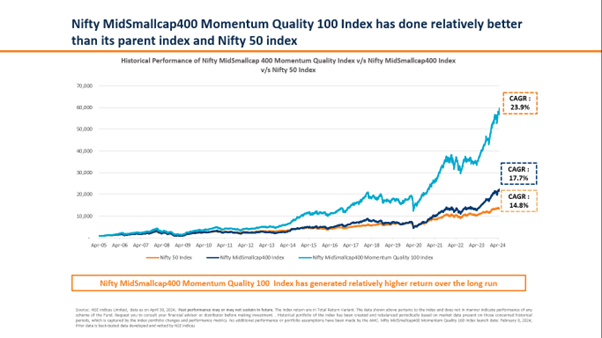

Mirae Asset Mutual Fund announces the launch of India’s first mutual fund scheme on Mid and Smallcap segment where the underlying portfolio will consist of 50 Midcap and 50 Smallcap stocks, selected basis quality, momentum and

liquidity parameters. The open-ended scheme, ‘Mirae Asset Nifty MidSmallcap400 Momentum Quality 100 ETF’, an open-ended scheme replicating/tracking Nifty MidSmallcap400 Momentum Quality 100 Total Return Index that aims

to capture wealth magnifiers and preservers using momentum and quality metrics which might have the potential of creating alpha in the long run. The index seeks to unlock huge opportunities present in both Midcap and Smallcap

segment by having an equal number of stocks from both segments in a 100 stock portfolio at the time of rebalancing. Investors may stand to gain as the portfolio seeks potential growth with exposure of Smallcap segment with

risk mitigation due to the presence of Midcap stocks.

Mirae Asset is also launching ‘Mirae Asset Nifty MidSmallcap400 Momentum Quality 100 ETF Fund of Fund’, an open-ended Fund of Fund (FOF) scheme investing in units of Mirae Asset Nifty MidSmallcap400 Momentum Quality 100

ETF and thus providing a Fund of Fund route for investors to take exposure in this portfolio.

The New Fund Offer (NFO) for Mirae Asset Nifty MidSmallcap400 Momentum Quality 100 ETF will open for subscription on May 06, 2024 and close on May 17, 2024. Concurrently, the Mirae Asset Nifty MidSmallcap400 Momentum Quality 100

ETF Fund of Fund will open for subscription on May 10, 2024 and close on May 24, 2024. These schemes will be managed by Ms. Ekta Gala and Mr. Vishal Singh.

In both schemes, the minimum initial investment during NFO will be Rs 5,000/- (Rupees Five Thousand) with subsequent investments being multiples of Re 1.

Commenting on the launch, Siddharth Srivastava, Head – ETF Product and Fund Manager, said, "We are excited to introduce a first-of-its-kind ETF and Fund of Fund for investors that focuses on both mid & smallcap companies,

selected based on smart beta factors. The underlying portfolio targets highly profitable companies with low leverage and stable earnings growth which have given relatively higher risk adjusted returns in the last 6 month and

1 year period. By investing in these funds, investors will get exposure to both Mid and smallcap companies, but with a risk profile which has been historically more aligned to Midcap segment. At current market valuations, investors

may invest in a lumpsum manner in ETF and FOF or through a Systematic Investment Plan (SIP) in FOF, but with a long-term investment horizon.”

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada