Mirae Asset Investment Managers (India) Pvt. Ltd. announces the launch of two new funds -- Mirae Asset Nifty 50 Index Fund (An open-ended scheme replicating/tracking Nifty 50 Total Return Index) and Mirae Asset Nifty LargeMidcap 250 Index Fund (An

open-ended scheme replicating/tracking Nifty LargeMidcap 250 Total Return Index).

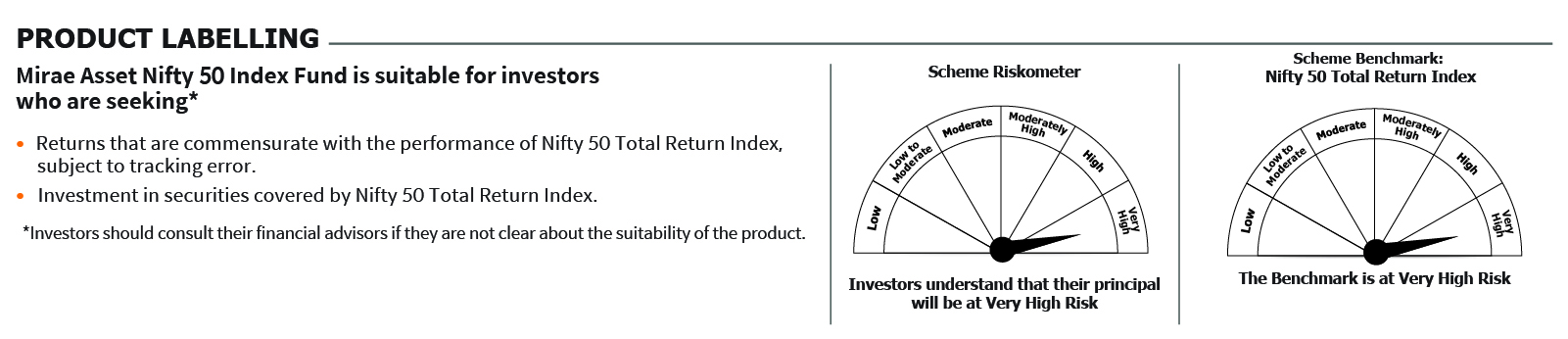

Mirae Asset Nifty 50 Index Fund aims to generate returns, before expenses, that are commensurate with the performance of the Nifty 50 Total Return Index, subject to tracking error. There is no assurance or guarantee that the investment

objective of the scheme would be achieved.

Nifty 50 Index is considered a barometer of Indian Stock Exchange. The index consists of 50 large bluechip companies, providing diversified exposure across 15 different sectors.

Mirae Asset Nifty LargeMidcap 250 Index aims to generate returns, before expenses, that are commensurate with the performance of Nifty LargeMidcap 250 Total Return Index. There is no assurance or guarantee that the investment objective

of the scheme would be achieved. The index aims to reflect the performance of all large cap and all mid cap companies listed at NSE with 50% weight allocated to each segment. The 250 stocks of Nifty LargeMidcap 250 Index are

the combination of the universe of stocks forming part of Nifty 100 and Nifty Midcap 150 Indices, offering a broadbased exposure to the Indian equity market.

The New Fund Offer (NFO) for Mirae Asset Nifty 50 Index Fund and Mirae Asset Nifty LargeMidcap

250 Index Fund opens on October 10, 2024, and closes on October 18, 2024. Both the schemes will re-open for continuous sale and repurchase on October 25, 2024.Gala & Mr. Vishal Singh. The minimum initial investment in both funds

will be Rs. 5,000/- and multiples of Re. 1/- thereafter during the NFO.

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada