MIRAE ASSET

NYSE FANG+ETF FUND OF FUND - (MAFPF)

(Fund of Fund - An Open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF)

| Type of Scheme | Fund of Fund - An Open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF |

| Investment Objective | An open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF There is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Ms. Ekta Gala (since May 10, 2021) |

| Allotment Date | 10th May 2021 |

| Benchmark Index | NYSE FANG+ Index (TRI) |

| Minimum Investment Amount |

₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: Minimum of ₹ 5000/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: If redeemed within 3 months from the date of allotment: 0.50% If redeemed after 3 months from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option |

| Monthly Average AUM (₹ Cr.) as on January 31, 2022 | 1,051.74 |

| Net AUM (₹ Cr.) | 1,002.89 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on January 31, 2022 |

Regular Plan: 0.73% Direct Plan: 0.15% Investors may note that they will bear recurring expenses of the underlying scheme in addition to the expenses of this scheme |

| Investors may note that they will bear recurring expenses of the underlying scheme in addition to the expenses of this scheme. The TER of underlying scheme i.e NYSE FANG+ ETF is 0.53% | |

| **For experience of Fund Managers Click Here | |

| ^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. | |

| NAV: | Direct | Regular |

| Growth | ₹ 10.462 | ₹ 10.423 |

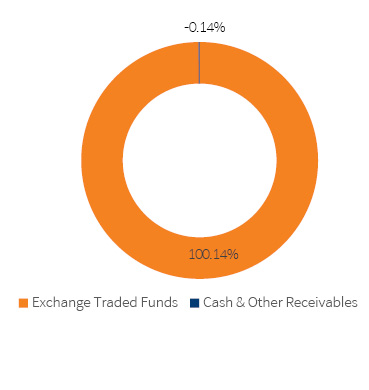

| Portfolio Holdings | % Allocation | |

| Exchange Traded Funds | ||

| Mirae Asset NYSE FANG+ ETF | 100.14% | |

| Exchange Traded Funds Total | 100.14% | |

| Cash & Other Receivables | -0.14% | |

| Total | 100.00% | |

| Returns (in%) | ||||

| Since Inception (absolute)* | ||||

| MAFPF | 3.75 |

|||

| Scheme Benchmark* | 5.50 |

|||

| Additional Benchmark** | 18.19 |

|||

| NAV as on 31st January, 2022 | 10.423 | |||

| Index Value (31st January, 2022) | Index Value of benchmark is 8,567.54 and S&P BSE Sensex (TRI) is 86,594.54 | |||

| Allotment Date | 10th May, 2021 | |||

| Scheme Benchmark | *NYSE FANG+ Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

*Absolute Return (less than one year)

Note:Fund manager : Ms. Ekta Gala managing the scheme since May 10, 2021.

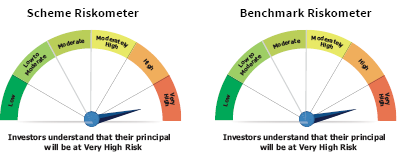

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income

• Investments predominantly in units of Mirae Asset NYSE FANG+ ETF

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 22.305. The performance of other funds managed by the same fund manager is given in the respective page of the schemes