Mirae Asset Investment Managers (India) Pvt. Ltd. announces the launch of two new funds -- Mirae Asset Nifty Metal ETF (an open-ended scheme replicating/tracking Nifty Metal Total Return Index) and Mirae Asset Nifty PSU Bank ETF

(An open-ended scheme replicating/tracking Nifty PSU Bank Total Return Index).

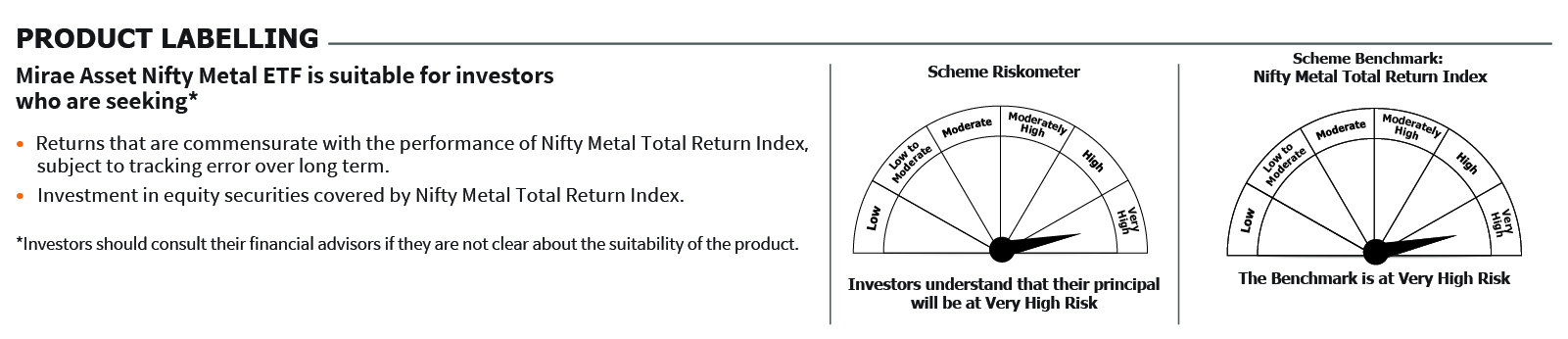

Mirae Asset Nifty Metal ETF aims to generate returns, before expenses, that are commensurate with the performance of the Nifty Metal Total Return Index, subject to tracking error. Nifty Metal Index provides exposure to 15 stocks

from Indian metals and mining sector, listed on the National Stock Exchange (NSE). The index consists of companies involved in the extraction, processing, and distribution of metals including iron ore, steel, aluminium, zinc,

copper, etc.

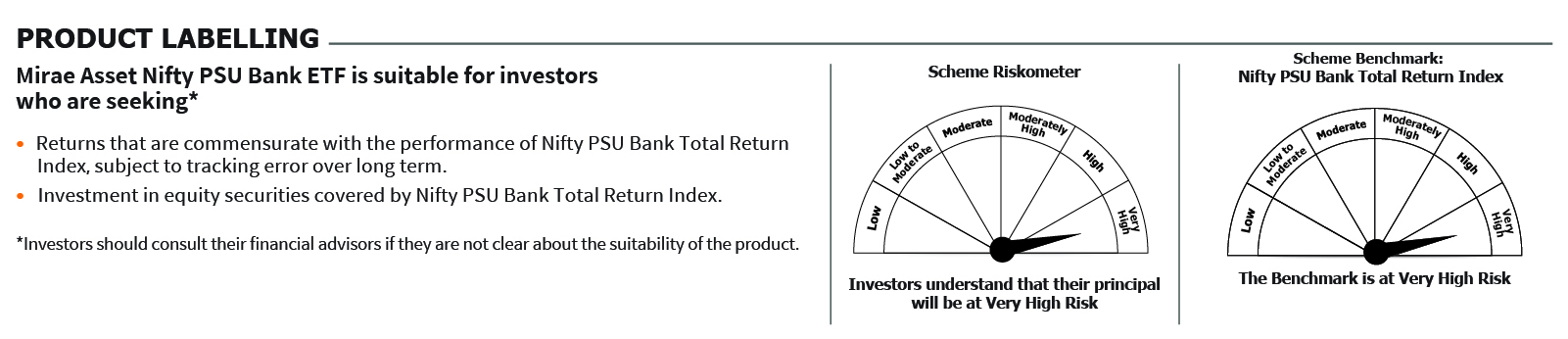

Mirae Asset PSU Bank ETF aims to generate returns, before expenses, that are commensurate with the performance of the Nifty PSU Bank Total Return Index, subject to tracking error. The Nifty PSU Bank Index comprises of Indian Public

Sector Undertaking Bank stocks listed on National Stock Exchange (NSE).

The New Fund Offer (NFO) for Mirae Asset Nifty Metal ETF opens on September 20, 2024, and closes on September 30, 2024. The scheme will re-open for continuous sale and repurchase on October 04, 2024.

The NFO for Mirae Asset PSU Bank ETF opens on September 24, 2024, and closes on September 30, 2024. The scheme will re-open for continuous sale and repurchase on October 03, 2024.

Both funds will be managed by Ms. Ekta Gala & Mr. Akshay Udeshi. The minimum initial investment in both funds will be Rs. 5,000/- and multiples of Re. 1/- thereafter during the NFO.

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada