Announcing the NFOs, Mr. Swarup Mohanty, CEO, Mirae Asset Investment Managers (India) Private Limited said, “Mirae Asset has been in the forefront of introducing global investment products for Indian investors. We are at a nascent

stage of the evolution of these themes in India, but globally these themes are taking centre stage, we believe introducing these funds to investors would offer them a chance to participate in these global themes”.

“We want to bring the experience of investing in unique global offerings to Indian investors at an opportune time so as to make their investment horizon broad based and relevant in the investment cycle of investors at large,” he

added.

Mr. Siddhartha Srivastava, Head-ETF Products at Mirae Asset Investment Managers (India) Private Limited said, “the New Fund Offers come at a time when valuations seem relatively attractive to investors and there is a substantial

tilt towards using these technologies by majority of the countries”.

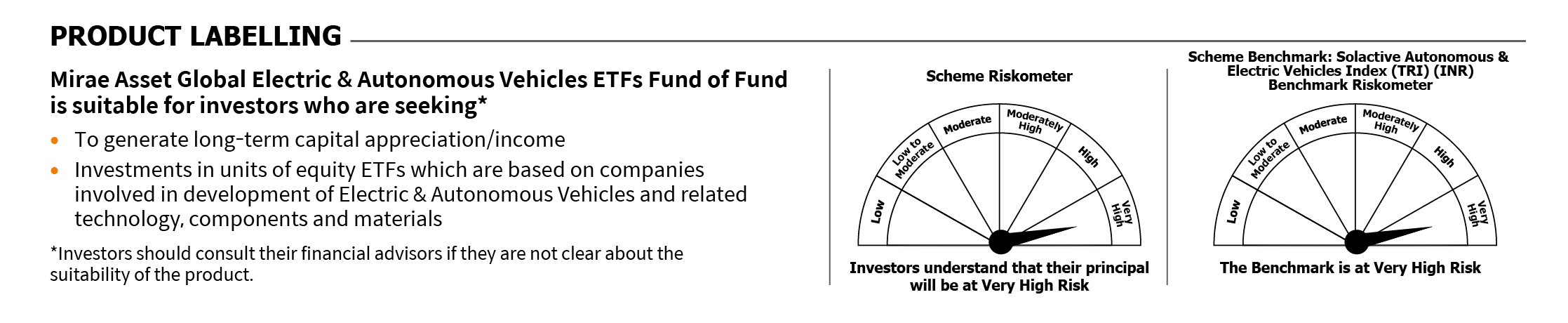

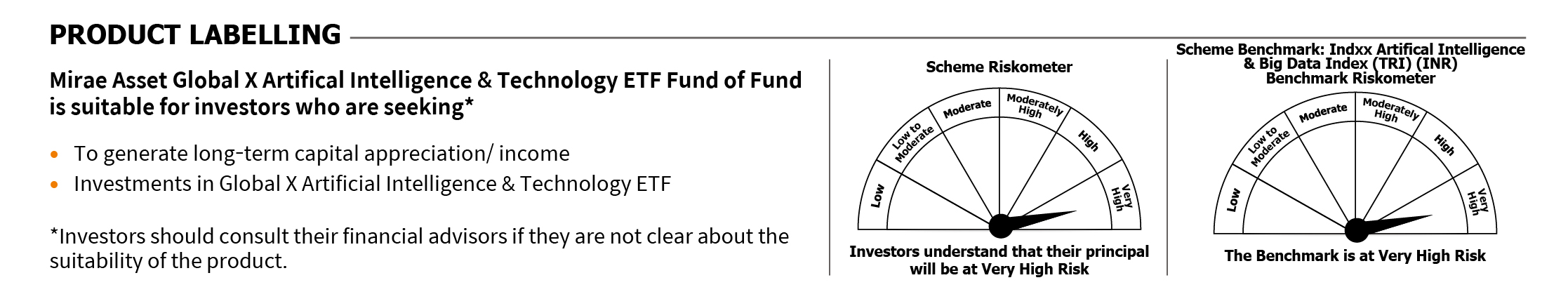

Mirae Asset Global Electric & Autonomous Vehicles ETFs Fund of Fund and Mirae Asset Global X Artificial Intelligence and Technology ETF Fund of Fund will be available to investors in both, Regular Plan and Direct Plan. Post

NFO, the Minimum Additional Purchase Amount will be Rs 1000 and in multiples of Re 1 thereafter.

For further information, contact:

Dattu Hegde,

The Good Edge,

dattu@thegoodedge.com | M: +91-9920710013

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada