View Performance of the funds managed by the Fund Manager

China

China

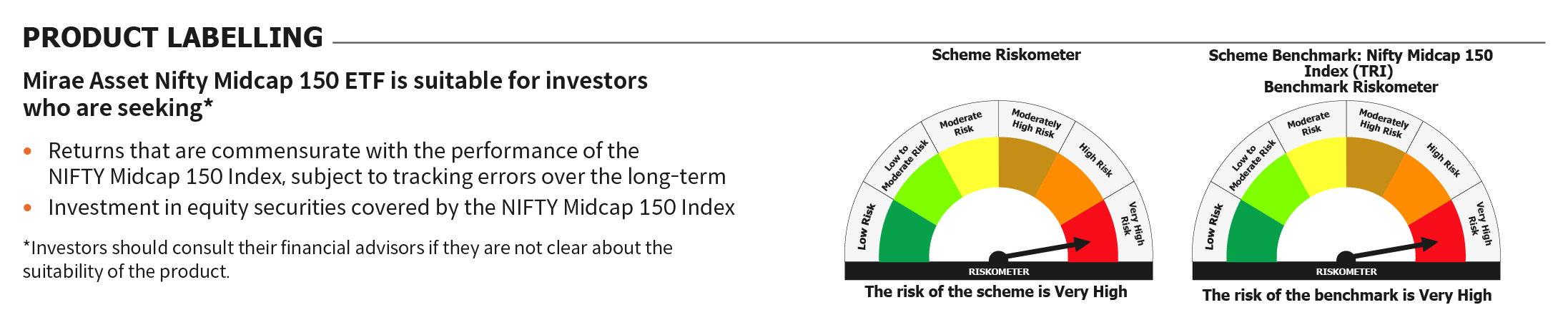

The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty Midcap 150 Total Return Index, subject to tracking error.

The Mirae Asset Nifty Midcap 150 ETF will be managed passively with investments in stocks in the same proportion as in the Nifty Midcap 150 Index.

The investment strategy would revolve around reducing the tracking error to the least possible through regular rebalancing of the portfolio, considering the change in weights of stocks in the Index as well as the incremental collections/redemptions in the Scheme.

A part of the funds may be invested in debt and money market instruments, to meet the liquidity requirements.

Subject to the Regulations and the applicable guidelines the Scheme may invest in the schemes of Mutual Funds.

An open-ended scheme replicating/tracking Nifty Midcap 150 Total Return Index

Ms. Ekta Gala

Mr. Ritesh Patel

Nifty Midcap 150 Index (Total Return Index) (INR)

On exchange In multiple of 1 units Directly with AMC In multiple of 4,00,000 units

9th March 2022

Mirae Asset Capital Markets (India) Private Limited

Kanjalochana Finserve Private Limited

East India Securities Limited

Parwati Capital Market Private Limited

Vaibhav Stock & Derivatives Broking Private Limited

Click here to View

Click here to view

Recommended Investment Horizon

3+ Years

Replicate/track Nifty Midcap 150 Index (INR), subject to tracking error.

Wealth Creation

| Name | Allocation | |

| 1 | Adani Total Gas Limited | 3.32% |

| 2 | Tata Power Company Limited | 2.27% |

| 3 | Tata Elxsi Limited | 1.73% |

| 4 | Voltas Limited | 1.62% |

| 5 | Trent Limited | 1.61% |

| 6 | MphasiS Limited | 1.57% |

| 7 | AU Small Finance Bank Limited | 1.55% |

| 8 | Zee Entertainment Enterprises Limited | 1.50% |

| 9 | Page Industries Limited | 1.42% |

| 10 | Bharat Electronics Limited | 1.42% |

*Data as on 31st March, 2022.

Mirae Asset ETF is a part of Mirae Asset Mutual Fund and is used for Exchange Traded Funds managed by Mirae Asset Investment Managers (India) Private Limited.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

Our representative will get in touch with you shortly.

If Inflation rate is selected then

futureValue = Future value considering the inflation rate

else

Calculate on current value.

SIPAmount = parseInt(-((Rate of interest / 12) * (-futureValue + (interest amount on loan * 0))) / ((-1 + interest amount on loan) * (1 + (rate of interest / 12))));

Annual Return = (Last NAV of the year - Last NAV of the previous year) / Last NAV of the previous year

For more details, please visit the AMFI website

Our website employs cookies to collect anonymous information in order to offer you the best browsing experience and allow us to better understand how you navigate the site. You can modify your cookie settings at any time.

By clicking “Accept” and viewing this website, you consent to the use of cookies.

To read the Policy, click here

We will email you the cobranding collateral shortly.