Mirae Asset Investment Managers (India) Pvt. Ltd. announces the launch of

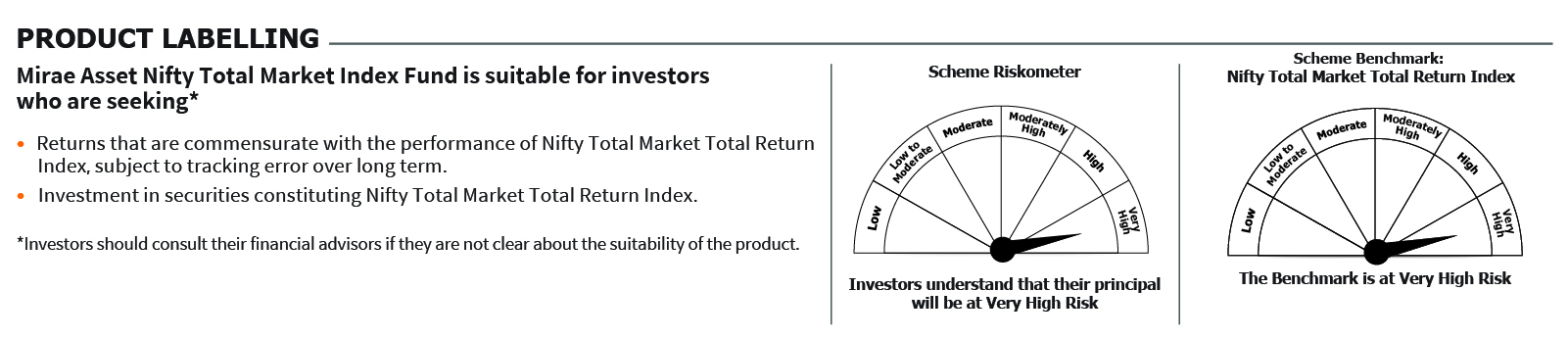

‘Mirae Asset Nifty Total Market Index Fund’, an open-ended scheme replicating/ tracking Nifty Total

Market Total Return Index, offering exposure to 750 companies across various market cap segments.

The Nifty Total Market Index provides a comprehensive representation of the Indian equity market,

offering exposure to large, mid, small, and micro-cap segments. This diversified approach may help

investors capture growth opportunities across the evolving landscape of the Indian equity market.

India’s market attractiveness may continue to rise as it is expected to become the world’s third-largest

economy by 2028. (Source: Data as on FY24, World Bank Group, Trading Economic).As market dynamics evolve,

the Mirae Asset Nifty Total Market Index Fund seeks to capture the opportunities presented across

various sectors and market caps. Key sectors such as banking, IT, pharmaceuticals, focus sectors like

manufacturing, infrastructure and emerging industries like fintech and digital entertainment are

captured from different market cap segments in this fund with an aim to provide investors with potential

opportunities for market cap and sectoral diversification and risk management.

The New Fund Offer (NFO) for Mirae Asset Nifty Total Market Return Index Fund will open for

subscription on October 08, 2024 and close on October 22, 2024. The scheme re-opens for continuous

sale and repurchase on October 29, 2024. The scheme will be managed by Ms. Ekta Gala and Mr. Vishal

Singh.

In the scheme, the minimum initial investment during NFO will be Rs 5,000/- (Rupees Five Thousand)

with subsequent investments being multiples of Re 1.

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada