MIRAE ASSET

MULTI CAP FUND - (MAMPF)$

(Multi Cap - An open-ended equity scheme investing across large cap, mid cap and small cap stocks)

| Type of Scheme | Multi Cap - An open-ended equity scheme investing across large cap, mid cap and small cap stocks |

| Investment Objective | The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in Indian equity and equity related securities of large cap, mid cap and small cap companies. However, there is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Mr. Ankit Jain (since Aug 21, 2023) |

| Allotment Date | 21st Aug, 2023 |

| Benchmark Index | NIFTY 500 Multicap 50:25:25 TRI |

| Minimum Investment Amount |

₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹ 1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹1,000/- (multiples of ₹1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: If redeemed within 1 year (365 days) from the date of allotment: 1% If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on September 29, 2023 | 1,605.61 |

| Net AUM (₹ Cr.) |

1,667.89 |

| Monthly Total Expense Ratio (Including Statutory Levies) as on September 29, 2023 |

Regular Plan: 2.03% Direct Plan: 0.39% |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 10.390 | ₹ 10.372 |

| IDCW | ₹ 10.390 | ₹ 10.369 |

$Pursuant to clause 13.2.2 of SEBI master circular dated May 19, 2023, the scheme is in existence for less than 6 months

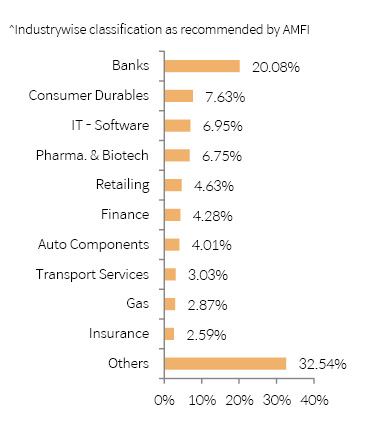

| Portfolio Holdings | % Allocation |

| Banks | |

| HDFC Bank Limited | 6.43% |

| ICICI Bank Limited | 3.48% |

| State Bank of India | 2.66% |

| Axis Bank Limited | 2.23% |

| Kotak Mahindra Bank Limited | 1.98% |

| The Federal Bank Limited | 1.72% |

| Equitas Small Finance Bank Limited | 0.85% |

| Karur Vysya Bank Limited | 0.74% |

| Consumer Durables | |

| Bata India Limited | 1.67% |

| Crompton Greaves Consumer Electricals Limited | 1.58% |

| Campus Activewear Limited | 1.00% |

| Indigo Paints Limited | 0.84% |

| Whirlpool of India Limited | 0.74% |

| Greenpanel Industries Limited | 0.71% |

| Stove Kraft Limited | 0.65% |

| Century Plyboards (India) Limited | 0.45% |

| IT - Software | |

| HCL Technologies Limited | 2.11% |

| Coforge Limited | 1.52% |

| Wipro Limited | 1.30% |

| Infosys Limited | 1.23% |

| Birlasoft Limited | 0.79% |

| Pharmaceuticals & Biotechnology | |

| Gland Pharma Limited | 2.09% |

| Lupin Limited | 1.42% |

| Sun Pharmaceutical Industries Limited | 1.16% |

| RPG Life Sciences Limited | 1.06% |

| Aurobindo Pharma Limited | 1.03% |

| Retailing | |

| Zomato Limited | 1.48% |

| FSN E-Commerce Ventures Limited | 1.43% |

| Go Fashion (India) Limited | 0.95% |

| Electronics Mart India Limited | 0.78% |

| Finance | |

| LIC Housing Finance Limited | 1.51% |

| Aptus Value Housing Finance India Limited | 1.19% |

| SBI Cards and Payment Services Limited | 1.19% |

| Cholamandalam Financial Holdings Limited | 0.39% |

| Auto Components | |

| NRB Bearing Limited | 1.34% |

| CEAT Limited | 1.18% |

| Motherson Sumi Wiring India Limited | 1.07% |

| Craftsman Automation Limited | 0.43% |

| Transport Services | |

| Gateway Distriparks Limited | 1.12% |

| Delhivery Limited | 1.06% |

| InterGlobe Aviation Limited | 0.86% |

| Gas | |

| Gujarat State Petronet Limited | 1.53% |

| Indraprastha Gas Limited | 1.34% |

| Insurance | |

| SBI Life Insurance Company Limited | 1.89% |

| Star Health And Allied Insurance Company Limited | 0.70% |

| Automobiles | |

| Eicher Motors Limited | 1.21% |

| Mahindra & Mahindra Limited | 0.77% |

| Maruti Suzuki India Limited | 0.59% |

| Healthcare Services | |

| Fortis Healthcare Limited | 1.35% |

| Vijaya Diagnostic Centre Limited | 1.18% |

| Capital Markets | |

| Indian Energy Exchange Limited | 1.10% |

| Nippon Life India Asset Management Limited | 1.06% |

| CARE Ratings Limited | 0.30% |

| Telecom - Services | |

| Bharti Airtel Limited | 2.45% |

| Construction | |

| Larsen & Toubro Limited | 2.37% |

| Industrial Products | |

| Prince Pipes And Fittings Limited | 0.97% |

| R R Kabel Limited | 0.65% |

| Bharat Forge Limited | 0.63% |

| Chemicals & Petrochemicals | |

| Navin Fluorine International Limited | 0.81% |

| Sudarshan Chemical Industries Limited | 0.73% |

| Chemplast Sanmar Limited | 0.60% |

| Diversified FMCG | |

| Hindustan Unilever Limited | 1.02% |

| ITC Limited | 0.79% |

| Fertilizers & Agrochemicals | |

| Bayer Cropscience Limited | 1.50% |

| Power | |

| NTPC Limited | 1.48% |

| Ferrous Metals | |

| Tata Steel Limited | 1.43% |

| Petroleum Products | |

| Reliance Industries Limited | 1.41% |

| Commercial Services & Supplies | |

| TeamLease Services Limited | 1.40% |

| Textiles & Apparels | |

| Page Industries Limited | 1.20% |

| Cement & Cement Products | |

| ACC Limited | 1.20% |

| Non - Ferrous Metals | |

| National Aluminium Company Limited | 1.03% |

| Household Products | |

| Jyothy Labs Limited | 1.00% |

| Personal Products | |

| Dabur India Limited | 0.91% |

| Minerals & Mining | |

| NMDC Limited | 0.76% |

| Electrical Equipment | |

| Avalon Technologies Limited | 0.64% |

| Equity Holding Total | 95.37% |

| Cash & Other Receivables | 4.63% |

| Total | 100.00% |

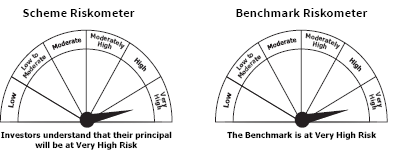

This product is suitable for investors who are seeking*

• To generate long term capital appreciation /income

• Investments predominantly in equity and equity related securities of large cap / mid cap/ small cap companies.

*Investors should consult their financial advisers if they are not clear about the suitability of the product.