Mirae Asset Investment Managers (India) Pvt. Ltd. on Friday announced the launch of Mirae Asset Nifty200 Alpha 30 ETF Fund of Fund (An open-ended fund of fund scheme investing in units of Mirae Asset Nifty200 Alpha 30 ETF).

The New Fund Offer for the scheme opens on Monday, July 8, 2024, and closes on Monday, July 22, 2024. The fund managers are Ms. Ekta Gala and Mr. Vishal Singh. Minimum investment should be Rs 5,000 and in multiples of Re 1 thereafter.

Systematic Investment Plan can be set up with an investment of Rs 500 and in multiplies of Re 1 thereafter.

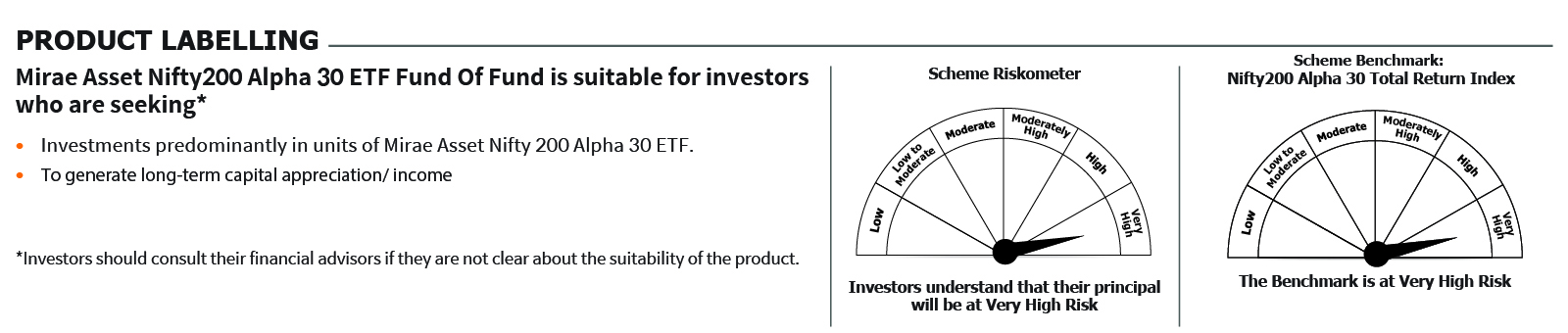

Mr. Siddharth Srivastava, Head-ETF Products, Mirae Asset Investment Managers (India) Pvt. Ltd., said, “Mirae Asset Nifty200 Alpha 30 ETF Fund of Fund is a strategic addition to our existing product portfolio, which seeks

to provide a valuable opportunity for investors who wish to invest in the Mirae Asset Nifty200 Alpha 30 ETF without requiring a broking or a demat account. This product is designed to capture the alpha and momentum strategy,

focusing on 30 large and mid-cap stocks* selected and weighted based on their ‘alpha score’ rather than free float market cap. The portfolio is reviewed on a quarterly basis and has exhibited dynamic rotation between sectors

and large and midcap stocks by capturing latest market trends.”

Alpha is simply a ‘persistence’ factor i.e. which seeks to benefit from continued latest trends in the market. By selecting and weighing stocks purely based on “Alpha score”, index remains unbiased towards large or midcap stock

and seeks to capture the alpha and momentum strategy in a true to label manner. This index seeks to generate returns by capturing latest market trends and hence has historically exhibited higher portfolio churns in order to

capture in-favour segments and stocks. However, investors should be aware of the higher drawdowns and increased volatility associated with this index, and consider it from a long-term investment perspective. Investors may consider

this product if they aim to capitalize on the momentum and alpha strategy after evaluating their risk profile.

Log In

Log In

Online e-KYC

Online e-KYC

![mirae asset usa]() Australia

Australia

![mirae asset brazil]() Brazil

Brazil

![mirae asset colombia]() Colombia

Colombia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset Japan]() Japan

Japan

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset singapore]() Singapore

Singapore

![mirae asset uk]() Ireland

Ireland

![mirae asset canada]() Canada

Canada

![mirae asset india]() Global

Global

![mirae asset australia]() Australia

Australia

![mirae asset hong kong]() Hong Kong SAR

Hong Kong SAR

![mirae asset india]() India

India

![mirae asset korea]() Korea

Korea

![mirae asset korea]() UAE

UAE

![mirae asset uk]() United Kingdom

United Kingdom

![mirae asset usa]() United States

United States

![mirae asset vietnam]() Vietnam

Vietnam

![mirae asset korea]() Korea

Korea

Global

Global

Australia

Australia

Hong Kong SAR

Hong Kong SAR

India

India

Korea

Korea

UAE

UAE

United Kingdom

United Kingdom

United States

United States

Vietnam

Vietnam

Korea

Korea

Australia

Australia

Brazil

Brazil

Colombia

Colombia

Hong Kong SAR

Hong Kong SAR

Japan

Japan

United Kingdom

United Kingdom

United States

United States

Singapore

Singapore

Ireland

Ireland

Canada

Canada