.jpg?sfvrsn=5c140f7e_2)

Cash and Overnight Funds

Most retail investors keep their excess funds or savings parked in their savings bank account. If you are a small business owner, you may also have substantial funds lying in your current account. Investors should understand that funds kept in savings bank account are essentially idle, in other words, they do not earn much returns. Interest paid by the ordinary savings bank accounts are usually in the range of 2.5 to 3.5%. On a post-tax basis, this is lower than the inflation rate. Current accounts do not pay any interest.

You can put your idle money to more productive use by parking it in overnight and liquid mutual funds. The average yields of these schemes tend to be higher than savings bank interest rates.

What are overnight funds?

These are debt mutual funds which invest in overnight securities. These securities have maturity of one day. Issuers of overnight securities (borrowers) borrow only “overnight” from the investors (lenders). The issuer has to repay the principal amount along with interest at the start of the next business day. The primary objective of overnight funds is to generate returns commensurate with low risk and providing high level of liquidity. As such, these funds are excellent investment options for conservative investors who want to park their money for a few days or weeks with a high degree of capital safety.

What are liquid funds?

Liquid fund or cash fund invests primarily in money market instruments like treasury bills, certificate of deposits, commercial papers, treasury bills etc., that have a residual maturity of less than or equal to 91 days. Redemptions or withdrawals from liquid funds are processed within 24 hours on business days. Some liquid schemes also provide facility of instant redemptions, i.e. money is instantly credited to your savings bank account upon submission of redemption request. The objective of these schemes is to provide investors an opportunity to earn more returns than current or savings account with high degree of liquidity.

Why are these funds suitable for your idle funds?

Interest rate risk

Overnight funds have virtually no interest rate risk because overnight securities mature overnight. So interest rate changes will have no impact on Net Asset Value (NAV) because the issuer will pay the interest and principal on the next business day. Liquid funds may experience some volatility but the volatility will be low because of the very short maturity profiles of these schemes. Longer the maturity of a scheme, higher is its interest rate sensitivity. Since liquid funds invest in debt or money market securities which mature within 91 days, its interest rate sensitivity is fairly low.

Credit risk

Overnight funds invest primarily in Collaterized Borrowing and Lending Obligations (CBLOs). These papers are fully backed by Government Securities. So there is no credit risk. However, investors should note that liquid funds may have credit risk, if the credit rating of papers in which a liquid fund invests gets downgraded, then as per SEBI rule, the scheme has to mark the value of the paper to market in its NAV calculation. Though SEBI has taken several measures to reduce the risk of liquid funds e.g. minimum allocation to G-Secs, issuer concentration, industry concentration norms, you must ensure that the credit quality of the underlying portfolio of your liquid fund is sufficiently high. You can check the credit quality of your liquid fund from the fund factsheet. You should also consult with a financial advisor if required.

Liquidity

Both overnight and liquid funds invest in highly liquid securities. Overnight funds do not levy any exit load on redemptions. In other words, you can redeem your investments in overnight funds at any time, without any charge or penalty. Investors should note that liquid funds charge exit load on redemptions made within 7 days of investments. You should take exit load into consideration when planning short term investments.

Redemption from these two categories of funds is credited in your bank account within T (Transaction) +1 working day.

Overnight and liquid funds for emergency fund planning

Good financial planning practices require investors to have an emergency fund to meet any exigency. Emergency fund can help to face financial exigencies like an unexpected loss of employment, a medical emergency, urgent home repairs etc., without disturbing the investments made for your long term financial goals. Financial advisors usually recommend investors have an emergency fund which can meet 3 to 6 months of their monthly incomes. Since overnight and liquid funds have relatively low risks and high liquidity, they are suitable for your emergency fund planning. Money parked in your emergency funds need not be idle; if you park it in an overnight or liquid fund, you emergency fund will grow over time due to accrued returns and compounding.

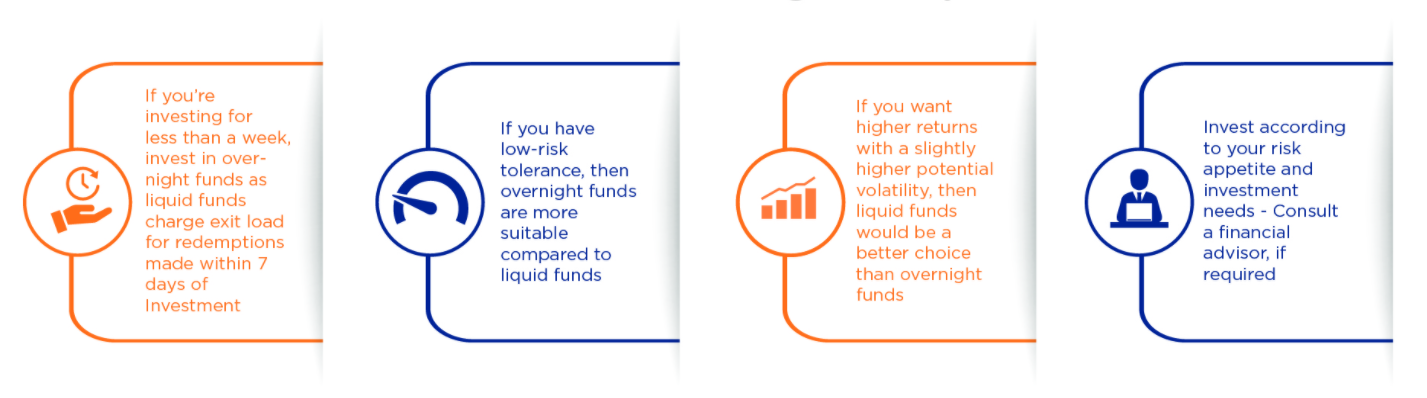

How to choose between overnight and liquid funds?

Articles

Debt mutual fund - a stable and steady investment choice

Bank fixed deposits and Government small savings schemes have been the traditional investment choice of average Indian households.

Read MoreFor information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.