Mirae Asset NYSE FANG+ ETF Fund of Fund

An Open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETFThe investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in units of Mirae Asset NYSE FANG+ ETF. There is no assurance that the investment objective of the Scheme will be realized.

NYSE FANG+ Index constitutes of 10 stocks – Alibaba, Facebook, Alphabet, Apple, Baidu, Nvidia, Amazon, Netflix, Twitter, Tesla

Investment Framework

The Scheme will invest in the units of Mirae Asset NYSE FANG+ ETF managed by Mirae Asset Mutual Fund as per the above stated asset allocation. The cumulative gross exposure through Units of Mirae Asset NYSE FANG+ ETF, Money market instruments / debt securities, Instruments and/or units of debt/liquid schemes of domestic Mutual Funds shall not exceed 100% of the net assets of the Scheme.

The NYSE FANG+ Index is an equal-dollar weighted Index designed to represent a segment of the technology and consumer discretionary sectors consisting of 10 highly-traded growth stocks of technology and tech-enabled companies.

NYSE FANG+ Index constitutes of 10 stocks – Alibaba, Facebook, Alphabet, Apple, Baidu, Nvidia, Amazon, Netflix, Twitter, Tesla

Power of 10

Market Cap $7.7Tn: Could have been 03rd largest country in terms of Gross Domestic Product (GDP)

Revenue $1.09 Tn: 3x of Indian government total receipts of FY 2019 -2020

Cash $500 Bn: % of total forex reserve held by RBI in 2020

Net Income $179 Bn: Exceeds combined net income of all Indian equities

FANG+ companies are part of our daily lives and now you can seek to make their growth story part of your portfolio too.

Source: Numbers are as of latest financial sourced from WSJ. GDP are nominal GDP data from world bank for 2019, department of economic affairs India, RBI Financial press release and Bloomberg. Data as on Feb 26, 2021Why Invest In The Fund

- Focused and equal weighted exposure in innovative high growth technology, internet and media stocks

- Portfolio of companies which are geared to participate in future technology disruptions

- Provides avenue to benefit also from INR depreciation

About NYSE FANG+ INDEX

The NYSE FANG+ Index is an equal weighted Index designed to represent a segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks.

INITIAL UNIVERSE

- Representative of the high-growth technology and internet/media Industry

- Full market capitalization of at least USD$ 5billion

- Trailing daily traded volume of USD$ 50million

- The periodical rebalancing occurs quarterly

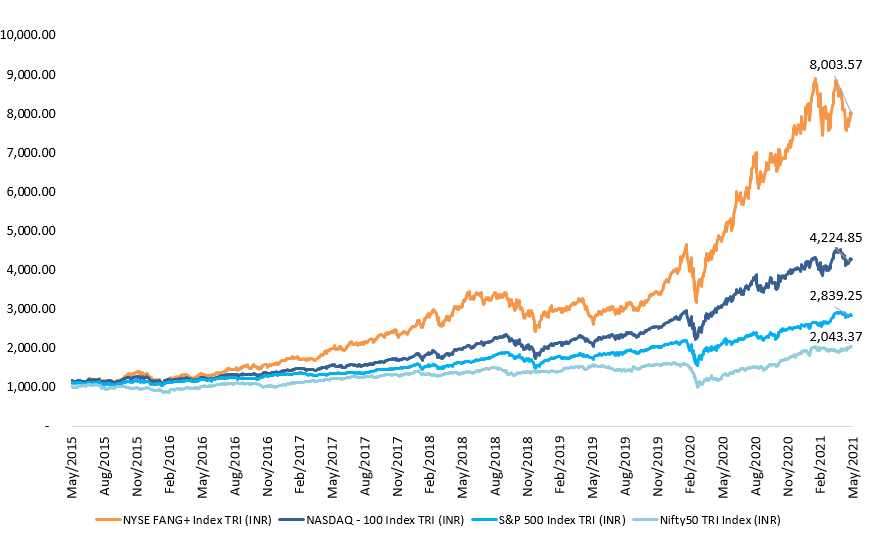

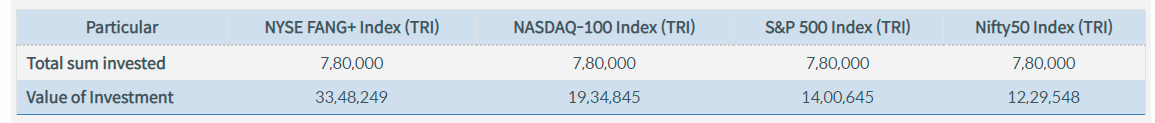

Value of SIP

Value of SIP Investment done since inception of NYSE FANG+ Index. (in Indian Rupees)

*Data as on February 26, 2021; Since Inception: 19th September 2014. This is for illustration purpose. It is assumed that an investor has invested Rs. 10,000/- monthly through SIP since inception of the index. Exchange rate of FBIL are used for conversion of index value from USD to INR. Past performance may or may not sustain in future. The index return is in Total Return Variant. The data shown above pertains to the Index and does not in manner indicate performance of any scheme of the Fund. Source: Bloomberg, NSE Indices Limited.

Fund facts

Fund facts

TYPE:

An Open-ended fund of fund scheme predominantly investing in Mirae Asset NYSE FANG+ ETF

FUND MANAGER:

Ms. Ekta Gala

ALLOTMENT DATE:

10th May 2021

BENCHMARK INDEX:

NYSE FANG+ Index

MINIMUM INVESTMENT AMOUNT:

For NFO period, Rs.5,000/- and in multiples of Re. 1/- thereafter.

POST NFO:

Minimum Additional Application Amount Rs. 1000/-.

Videos

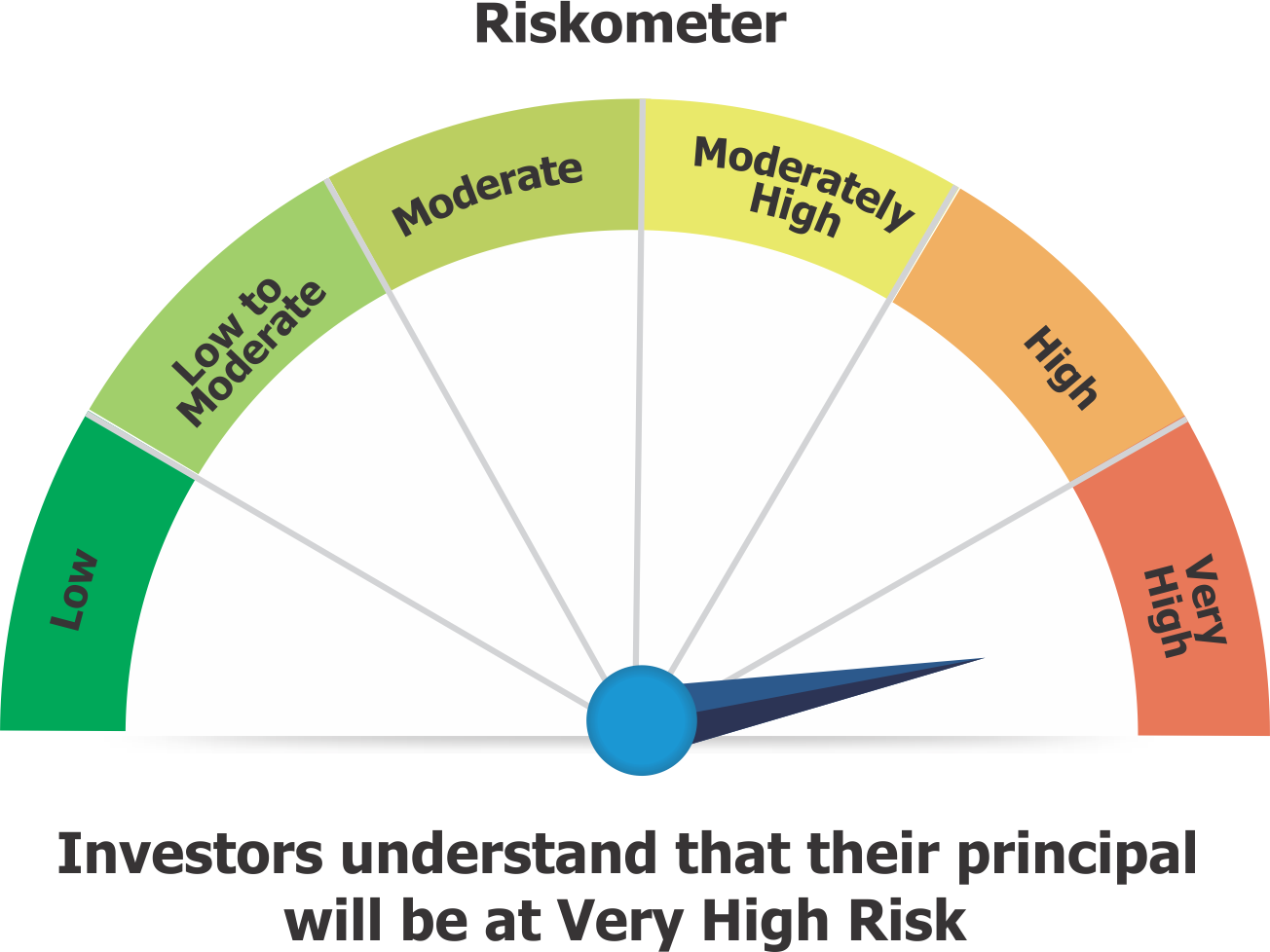

MiraeAsset NYSE FANG + ETF Fund of Fund is suitable for investors who are seeking•

• To generate long term capital apriciation/income

• Investments predomentaly in unites of Mirae Asset NYSE FANG + ETF

*Investors should consult their financial advisers if they are not clear about the suitability of the product

RISKOMETER

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

For further information about other schemes (product labelling and performance of the fund) please visit the website of the AMC: www.miraeassetmf.co.in

Please consult your financial advisor before investing

.jpg?sfvrsn=c96e3eb_2)

.png)

.jpg?sfvrsn=229570a7_2)

.jpg?sfvrsn=b36c3287_2)

.jpg?sfvrsn=1f731762_2)

.jpg?sfvrsn=62f182ec_2)