The primary objective of any investment is to get returns. Returns can be in the form of income or capital appreciation or both. The two most popular measures for MF returns are compound annual growth rate (CAGR) and XIRR in mutual funds.

CAGR, as the name suggests, is the rate at which your investment grows per annum over the investment period, assuming annual compounding. However, CAGR or point to point returns are not relevant or cannot be used in the case of multiple

cash-flows, but XIRR in mutual funds can be used for multiple cash flows. XIRR meaning in mutual fund is to calculate returns on investments where there are multiple transactions

taking place in different times. Full form of XIRR is Extended Internal Rate of Return.

What are multiple cash-flows?

The simplest form of investment is one-time investment or lump sum in investment parlance and one-time redemption, i.e. selling your entire investment after a period of time. This involves two cash-flows, one cash-outflow (investment) and

one cash-inflow (redemption). However, in many cases there can be multiple cash-inflows (e.g. SIP, additional purchases etc.) and multiple cash-outflows (e.g. SWP, dividends, partial redemptions etc.). CAGR cannot be used in such cases.

Internal Rate of Return (IRR)

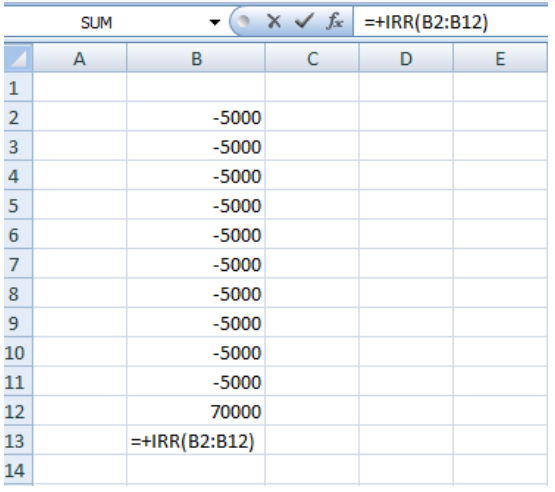

The metric used to measure the returns of a series of cash-flows is known as IRR or Internal Rate of Return. For the sake of simplicity, you can think of IRR as the annualized discounted cash-flows (DCF) rate of return. In this method, cash-flows

are discounted at a certain rate (IRR) based on when the cash-flows happens to know the present value of investment (NPV). Cash-flows - it can either be inflows or outflows - which happen earlier in the investment tenure, are discounted

less, while the ones which happen later are discounted more. This is due to time value of money, as value of money diminishes over time. IRR is the rate of discounting at which the present value (NPV) is zero.

Investors can use IRR to calculate the returns of their SIP, SWP, lump sum investment with additional purchases, multiple redemptions and other types of transactions involving multiple

cash-flows. IRR takes into account all cash-flows – both, inflows and outflows - and the times at which cash-flows happen. The IRR equation is quite complex as one has to do trial and errors to calculate IRR manually. However, one can

easily calculate IRR of cash-flows using the built in formula for IRR in Microsoft Excel Sheet as shown below -

Limitation of IRR

The biggest drawback of the IRR formula in excel sheet is that it assumes that the time interval between any consecutive cash-flows must be the same. This is a serious limitation, because time intervals between cash-flows happening are seldom

the same throughout the tenure of the investment.

Let us take the example of a monthly SIP. Let us assume that the SIP date is on the 7th of every month. Even though it is a monthly SIP, the interval between

two consecutive SIP instalments will vary from month to month because months have different number of days (28, 29, 30 or 31 days). Also, if your SIP date is on a holiday or falls on weekends in any month, the transaction will take place

on the next business day, therefore the interval will be different. Similarly for dividend options, interval between dividend pay-outs may vary over the tenure of the investment. If the time intervals are not exactly the same, then excel

sheet will return an incorrect value.

Importance of XIRR in Mutual Funds

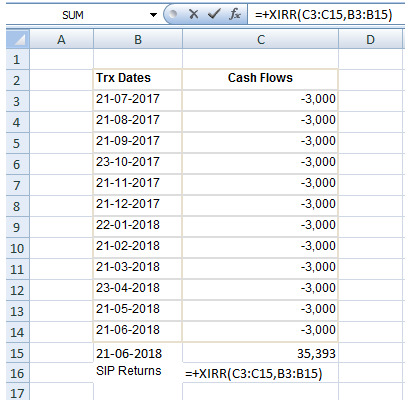

Fortunately, you can use a formula called XIRR in excel sheets which can take care of uneven cash-flow intervals. XIRR is simply a modification over IRR with the additional flexibility to assign specific dates to individual cash flows, thus

making it a much more accurate calculation of returns. To know XIRR in mutual funds, all you have to do is to enter the transactions (SIP / SWP instalments, additional purchases, redemptions etc.) and the corresponding dates. You can get

these transaction details from the statement of account sent by the fund house and apply the XIRR formula in excel sheet. Please see below for XIRR calculation of a simple SIP in excel sheet –

Points to be noted when calculating XIRR in Excel

To calculate XIRR in mutual funds, all cash-outflows (SIP instalments, lump sum purchases etc.) have to be entered as negative values (affix minus sign before the amount) and all cash-inflows (SWP, dividends, redemptions etc.) have to be entered

as positive values. If you have not yet redeemed all your units then the current investment value needs to be entered along with the date of NAV, to calculate the XIRR of your MF investment. Some transactions like dividend re-investment

do not involve actual cash-flows and therefore, should not be included in XIRR calculation. Switches are tricky, if you are calculating XIRR in MF at a scheme level, then switch should be treated as redemption i.e. cash out-flow or investment

or the cash-inflow depending on whether you are calculating XIRR in mutual funds for source scheme (in the switch) or target scheme. However, if you are calculating XIRR in MF at a portfolio level then switch is irrelevant in XIRR calculation.

Conclusion

In this article, we discussed meaning of XIRR in mutual fund and how it should be used to calculate multiple cash-flows e.g. SIP, SWP, additional purchase, dividends, partial redemptions etc. Many investors are familiar with CAGR. Like CAGR,

XIRR in MF also uses the concept of compounding – in fact, you may think of XIRR as an aggregation of CAGRs. You must use XIRR if you have multiple cash-flows in your mutual fund investments.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada