MIRAE ASSET

NIFTY 50 ETF - (MAN50ETF)

(Exchange Traded Fund (ETF) - An open ended scheme replicating/tracking Nifty 50 Index)

| Type of Scheme | Exchange Traded Fund (ETF) - An open ended scheme replicating/tracking Nifty 50 Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty 50 Index, subject to tracking error. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

<Ms. Ekta Gala (since December 28, 2020) |

| Allotment Date | 20th November, 2018 |

| Benchmark Index | Nifty 50 Index (TRI) |

| Minimum Investment Amount |

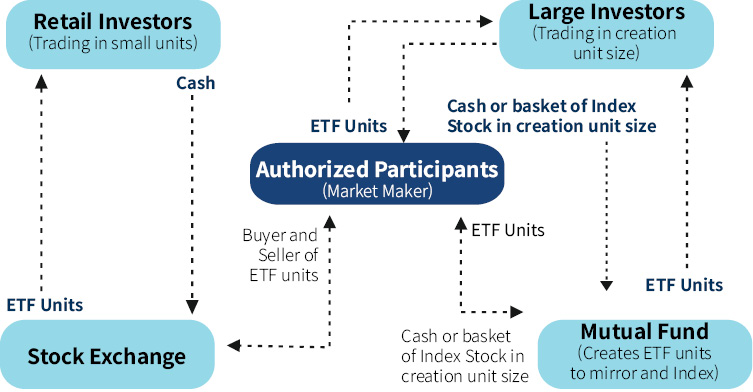

Other Investors(Including Authorized Participants/ Large Investors): Application for subscription of the Units in Creation unit size can be made either:In exchange of Cash*[as determined by the AMC equivalent to the cost incurred towards the purchase of predefined basket of securities that represent the underlying index (i.e. Portfolio Deposit)], Cash component and other applicable transaction charges; or in exchange of Portfolio Deposit [i.e. by depositing basket of securities constituting Nifty 50 Index] along with the cash component and applicable transaction charges." There is no minimum investment, although units can be purchased/subscribed in round lots of 1 on the BSE/NSE (Stock Exchanges) on all the trading days. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size.For other than Creation Unit Size: Not Applicable -The Units of MAN 50 ETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on January 31, 2022 | 726.09 |

| Net AUM (₹ Cr.) | 381.04 |

| Tracking Error Value ~ | 20.74 bps |

| ~stating tracking error is for 3 years | |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on January 31, 2022 | 0.08% |

| **For experience of Fund Managers Click Here | |

| ^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. | |

| ₹ 178.873 (Per Unit) |

Creation Unit size = 50,000 units

1 Unit approximately equal to 1/100th of the value of Nifty 50 Index

East India Securities Limited

Kanjalochana Finserve Private Limited

Live iNav is updated on Mirae Asset Website

NSE Symbol : MAN50ETF

BSE Code: 542131

Bloomberg Code: MAN50ETF IN Equity

Reuters Code: MIRA.NS

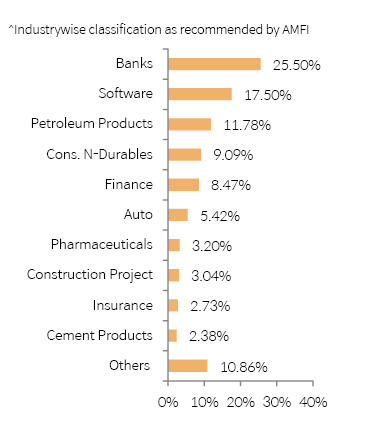

| Portfolio Holdings | % Allocation | |

| Banks | ||

| HDFC Bank Ltd | 8.58% | |

| ICICI Bank Ltd | 7.22% | |

| Kotak Mahindra Bank Ltd | 3.60% | |

| State Bank of India | 2.73% | |

| Axis Bank Ltd | 2.63% | |

| IndusInd Bank Ltd | 0.75% | |

| Yes Bank Limited | 0.00% | |

| Software | ||

| Infosys Ltd | 8.49% | |

| Tata Consultancy Services Ltd | 5.10% | |

| HCL Technologies Limited | 1.57% | |

| Tech Mahindra Limited | 1.21% | |

| Wipro Ltd | 1.12% | |

| Petroleum Products | ||

| Reliance Industries Ltd* | 10.86% | |

| Bharat Petroleum Corporation Limited | 0.50% | |

| Indian Oil Corporation Ltd | 0.42% | |

| Consumer Non Durables | ||

| Hindustan Unilever Ltd | 2.68% | |

| ITC Ltd | 2.54% | |

| Asian Paints Ltd | 1.87% | |

| Nestle India Limited | 0.87% | |

| Tata Consumer Products Limited | 0.57% | |

| Britannia Industries Ltd | 0.55% | |

| Finance | ||

| Housing Development Finance Corporation Ltd | 6.01% | |

| Bajaj Finance Limited | 2.45% | |

| Auto | ||

| Maruti Suzuki India Ltd | 1.51% | |

| Tata Motors Limited | 1.22% | |

| Mahindra & Mahindra Limited | 1.12% | |

| Bajaj Auto Limited | 0.61% | |

| Eicher Motors Ltd | 0.49% | |

| Hero MotoCorp Limited | 0.47% | |

| Pharmaceuticals | ||

| Sun Pharmaceutical Industries Ltd | 1.19% | |

| Dr. Reddy's Laboratories Ltd | 0.69% | |

| Divi's Laboratories Ltd | 0.68% | |

| Cipla Limited | 0.64% | |

| Construction Project | ||

| Larsen & Toubro Ltd | 3.04% | |

| Insurance | ||

| Bajaj Finserv Limited | 1.25% | |

| HDFC Life Insurance Company Ltd | 0.76% | |

| SBI Life Insurance Company Limited | 0.72% | |

| Cement & Cement Products | ||

| UltraTech Cement Limited | 1.10% | |

| Grasim Industries Ltd | 0.85% | |

| Shree Cement Limited | 0.43% | |

| Telecom - Services | ||

| Bharti Airtel Ltd | 2.27% | |

| Ferrous Metals | ||

| Tata Steel Ltd | 1.14% | |

| JSW Steel Limited | 0.82% | |

| Power | ||

| Power Grid Corporation of India Ltd | 0.97% | |

| NTPC Ltd | 0.89% | |

| Consumer Durables | ||

| Titan Company Ltd | 1.30% | |

| Non - Ferrous Metals | ||

| Hindalco Industries Limited | 0.94% | |

| Oil | ||

| Oil & Natural Gas Corporation Limited | 0.83% | |

| Transportation | ||

| Adani Ports and Special Economic Zone Limited | 0.69% | |

| Pesticides | ||

| UPL Limited | 0.56% | |

| Minerals/Mining | ||

| Coal India Ltd | 0.44% | |

| Equity Holding Total | 99.97% | |

| Cash & Other Receivables | 0.03% | |

| Total | 100.00% | |

*Includes "Partly Paid Shares"

| Returns (in%) | ||||

| 1 Yr | 3 Yrs | SI | ||

| MAN50ETF | 28.39 |

18.16 |

17.82 |

|

| Scheme Benchmark* | 28.50 |

18.35 |

17.76 |

|

| NAV as on 31st January, 2022 | 178.873 | |||

| Index Value (31st January, 2022) | Index Value of benchmark is 24,894.62 |

|||

| Allotment Date | 20th November, 2018 | |||

| Scheme Benchmark | *Nifty 50 Index (TRI) | |||

Note:

Fund manager : Ms. Ekta Gala managing the scheme since December 28, 2020.

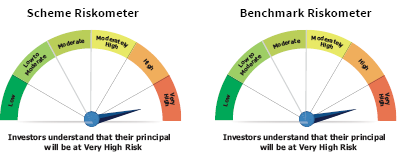

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of the NIFTY 50, subject to tracking errors over long term

• Investment in equity securities covered by the NIFTY 50

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 105.24. The performance of other funds managed by the same fund manager is given in the respective page of the schemes