Loss aversion is a trait of investor behaviour wherein investors prefer to avoid a loss than to make an equivalent profit. Loss aversion is also known as Regret Aversion. When faced with a choice of avoiding a loss of Rs 1,000 or making a

profit of Rs 1,000, investors with loss aversion bias will prefer not making a loss to making a profit. Investors with loss aversion make often sub-optimal investment decision.

Loss Aversion versus Risk Aversion

It is easy to confuse between risk aversion and loss aversion because on the surface they appear to be the same. However, there is a difference between the two. Risk aversion is avoiding risks or the possibility of a loss; it gets reflected

in their choice of investments. Risk-averse investors will prefer less risky investments e.g. fixed income over equity, large cap over midcap etc. Investors with loss aversion bias may not be necessarily risk averse; they often invest

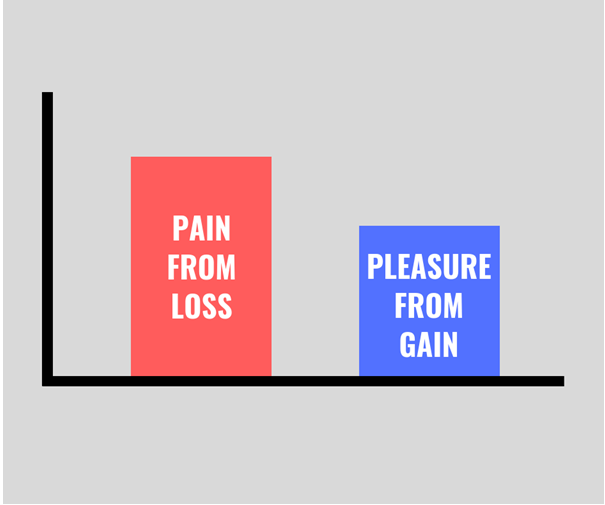

in risky assets. Loss aversion comes into play when investors are faced with uncertainties. The regret of a loss is far more than the satisfaction from an equivalent. According to behavioural economists, the psychological impact of a loss

is twice that of same amount of profit.

Harmful effects of loss aversion

- Loss aversion causes investors to hold on to loss making stocks or funds for very long period. They refuse to sell a stock or fund at a loss and can hold on it for long periods of time even if there are better alternative investment options

available.

- Aversion for losses makes investors hold on to loss making stocks or funds till the loss is recovered. Ultimately, when the investor sells the stock or fund, a long time may have elapsed and the return on the investment is very low.

- There are also instances of investors holding on to loss making stocks / funds and then finally selling them at a much bigger loss than what they would have incurred if they sold earlier.

- Loss aversion is commonly seen in property / real estate investments. Investors refuse to sell their property at a loss and hold on it to it hoping the investment will turn profitable someday. Throughout the holding period of the investment,

they pay interest on their loans which could have been avoided if they sold earlier.

How to avoid loss aversion and conclusion

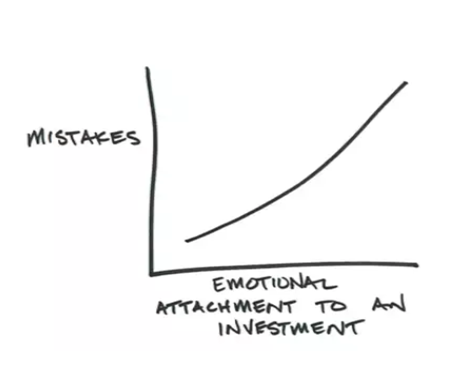

No one likes to make a loss, but loss aversion can cause you to lose more money or make less money than what you feared to lose. You can avoid loss aversion by not getting too emotionally involved in your investments. There are risks involved

in investments, many of these risks are beyond your control and you cannot be right all the time. Sometimes, it is better to book a loss and move on to alternative investment options. It is difficult to separate emotions from investing,

but successful investors are able to do it. A good financial advisor can help you overcome this behavioural bias. You should have a rational and objective portfolio performance evaluation process; take the help of a financial advisor if

required. You should do what is right to meet your financial goals including selling funds that are underperforming consistently and switching to better funds.

Disclaimer:

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund. All Mutual Fund investors have to go through a one-time KYC (Know Your Customer) including the process for change in address, Phone number, bank details, etc. Investors

should deal only with registered Mutual Funds details of which can be verified on SEBI website (https://www.sebi.gov.in) under ‘Intermediaries /Market Infrastructure Institutions’.

For further information on KYC, RMFs and procedure to lodge a complaint in case of any grievance, you may refer the Knowledge Centre section available on the website of Mirae Asset Mutual Fund. Investors may lodge complaints on https://www.scores.gov.in against registered intermediaries if they are unsatisfied with the responses. SCORES facilitate you to lodge your complaint online with SEBI and subsequently view its status.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

ETF Website

ETF Website

Invest Now

Invest Now

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada