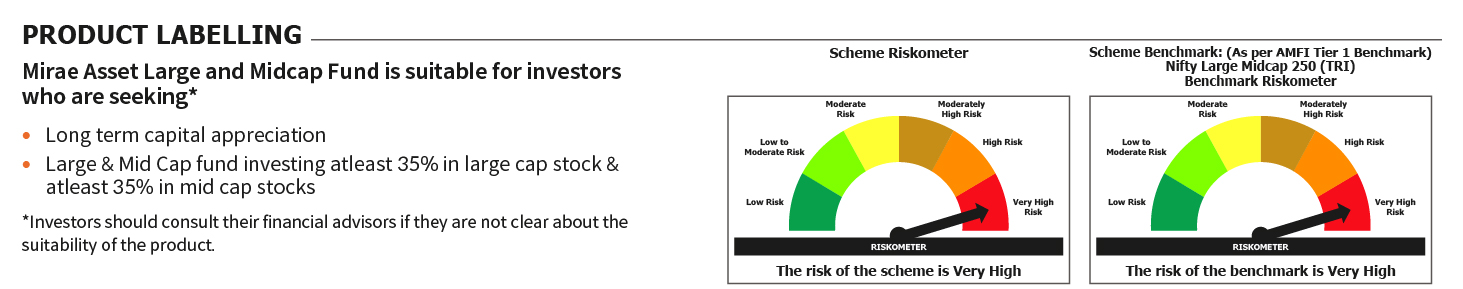

The risk profile of Mirae Asset Large & Midcap Fund is ‘Moderately High’. Investors should understand that their principal investment in this fund will be at moderately high risk.

The Scheme has Regular Plan and Direct Plan with a common portfolio and separate NAVs. Investors should indicate the Plan for which the subscription is made by indicating the choice in the application form. Each of the above Regular and Direct Plan under the scheme will have the following Options - 1) Growth Option and 2) Dividend Option. Under the dividend Option, there will be 2 sub options -: 1) Dividend Payout and 2) Dividend Reinvestment.

Total Expense ratio or TER represents the annual fund operating expenses of a scheme, expressed as a percentage (%) of the fund’s daily net assets. All expenses of an AMC must be managed within the maximum limits of TER as per SEBI Mutual Fund Regulations.

As per the current regulations, the TER allowed is 2.25% for the first Rs.500 Crores, 2.00% for the next Rs.250 Crores, 1.75% for the next Rs.1250 Crores, 1.60% for the next Rs 3000 Crores and 1.50% for next Rs 5,000 Crores.

On the next Rs. 40,000 Crores of the daily net assets, TER reduction of 0.05% for every increase of Rs 5,000 Crores of daily net assets or part thereof, on the next Rs. 40,000 Crores of the daily net assets. Balance of assets, the TER would be 1.05%.

For example - An expense ratio of 2% per annum means that, each year 2% of the schemes’ total assets (AUM) can be used to cover operating expenses like administration, management, advertising and brokerage payment etc.

There may be changes from time to time in a mutual fund schemes. In such cases, the AMC is required to inform about the changes to all their unit holders through email, direct communication and through newspaper advertisement. If the change is pertaining to any fundamental attribute of the Scheme, the AMC shall comply with requisite procedure as prescribed in the MF Regulations, like offering one month load free exit period, etc. Apart from the above, the Scheme Information Document (SID) and Key Information Memorandum (KIM) are also required to be updated.

With effect from this financial year (2020-21), dividends are taxable in the hands of the investor. The dividend has to be added to the total income of the investor and taxed at the income tax rate applicable to the investor. TDS at the rate of 10% will be done by AMC, if the dividend from equity funds exceeds Rs 5,000 in a financial year.

Capital gains arising out of long term investments (held for more than 12 months) are tax free upto Rs 1 Lakh in a financial year. Long term capital gain over Rs 1 Lakh in a financial year is taxed at 10%. Short term (investments held for less than 12 months) capital gains are taxed at 15%.

Investors can participate in the growth of emerging companies which have the potential to be tomorrow's blue-chip companies with the potential of wealth creation in the long term. Scheme mandate with minimum 35% large cap exposure aims to limit volatility. The fund has been able to outperform its benchmark over the last 10 years.

The fund’s returns are subject to market risk. The returns of the funds can be volatile and even negative depending on market conditions. Past performance of the fund may or may not be sustained in the future.

For Historic NAV Click here

| Record date | Div. Ind (₹) | Div. Corp (₹) | Cum Nav (₹) |

For Historic Dividend Click here

Mirae Asset Equity Investment Process and Philosophy

Since inception

Since 31st January 2019

(Erstwhile known as Mirae Asset Emerging Bluechip Fund)

(Large & Mid Cap Fund - An open-ended equity scheme investing in both large cap and mid cap stocks)(Erstwhile known as Mirae Asset Emerging Bluechip Fund)

(Large & Mid Cap Fund - An open-ended equity scheme investing in both large cap and mid cap stocks)69

24

55

| Name | Asset |

19.26%

19.26%

10.78%

10.78%

8.57%

8.57%

5.46%

5.46%

5.28%

5.28%

5.10%

5.10%

5.02%

5.02%

4.64%

4.64%

4.25%

4.25%

4.02%

4.02%

27.17%

27.17%

*Data as on 31st March, 2022.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.