Mirae Asset Global Allocation Fund

Mirae Asset Global Allocation Fund

(Close Ended Fund Category III AIF)

About the scheme

The investment objective of the Fund is to provide long-term capital appreciation from a portfolio investing in units of overseas equity ETFs which are based on broad market indices and/or emerging themes. A Restricted Scheme (Non-Retail) classified as a Close-ended Category III AIF under the IFSCA FM Regulations.

Asset Allocation

| Instrument | Allocation (% of NAV) |

|---|---|

| Global ETFs & Overseas fund in various jurisdictions | 90% – 100% |

| Short term fixed deposit, liquid ETFs, units of liquid/overnight funds | Upto 10% (ten percent) |

The above asset allocation may not be met at all points of time on account of various reasons viz. global markets, subscriptions / redemptions etc., and shall be rebalanced within reasonable time period as per best judgement of the FME.

Base Currency:

USD

Target Investors:

Resident investors, Family offices, Institutions, NRIs & Foreign nationals

Target Corpus:

USD 200 Million, with a green shoe option of USD 200 Million

Minimum Subscription:

USD 1,51,000 to all investors.

For Accredited Investors USD 10,000

Valuation:

Weekly

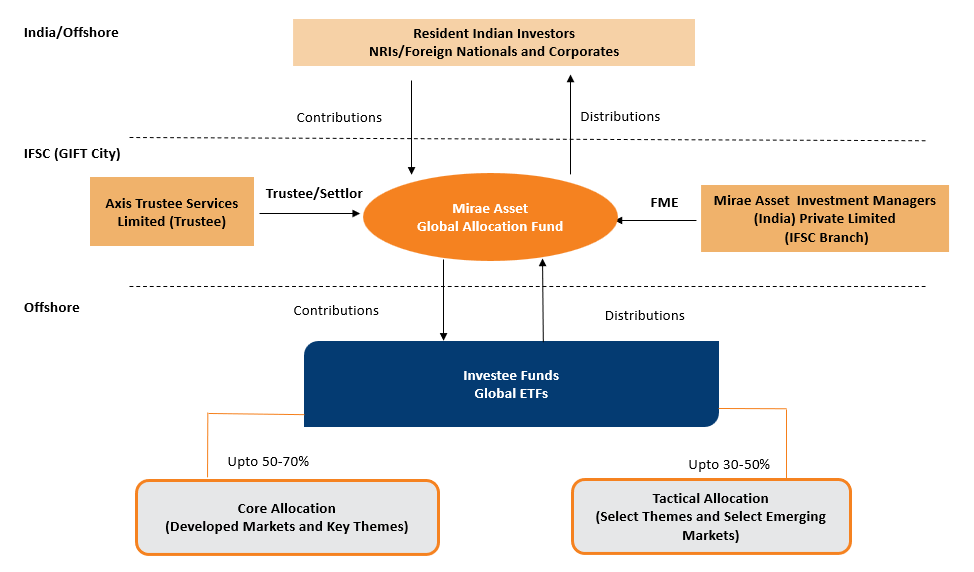

Fund Structure:

Portfolio Allocation:

The above is an illustrative form of the proposed portfolio and the actual portfolio will depend on the market and investment opportunity. Also the allocation between Core and Tactical may change from time to time without any notice in accordance with the asset allocation as mentioned in the PPM of the Fund.

Investing in Alternative Investment Funds (AIFs) carries inherent market risks. It is crucial to thoroughly review all scheme-related documents to make well-informed investment decisions