Mirae Asset Investment Managers (India) Pvt. Ltd. announces the launch of

‘Mirae Asset Small Cap Fund’, an open-ended equity scheme predominantly investing in small cap

stocks. The fund aims to provide investors with an opportunity to participate in the potential growth of

fundamentally strong small cap companies through a research driven and disciplined investment

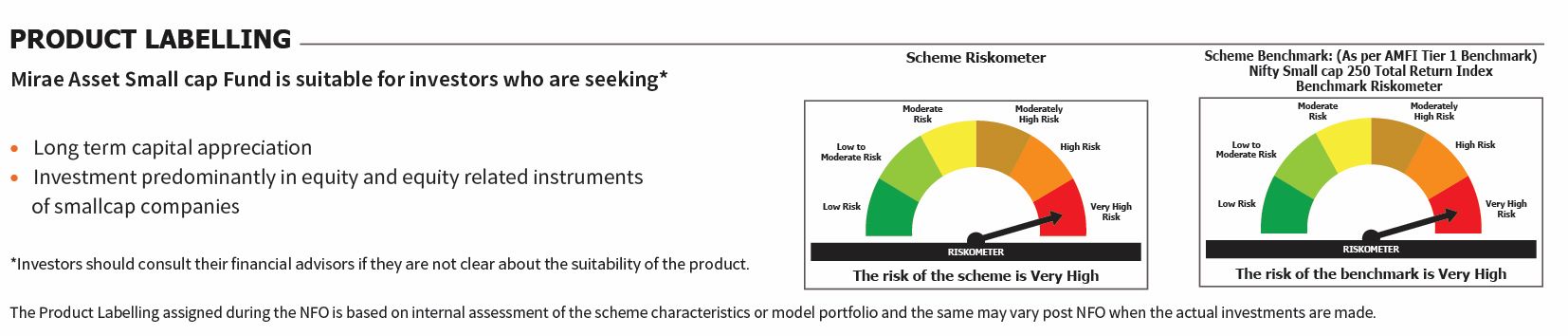

approach. The fund will be benchmarked with Nifty Small Cap 250 Total Return Index (TRI) and will be

managed by Mr. Varun Goel, Sr. Fund Manager - Equity

Mirae Asset Small Cap Fund is tailored for investors with a high-risk appetite who are seeking wealth

creation through participation in higher growing segments of the economy. This includes young, dynamic

investors who aim to explore high-growth opportunities, experienced risk-takers aiming to enhance

portfolio returns, and Systematic Investment Plans (SIP) investors aiming to manage market volatility

through disciplined investing. By catering to varied profiles, the scheme aims to meet the diverse

objectives of investors.

The New Fund Offer (NFO) for Mirae Asset Small Cap Fund will open for subscription on January 10, 2025

and close on January 24, 2025. The scheme will re-open for continuous sale and repurchase on February

03, 2025. In the scheme, the minimum initial investment during New Fund Offer will be Rs 5,000/- (Rupees

Five Thousand) with subsequent investments being multiples of Re 1

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada