The sharp turn

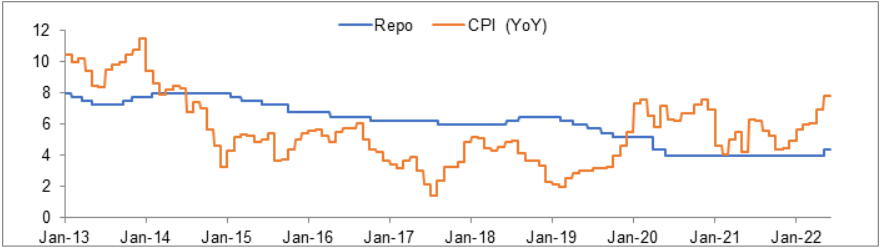

In the last two years, we have deep rate cuts and entire focus was on reviving growth. Pandemic ended with rise of new concerns. Amid weak global signals, rising bond yields, persistent high inflation, uncertainty around the

Russia-Ukraine war and rate hikes by the US Fed – market is under pressure. We can see huge outflows from equity market and building pressure in debt market for mark to market losses.

Inflation is the major concern both in India and globally. Major economies inflation has been decades high. The Indian inflation for April was at 7.97% while US was at 8.3% in April (highest since 1981). Hence major central

banks have taken the rate hike path. At home, Interest rates have been trending north as the RBI shifted its focus from growth to ensuring inflation remains within the target going forward, by starting the cycle of rising

interest rate.

Source: Bloomberg, as on 1 June, 2022.

At the start of the year Inflation rose due to high crude oil prices and is further inching up due to elevation in food prices. This cost push inflation is expected to remain high for some time. Therefore, the action on interest

rates may continue to control the same. Coming down to the impact it may have – one of the impacts can be seen in lending rates. But same is not reflected in deposit rates. As banks have enough liquidity (surplus money

for disbursement) and not huge demand for loans, they need not increase deposit rates. Increase in lending rates may lead to rise in cost of borrowing for corporates and ultimately may impact economy growth. Government

efforts to give fuel excise cuts and LPG subsidy and enhanced food and fertilizer subsidy will reduce government revenues which may lead to increased government borrowing.

What is in this for the investor?

Like equity, debt market also goes through different cycles. The recent rise in domestic and global bond yields has led to a fall in the value of traded bonds and debt fund returns. Most common investment behaviour in equity

is strategically investing based on economic cycle and sector exposure to benefit from volatility and generate return. If in the same way debt is approached based on interest rate cycle by investing in the appropriate fund

of the debt scheme categories, one can generate better risk adjusted returns.

Based on current scenario below are few of the suitable options investor can go for.

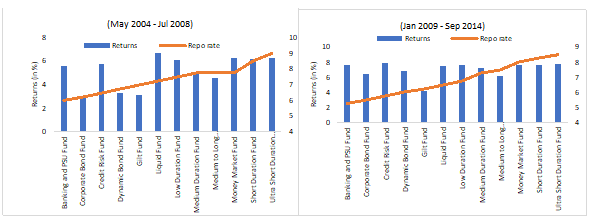

- Investing in the short maturity funds is one of the strategies in a rising interest scenario. This helps to minimize the loss due to rise in yields and gives benefit of frequent reinvestment at high yields. Such funds

invest in short term papers and as they mature, the money is reinvested in better yield paper. Below data shows how investment at short term funds have done well in periods of raising interest rate.

Returns computed by weighted average index of underlying CRISIL-ranked funds of the respective category as per the SEBI Categorization Circular dated October 06, 2017. Please click on https://www.crisil.com/en/home/what-we-do/financial-products/mf-ranking.html for CRISIL ranked funds. Past performance may or may not sustain in future. Source: CRISIL Research data

- Invest in funds that follow accrual strategies (hold paper till maturity and take benefit of coupon payment) to minimise interest rate risk. Funds which follows buy and hold approach can be a suitable option. The investor

stays invested during the whole maturity of the papers so as to benefit from coupon of the papers.

- Yields for long duration funds have increased and seems attractive, though there is volatility in the market but for investors looking for locking into high yields for a long investment horizon can do SIP (Systematic

Investment Plan) in long duration funds to reduce volatility and benefiting by holding till maturity or till rate cycle changes again. This may be considered as an optimum solution for investor to keep investing

during all rate hikes and gain benefits in future rate cut phases.

- Investor investing in traditional investments like guaranteed return deposits, where transmission of rates (rate change by RBI to banks changing rate) has a huge lag - debt funds may be considered faster in reflecting

interest rate changes. In current scenario, though repo rate has increased, deposit rates have remained more or less sticky and may remain so till there is surplus liquidity in the market. Debt market shows real

time reflection of rise in yields, making it a suitable option.

It is a misconception that investors can benefit from debt mutual funds only in a falling interest rate scenario. They can select funds from the various debt fund categories as per their risk profiles and goals to create a

diversified portfolio, which could create wealth in different interest rate environments. Equity has taught investor to think long term via Systematic Investment Plan (SIPs). Same learning is applicable for long term investors

on their debt investments with a mix of buy and hold and long term debt which gives them a mix of coupon and long debt experience as long as they understand the volatility in debt and therefore have investment horizon to

overcome volatility.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’. For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada