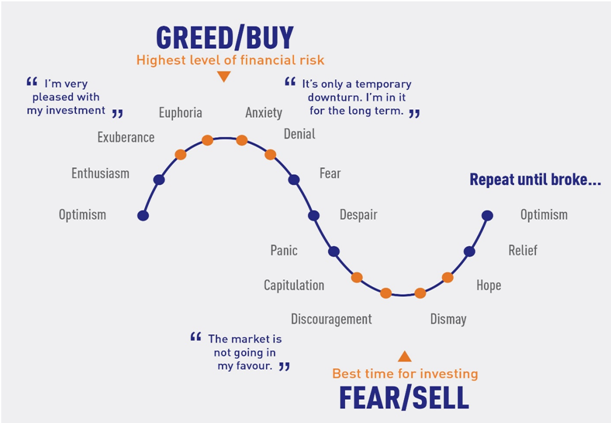

There is an old saying in Wall Street, “Financial markets are driven by two powerful emotions – Greed and Fear”. Legendary investor, Warren Buffet in his 1986 letter to Berkshire Hathaway shareholders wrote that, “Occasional outbreaks of those

two super-contagious diseases, Fear and Greed, will forever occur in the investment community”. Investor behaviour driven primarily by Greed and Fear is responsible for the dizzying highs in bull markets and subsequent crash in bear markets.

How Greed affects asset prices and returns

Jeff Bezos, the CEO of Amazon once asked Warren Buffet, “Your investment thesis is so simple. Why doesn’t everyone just copy you?” Buffet responded to Bezos by saying, “Because no one wants to get rich slow”. What Warren Buffet said to Jeff

Bezos is the essence of Greed in investment behaviour. Investors want to make profits quickly and bull markets provide a great opportunity to make profits in a short period of time. When price keeps rising, more and more people invest

more and more money in stocks. Stock prices follow the law of demand and supply. With higher demand (more money), prices keep rising further and profits grow. Growing profits fuel more greed and more money get invested raising prices to

excessive levels. At very high prices, asset bubbles are created i.e. prices are much more than intrinsic or fundamental value of assets. Like all bubbles, asset bubbles eventually burst and prices crash. Investors who had bought stocks

at very high prices face big losses when market corrects.

How Fear affects asset prices and returns

When asset prices get overheated it eventually corrects. Bear markets (falling markets) can be triggered by a number of factors but the most common factor is slowing or sluggish economy. It has generally been seen that a stock price fall faster

than it rises. 2 – 3 years of gains in stock price can be wiped out in just 2 – 3 months during bear markets. A number of reasons can be ascribed to severe crashes seen in bear markets e.g. high leverage through derivatives near bull market

peaks, margin calls getting triggered etc, but the fundamental reason is Fear. When prices fall sharply, investors fear that it will fall more and sell in panic. As mentioned earlier, stock prices follow the law of demand and supply. In

a bear market, supply of stocks is high since most investors want to sell in panic. Panic selling causes stock prices to fall sharply. Ultimately, prices fall to such low levels that stock valuations become attractive (cheap) and the markets

eventually bottoms out.

Effect of investor behaviour in market corrections

You cannot control the market but you have control over your actions. Your actions will determine whether you make a profit or loss in stocks or mutual funds.

Let us assume you invested Rs 100,000 in an equity mutual fund scheme. The scheme NAV was Rs 100 and you bought 100 units. The NAV rose to Rs 110 and then fell to Rs 90. Even though

the market value of your fund is now less than your purchase price, this is only a notional loss – not an actual loss. Over time, market value of your investment may go up when the stock market recovers. Whether you make a profit or loss

ultimately will depend on your actions. You may do one of the following:-

- Fear that market value of your fund will fall even further and redeem. By redeeming you will convert the notional loss of 100 X (100 – 90) = Rs 10,000 into an actual loss of Rs 10,000.

- Think the market value of your fund will fall even further and you will have the opportunity to buy it again at a lower cost. Let us assume that you were right and the fund NAV falls to Rs 80. Even if Rs 80 is the lowest price you are

unlikely to invest at that price because you will fear that price will fall even further. In almost all bear markets, the more the market fell, the greater was the fear among investors. Most investment experts have conceded that it

is almost impossible to time a bear market bottom. Most investors who have made a loss want to feel confident about recovery before investing again. However, turnaround from market bottoms is usually very rapid. Therefore, by the time

you invest again prices would have risen considerably above the market bottom. Let us assume you invested when the NAV is 95. You have Rs 90,000 from your redemption proceeds. So you will buy 947.4 units. In 1 – 2 years, the fund NAV

becomes Rs 110. The market value of your investment will be Rs 104,210. So your profit is Rs 4,210.

- You do nothing – simply, stick to your investment plan despite the fall in prices. The market value of your investment may rise, fall and rise again. When your fund NAV is Rs 110, your profit will be = 100 X (110 – 100) = Rs 10,000. Doing

nothing and remaining disciplined was the best course of action in this example.

Conclusion

It is said that even Sir Isaac Newton lost a lot of money in a speculative investment in shares of one of the hottest stocks in Britain during his time. Reflecting on his losses, the great scientist said, “I could calculate the motions of

the heavenly bodies, but not the madness of people”. Stock market prices reflect the collective investment behaviour of all investors. Greed and fear are base instincts driving investment behaviour but they are greatly detrimental to your

financial interests. It is not easy to remain calm in highly volatile markets. But if you do not let greed and fair affect your investment behaviour then you may be in a much stronger position to meet your financial goals.

An Investor Education and Awareness Initiative by Mirae Asset Mutual Fund.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click Here.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada