MIRAE ASSET

NYSE FANG+ ETF - (MAFANG)

(Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking NYSE FANG+ Total Return Index)

| Type of Scheme | Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking NYSE FANG+ Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the NYSE FANG+ Total Return Index, subject to tracking error and forex movement. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Mr. Siddharth Srivastava (since May 06, 2021) |

| Allotment Date | 06th May, 2021 |

| Benchmark Index | NYSE FANG+ Index (TRI) (INR) |

| Minimum Investment Amount |

On exchange (in multiple of 1 units), Directly with AMC or Authorized Participant (in multiple of 2,00,000 units) |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MAFANG in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on Febraury 28, 2022 | 1,310.76 |

| Net AUM (₹ Cr.) | 1,242.68 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on Febraury 28, 2022 | 0.53% |

| **For experience of Fund Managers Click Here | |

| ^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. | |

| ₹ 47.850 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

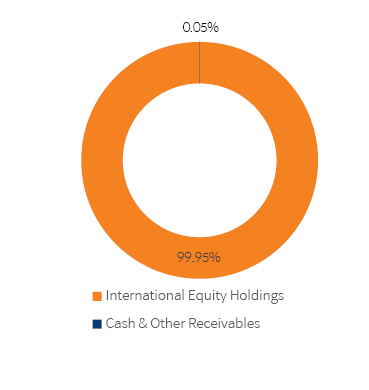

| Portfolio Holdings | % Allocation | |

| International Equity Shares | ||

| Apple Inc | 10.97% | |

| Alphabet Inc A | 10.83% | |

| Tesla Inc | 10.61% | |

| Microsoft Corp | 10.49% | |

| Amazon Com Inc | 10.27% | |

| Nvidia Corp Com | 9.97% | |

| Netflix Inc | 7.64% | |

| Facebook Inc | 7.19% | |

| International Equity Holding Total | 77.97% | |

| American Depository Receipt | ||

| Baidu Inc Spon ADR | 12.20% | |

| Alibaba Group Holding Ltd | 9.79% | |

| American Depository Receipt Total | 21.99% | |

| Cash & Other Receivables | 0.05% | |

| Total | 100.00% | |

| Returns (in%) | ||||

| 6 Months | SI (absolute)* | |||

| MAFANG | 11.21% |

-1.95% |

||

| Scheme Benchmark* | 11.07% |

-1.86% |

||

| Additional Benchmark** | 0.59% |

16.05% |

||

| NAV as on 28th February, 2022 | 47.850 | |||

| Index Value (28th February, 2022) | Index Value of benchmark is 7,969.32 and S&P BSE Sensex (TRI) is 84,075.57 | |||

| Allotment Date | 06th May, 2021 | |||

| Scheme Benchmark | *NYSE FANG+ Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

*Absolute Return (less than one year)

Note:Fund manager : Mr. Siddharth Srivastava managing the scheme since May 06, 2021.

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

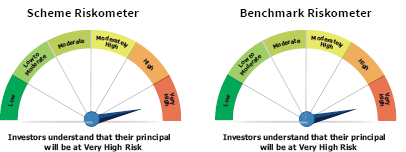

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of NYSE FANG+ Total Return Index.subject to tracking error and foreign exchange movement

• Investments in equity securities covered by NYSE FANG+ Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 48.597. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option