We humans like to believe that we are rational beings. But market swing is a daily reminder, that in groups, we are everything but that.

Despite reams of numbers and reports, almost all our investing decisions require emotional comfort, and nothing weakens that comfort than the fear of a tangible loss. This fear of loss has overruled many ideas, ambitions, adventures

and investments.

Look at it this way: a vast number of Fixed Deposits (FD) investors are stuck with around 3% to 5.5%% p.a return. Just because of the fear. And frankly, it’s quite understandable. Market fall activates the same neurological

response in many investors which the sight of the predator did in our proto-ancestors.

But speak to an aged investor, you will find some common themes in their investing experience. It’s not the fear that lingers, it’s the regret they have. There will be common themes: the stock/fund they didn’t buy; the ones

they sold early; the ones they did buy enough; and so on.

And here is the point of this. We suffer fear (of loss) immediately, but we suffer regret longer. In almost all cases - for a life time. This investing regret is rooted in decisions errors – and most often - in missed opportunities.

The aim of investing is to thus balance short-term fear and long-term regret. The question is then, “How do we do that”.

Well, Mostly by defending against market euphoria and by exploiting market fear.

While easier said, what it requires is that our thinking mind overrides the primordial fight or flight auto-instincts. Therefore, the overall success of any investing plan is rooted in the discipline it imposes on this auto-response.

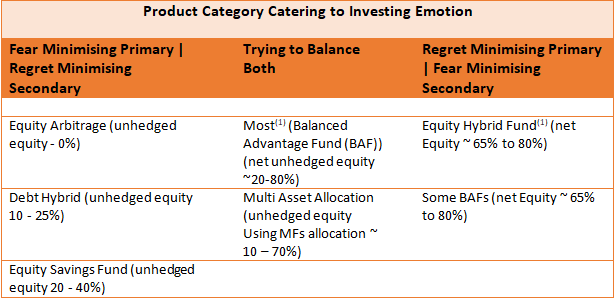

Such a plan has to achieve proper balance of fear and hope. Arguably, Hybrid funds tend to operate in this space. They try to balance both the emotions to varying degree to optimize the investing experience. If we refer

to the below table we can see that these funds at a basic level are catering to those very concerns.

*Arranged in order of relevance. (1): based on the net equity allocation trend observed within the category. The Scheme categorisation is as per SEBI Categorisation circular dated October 06, 2017

In the next module we shall see in details as to how we may aim to arrange our emotional choices more consciously and to our long-term

advantage.

Nifty & Crisil Index benchmarks for the respective products have been used to represent the performance profile of each product category. Risk of Loss data chart implies the percentage negative performance for the rolling returns

observed for the respective indices in the given period. The loss is estimated using respective annualized rolling return period on daily basis since 2002.

(The Scheme categorisation is as per SEBI Categorisation circular dated October 06, 2017. The risk spectrum shown above is for broadly explaining the risk spectrum of Mutual fund schemes under Hybrid category. The actual risk of

the schemes of Hybrid categories mentioned above may or may not be in line with the risk curve shown above)

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada