MIRAE ASSET

NIFTY INDIA MANUFACTURING ETF - (MTETF)$

(Exchange Traded Fund - An open- ended scheme replicating/ tracking Nifty India Manufacturing Index)

| Type of Scheme | Exchange Traded Fund - An open- ended scheme replicating/ tracking Nifty India Manufacturing Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty India Manufacturing Total Return Index, subject to tracking error. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Ms. Ekta Gala (since January 27, 2022) |

| Allotment Date | 27th January 2022 |

| Benchmark Index | Nifty India Manufacturing Total Return Index (INR) |

| Minimum Investment Amount |

₹5,000/- and in multiples of ₹1/- thereafter. On exchange: In multiples of 1 units; Directly with AMC ( in multiples of 100,000 units) |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

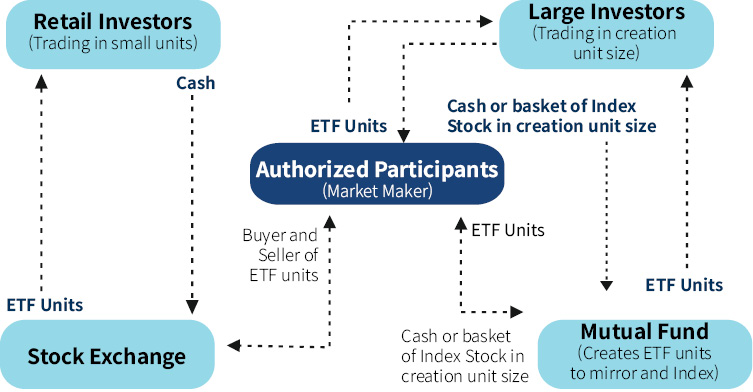

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MTETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on January 31, 2022 | 6.66 |

| Net AUM (₹ Cr.) | 63.14 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on January 31, 2022 | 0.40% |

| **For experience of Fund Managers Click Here | |

| ₹ 78.968 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

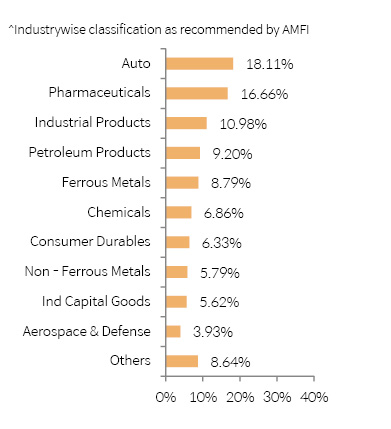

| Portfolio Holdings | % Allocation | |

| Auto | ||

| Maruti Suzuki India Ltd | 4.68% | |

| Tata Motors Limited | 3.80% | |

| Mahindra & Mahindra Limited | 3.47% | |

| Bajaj Auto Limited | 1.90% | |

| Eicher Motors Ltd | 1.51% | |

| Hero MotoCorp Limited | 1.45% | |

| Ashok Leyland Limited | 0.78% | |

| Escorts Limited | 0.53% | |

| Pharmaceuticals | ||

| Sun Pharmaceutical Industries Ltd | 4.19% | |

| Dr. Reddy's Laboratories Ltd | 2.43% | |

| Divi's Laboratories Ltd | 2.39% | |

| Cipla Limited | 2.23% | |

| Lupin Limited | 1.02% | |

| Laurus Labs Limited | 0.92% | |

| Aurobindo Pharma Ltd | 0.83% | |

| Gland Pharma Limited | 0.79% | |

| Biocon Ltd | 0.78% | |

| Torrent Pharmaceuticals Ltd | 0.61% | |

| Cadila Healthcare Limited | 0.48% | |

| Industrial Products | ||

| Astral Limited | 2.02% | |

| Bharat Forge Limited | 1.99% | |

| Supreme Industries Limited | 1.44% | |

| Cummins India Limited | 1.35% | |

| Polycab India Limited | 1.12% | |

| SKF India Limited | 0.89% | |

| AIA Engineering Limited | 0.79% | |

| Schaeffler India Limited | 0.77% | |

| Graphite India Limited | 0.35% | |

| HEG Limited | 0.25% | |

| Petroleum Products | ||

| Reliance Industries Ltd* | 4.74% | |

| Bharat Petroleum Corporation Limited | 1.76% | |

| Indian Oil Corporation Ltd | 1.48% | |

| Hindustan Petroleum Corporation Ltd | 0.93% | |

| Castrol India Limited | 0.28% | |

| Ferrous Metals | ||

| Tata Steel Ltd | 3.95% | |

| JSW Steel Limited | 2.90% | |

| Jindal Steel & Power Limited | 0.73% | |

| Steel Authority of India Limited | 0.66% | |

| APL Apollo Tubes Limited | 0.55% | |

| Chemicals | ||

| Pidilite Industries Limited | 1.74% | |

| SRF Limited | 1.62% | |

| Aarti Industries Limited | 0.92% | |

| Atul Limited | 0.72% | |

| Tata Chemicals Ltd | 0.69% | |

| Navin Fluorine International Limited | 0.63% | |

| Linde India Limited | 0.27% | |

| Solar Industries India Limited | 0.26% | |

| Consumer Durables | ||

| Havells India Ltd | 1.38% | |

| Voltas Ltd | 1.27% | |

| Crompton Greaves Consumer Electricals Limited | 1.17% | |

| Dixon Technologies (India) Limited | 0.73% | |

| Bata India Limited | 0.58% | |

| Kajaria Ceramics Ltd | 0.51% | |

| Relaxo Footwears Limited | 0.41% | |

| Whirlpool of India Limited | 0.27% | |

| Non - Ferrous Metals | ||

| Hindalco Industries Limited | 3.32% | |

| Vedanta Limited | 1.95% | |

| Hindustan Zinc Limited | 0.37% | |

| Hindustan Copper Limited | 0.15% | |

| Industrial Capital Goods | ||

| Siemens Limited | 2.19% | |

| ABB India Limited | 1.29% | |

| Honeywell Automation India Limited | 1.00% | |

| Bharat Heavy Electricals Limited | 0.79% | |

| GMM Pfaudler Limited | 0.35% | |

| Aerospace & Defense | ||

| Bharat Electronics Ltd | 2.65% | |

| Hindustan Aeronautics Limited | 1.28% | |

| Auto Ancillaries | ||

| Balkrishna Industries Ltd | 0.78% | |

| Tube Investments of India Limited | 0.68% | |

| MRF Limited | 0.62% | |

| Bosch Limited | 0.58% | |

| Sundram Fasteners Limited | 0.36% | |

| Exide Industries Limited | 0.33% | |

| Amara Raja Batteries Limited | 0.25% | |

| Endurance Technologies Limited | 0.23% | |

| Pesticides | ||

| UPL Limited | 1.99% | |

| PI Industries Limited | 0.91% | |

| Textile Products | ||

| Page Industries Ltd | 1.14% | |

| Fertilisers | ||

| Coromandel International Limited | 0.44% | |

| Chambal Fertilizers & Chemicals Limited | 0.33% | |

| Equity Holding Total | 100.92% | |

| Cash & Other Receivables Total | -0.92% | |

| Total | 100.00% | |

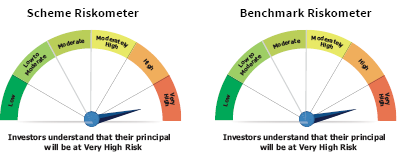

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of the Nifty India Manufacturing Total Return Index, subject to tracking error over long term

• Investment in equity securities coverd by Nifty India Manufacturing Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : Since the scheme is in existence for less than 6 Month, as per SEBI regulation performance of the scheme has not been shown. The performance of other funds managed by the same fund manager is given in the respective page of the schemes