MIRAE ASSET

MIDCAP FUND - (MAMCF)

(Midacap Fund - An open ended equity scheme predominantly investing in mid cap stocks)

| Type of Scheme | An open ended equity scheme predominantly investing in mid cap stocks |

| Investment Objective | The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in Indian equity and equity related securities of midcap companies. From time to time, the fund manager may also participate in other Indian equities and equity related securities for optimal portfolio construction. There is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Mr. Ankit Jain (since inception) |

| Allotment Date | 29th July, 2019 |

| Benchmark Index | Nifty Midcap 150 (TRI) |

| Minimum Investment Amount |

₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹ 1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹1,000/- (multiples of ₹1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: If redeemed within 1 year (365 days) from the date of allotment: 1%. If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on September 29, 2023 | 12,172.07 |

| Net AUM (₹ Cr.) |

12,172.62 |

| Monthly Total Expense Ratio (Including Statutory Levies) as on September 29, 2023 |

Regular Plan: 1.71% Direct Plan: 0.65% |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 28.073 | ₹ 26.469 |

| IDCW | ₹ 23.644 | ₹ 22.153 |

| New Position Bought |

| Stock |

| Auto Components |

| NRB Bearing Limited |

| Banks |

| HDFC Bank Limited |

| Retailing |

| Electronics Mart India Limited |

| Positions Increased |

| Stock |

| Banks |

| Utkarsh Small Finance Bank Ltd |

| Capital Markets |

| HDFC Asset Management Company Limited |

| Cement & Cement Products |

| ACC Limited |

| Chemicals & Petrochemicals |

| Navin Fluorine International Limited |

| Sudarshan Chemical Industries Limited |

| Commercial Services & Supplies |

| TeamLease Services Limited |

| Consumer Durables |

| Bata India Limited |

| Finance |

| LIC Housing Finance Limited |

| Power Finance Corporation Limited |

| Financial Technology (Fintech) |

| PB Fintech Limited |

| Gas |

| Indraprastha Gas Limited |

| Healthcare Services |

| Fortis Healthcare Limited |

| Insurance |

| Star Health And Allied Insurance Company Limited |

| IT - Software |

| Coforge Limited |

| Textiles & Apparels |

| Page Industries Limited |

| Positions Decreased |

| Stock |

| Automobiles |

| TVS Motor Company Limited |

| Banks |

| Axis Bank Limited |

| Indian Bank |

| Capital Markets |

| UTI Asset Management Company Limited |

| Cement & Cement Products |

| Nuvoco Vistas Corporation Limited |

| Consumer Durables |

| Voltas Limited |

| Electrical Equipment |

| Thermax Limited |

| Finance |

| Shriram Finance Limited |

| Healthcare Services |

| Krishna Institute Of Medical Sciences Limited |

| Industrial Products |

| Bharat Forge Limited |

| SKF India Limited |

| Leisure Services |

| Westlife Foodworld Limited |

| Power |

| NTPC Limited |

| Retailing |

| FSN E-Commerce Ventures Limited |

| Telecom - Services |

| Tata Communications Limited |

| Portfolio Holdings | % Allocation |

| Banks | |

| The Federal Bank Limited | 3.59% |

| State Bank of India | 2.19% |

| Axis Bank Limited | 2.03% |

| HDFC Bank Limited | 1.91% |

| Indian Bank | 1.38% |

| Utkarsh Small Finance Bank Ltd | 0.77% |

| Consumer Durables | |

| Bata India Limited | 2.23% |

| Crompton Greaves Consumer Electricals Limited | 2.20% |

| Kajaria Ceramics Limited | 1.58% |

| Century Plyboards (India) Limited | 1.01% |

| Dixon Technologies (India) Limited | 0.90% |

| Voltas Limited | 0.67% |

| Pharmaceuticals & Biotechnology | |

| Lupin Limited | 2.82% |

| Natco Pharma Limited | 1.38% |

| IPCA Laboratories Limited | 1.22% |

| Biocon Limited | 1.14% |

| Laurus Labs Limited | 1.13% |

| Ajanta Pharma Limited | 0.58% |

| Industrial Products | |

| Bharat Forge Limited | 3.20% |

| SKF India Limited | 2.26% |

| Prince Pipes And Fittings Limited | 1.25% |

| Finance | |

| Power Finance Corporation Limited | 2.48% |

| Shriram Finance Limited | 1.85% |

| LIC Housing Finance Limited | 1.52% |

| IT - Software | |

| Coforge Limited | 2.35% |

| LTIMindtree Limited | 2.02% |

| MphasiS Limited | 0.65% |

| Auto Components | |

| CEAT Limited | 1.53% |

| Motherson Sumi Wiring India Limited | 1.12% |

| Sona BLW Precision Forgings Limited | 0.87% |

| Craftsman Automation Limited | 0.79% |

| NRB Bearing Limited | 0.46% |

| Gas | |

| Gujarat State Petronet Limited | 1.91% |

| Indraprastha Gas Limited | 1.69% |

| Transport Services | |

| Delhivery Limited | 2.07% |

| Container Corporation of India Limited | 1.51% |

| Chemicals & Petrochemicals | |

| Atul Limited | 1.37% |

| Navin Fluorine International Limited | 0.78% |

| Chemplast Sanmar Limited | 0.73% |

| Sudarshan Chemical Industries Limited | 0.69% |

| Cement & Cement Products | |

| JK Cement Limited | 1.59% |

| ACC Limited | 1.00% |

| Nuvoco Vistas Corporation Limited | 0.60% |

| Insurance | |

| Max Financial Services Limited | 2.11% |

| Star Health And Allied Insurance Company Limited | 0.86% |

| Healthcare Services | |

| Fortis Healthcare Limited | 1.95% |

| Krishna Institute Of Medical Sciences Limited | 0.68% |

| Power | |

| NTPC Limited | 2.42% |

| Telecom - Services | |

| Tata Communications Limited | 2.35% |

| Electrical Equipment | |

| Thermax Limited | 2.15% |

| Fertilizers & Agrochemicals | |

| Bayer Cropscience Limited | 2.14% |

| Capital Markets | |

| HDFC Asset Management Company Limited | 1.55% |

| UTI Asset Management Company Limited | 0.59% |

| Industrial Manufacturing | |

| Honeywell Automation India Limited | 1.45% |

| Tega Industries Limited | 0.25% |

| Retailing | |

| FSN E-Commerce Ventures Limited | 1.36% |

| Electronics Mart India Limited | 0.29% |

| Personal Products | |

| Emami Limited | 1.60% |

| Financial Technology (Fintech) | |

| PB Fintech Limited | 1.55% |

| Textiles & Apparels | |

| Page Industries Limited | 1.51% |

| Automobiles | |

| TVS Motor Company Limited | 1.32% |

| Ferrous Metals | |

| Jindal Steel & Power Limited | 1.27% |

| Leisure Services | |

| The Indian Hotels Company Limited | 0.77% |

| Westlife Foodworld Limited | 0.51% |

| Realty | |

| Prestige Estates Projects Limited | 1.25% |

| Minerals & Mining | |

| NMDC Limited | 1.14% |

| Aerospace & Defense | |

| Bharat Electronics Limited | 0.79% |

| Commercial Services & Supplies | |

| TeamLease Services Limited | 0.57% |

| Equity Holding Total | 97.49% |

| Cash & Other Receivables | 2.51% |

| Total | 100.00% |

| Returns (in%) | ||||

| 1 Yr | 3 Yrs | SI | ||

| MAMCF | 24.63% | 32.39% | 26.27% | |

| Scheme Benchmark* | 30.67% | 33.79% | 26.92% | |

| Additional Benchmark** | 16.15% | 21.49% | 15.65% | |

| NAV as on 29th September, 2023 | ₹ 26.469 | |||

| Index Value (29th September, 2023) | Index Value of Scheme benchmark is 19,021.23 and S&P BSE Sensex (TRI) is 1,00,641.85 |

|||

| Allotment Date | 29 July, 2019 | |||

| Scheme Benchmark | *Nifty Midcap 150 (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Fund manager : Mr. Ankit Jain managing the scheme since July, 2019

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

Latest available NAV has been taken for return calculation wherever applicable

Past Performance may or may not be sustained in future.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.00. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option

| Period | Total Amount Invested | Mkt Value as on 29-September-2023 |

SI |

5,00,000 | 8,69,150 |

3 Yrs |

3,60,000 | 5,04,450 |

1 Yr |

1,20,000 | 1,43,412 |

Returns (%) |

Period |

||

SI |

3yrs |

1yr |

|

Fund Return& (%) |

27.29 | 23.26 | 38.45 |

Benchmark Return& (%) |

29.73 | 26.90 | 45.94 |

Add. Benchmark Return& (%) |

16.53 | 13.42 | 14.63 |

& The SIP returns are calculated by XIRR approach assuming investment of ₹ 10,000/- on the 1st working day of every month.

| Regular Plan | |||

| Record Date | Quantum (₹ per unit) |

Face Value (₹ per unit) |

NAV (₹ per unit) |

14-Feb-23 |

1.75 |

10.00 |

19.170 |

| Direct Plan | |||

| Record Date | Quantum (₹ per unit) |

Face Value (₹ per unit) |

NAV (₹ per unit) |

14-Feb-23 |

1.70 |

10.00 |

20.220 |

Past Performance may or may not be sustained in future. Pursuant to payment of IDCW the NAV of the IDCW option of the scheme will fall to the extent of payout and statutory levy (if any). IDCW history is for MAMCF - Regular & Direct Plan - IDCW Option

| Volatility | 15.15% |

| Beta: | 0.84 |

| R Squared | 0.85 |

| Sharpe Ratio#: | 1.68 |

| Information Ratio | -0.22 |

| Portfolio Turnover Ratio | 0.41 times |

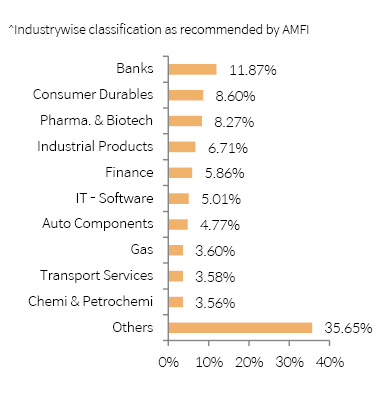

@The Volatility, Beta, R Squared, Sharpe Ratio & Information Ratio are calculated on returns from last three years Monthly data points. # Risk free rate: FBIL OVERNIGHT MIBOR as on 29th September, 2023. ^Basis last rolling 12 months. |

|

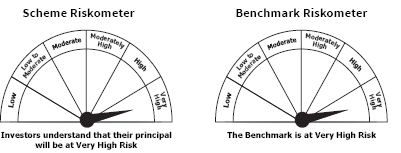

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income.

• Investments predominantly in equity & equity related securities of midcap companies

*Investors should consult their financial advisers if they are not clear about the suitability of the product.