MIRAE ASSET

BALANCED ADVANTAGE FUND - (MABAF)

(Balanced Advantage Fund - An open-ended Dynamic Asset Allocation Fund)

| Type of Scheme | Balanced Advantage Fund - An open-ended Dynamic Asset Allocation Fund |

| Investment Objective | The investment objective of the scheme is to capitalize on the potential upside of equities while attempting to limit the downside by dynamically managing the portfolio through investment in equity & equity related instruments and active use of debt, money market instruments and derivatives. However, there is no assurance or guarantee that the investment objective of the scheme will be realized. |

Fund Managers** |

Mr. Harshad Borawake

(Equity portion) (since August 11, 2022) and Mr. Mahendra Jajoo (Debt portion) (since August 11, 2022) |

| Allotment Date | 11th August, 2022 |

| Benchmark Index | Nifty 50 Hybrid Composite Debt 50:50 Index |

| Minimum Investment Amount |

₹ 5,000/- (multiples of ₹ 1/- thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹ 1,000/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: I. For investors who have opted for SWP under the plan: a) 15% of the units allotted (including Switch-in/STP - in) on or before completion of 365 days from the date of allotment of units: Nil. b) Any redemption in excess of such limits in the first 365 days from the date of allotment shall be subject to the following exit load: (Redemption of units would be done on First In First Out Basis (FIFO): •If redeemed within 1 year (365 days) from the date of allotment: 1% •If redeemed after 1 year (365 days) from the date of allotment: NIL II. Other Redemptions: For Investors who have not opted for SWP under the plan (including Switch out, STP out): •If redeemed within 1 year (365 days) from the date of allotment: 1% •If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on November 30, 2023 | 1,319.87 |

| Net AUM (₹ Cr.) |

1,388.73 |

| Monthly Total Expense Ratio (Including Statutory Levies) as on November 30, 2023 |

Regular Plan: 2.13% Direct Plan: 0.73% |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 11.878 | ₹ 11.657 |

| IDCW | ₹ 11.873 | ₹ 11.654 |

| New Position Bought |

| Stock |

| Automobiles |

| Eicher Motors Limited |

| Chemicals & Petrochemicals |

| Navin Fluorine International Limited |

| Ferrous Metals |

| Steel Authority of India Limited |

| Finance |

| Cholamandalam Investment and Finance Company Limited |

| IT - Services |

| Tata Technologies Ltd |

| Pharmaceuticals & Biotechnology |

| JB Chemicals and Pharma Ltd |

| Positions Increased |

| Stock |

| Automobiles |

| Maruti Suzuki India Limited |

| Banks |

| HDFC Bank Limited |

| ICICI Bank Limited |

| State Bank of India |

| Consumable Fuels |

| Coal India Limited |

| Diversified FMCG |

| Hindustan Unilever Limited |

| Finance |

| LIC Housing Finance Limited |

| IT - Software |

| Infosys Limited |

| Pharmaceuticals & Biotechnology |

| Aurobindo Pharma Limited |

| Positions Decreased |

| Stock |

| Automobiles |

| Tata Motors Limited |

| Banks |

| IndusInd Bank Limited |

| Capital Markets |

| KFin Technologies Limited |

| Food Products |

| Nestle India Limited |

| Healthcare Services |

| Krishna Institute Of Medical Sciences Limited |

| Insurance |

| ICICI Lombard General Insurance Company Limited |

| Retailing |

| Electronics Mart India Limited |

Average Maturity |

3.36 Years |

Modified Duration |

2.59 Years |

Macaulay Duration |

2.70 Years |

Annualized Portfolio YTM* |

7.45% |

*In case of semi annual YTM, it will be annualized.

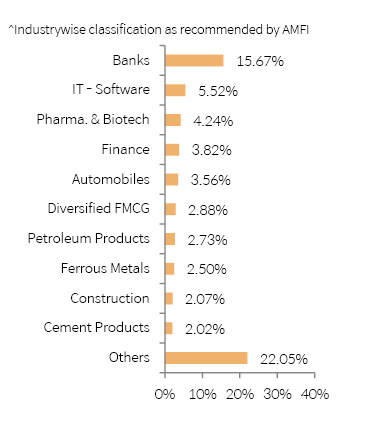

| Portfolio Holdings | % Allocation |

| Banks | |

| HDFC Bank Limited | 4.67% |

| ICICI Bank Limited | 4.17% |

| State Bank of India | 2.42% |

| Axis Bank Limited | 1.80% |

| Kotak Mahindra Bank Limited | 1.01% |

| The Federal Bank Limited | 0.56% |

| IndusInd Bank Limited | 0.55% |

| Bandhan Bank Limited | 0.38% |

| RBL Bank Limited | 0.09% |

| Canara Bank | 0.01% |

| IT - Software | |

| Infosys Limited | 2.62% |

| Tata Consultancy Services Limited | 1.33% |

| HCL Technologies Limited | 0.92% |

| LTIMindtree Limited | 0.34% |

| Tech Mahindra Limited | 0.30% |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Limited | 1.41% |

| Aurobindo Pharma Limited | 0.98% |

| Torrent Pharmaceuticals Limited | 0.75% |

| Biocon Limited | 0.60% |

| Dr. Reddy's Laboratories Limited | 0.27% |

| J B Chemicals and Pharma Ltd | 0.23% |

| Finance | |

| Shriram Finance Limited | 0.82% |

| Power Finance Corporation Limited | 0.78% |

| Fusion Micro Finance Limited | 0.48% |

| LIC Housing Finance Limited | 0.45% |

| Cholamandalam Financial Holdings Limited | 0.38% |

| SBI Cards and Payment Services Limited | 0.36% |

| Bajaj Finserv Limited | 0.30% |

| Cholamandalam Investment and Finance Company Limited | 0.24% |

| Automobiles | |

| Maruti Suzuki India Limited | 1.57% |

| Tata Motors Limited | 1.27% |

| TVS Motor Company Limited | 0.41% |

| Eicher Motors Limited | 0.25% |

| Hero MotoCorp Limited | 0.07% |

| Diversified FMCG | |

| ITC Limited | 1.60% |

| Hindustan Unilever Limited | 1.28% |

| Petroleum Products | |

| Reliance Industries Limited | 2.71% |

| Bharat Petroleum Corporation Limited | 0.02% |

| Ferrous Metals | |

| Tata Steel Limited | 1.11% |

| Jindal Steel & Power Limited | 0.50% |

| Steel Authority of India Limited | 0.47% |

| JSW Steel Limited | 0.43% |

| Construction | |

| Larsen & Toubro Limited | 2.07% |

| Cement & Cement Products | |

| Ambuja Cements Limited | 1.17% |

| Grasim Industries Limited | 0.41% |

| JK Cement Limited | 0.34% |

| ACC Limited | 0.10% |

| Telecom - Services | |

| Bharti Airtel Limited | 2.01% |

| Retailing | |

| Electronics Mart India Limited | 0.85% |

| Go Fashion (India) Limited | 0.57% |

| Zomato Limited | 0.45% |

| Consumer Durables | |

| Titan Company Limited | 0.76% |

| Havells India Limited | 0.35% |

| Kajaria Ceramics Limited | 0.35% |

| Crompton Greaves Consumer Electricals Limited | 0.19% |

| Greenply Industries Limited | 0.17% |

| Insurance | |

| SBI Life Insurance Company Limited | 0.89% |

| Max Financial Services Limited | 0.39% |

| ICICI Lombard General Insurance Company Limited | 0.29% |

| IT - Services | |

| Tata Technologies Ltd | 1.51% |

| Auto Components | |

| Samvardhana Motherson International Limited | 0.61% |

| Craftsman Automation Limited | 0.59% |

| Sona BLW Precision Forgings Limited | 0.28% |

| Aerospace & Defense | |

| Bharat Electronics Limited | 0.72% |

| MTAR Technologies Limited | 0.52% |

| Ideaforge Technology Limited | 0.16% |

| Electrical Equipment | |

| TD Power Systems Limited | 0.95% |

| Avalon Technologies Limited | 0.30% |

| Power | |

| NTPC Limited | 1.17% |

| Consumable Fuels | |

| Coal India Limited | 0.95% |

| Leisure Services | |

| Yatra Online Limited | 0.55% |

| Westlife Foodworld Limited | 0.38% |

| Non - Ferrous Metals | |

| Hindalco Industries Limited | 0.82% |

| Transport Services | |

| InterGlobe Aviation Limited | 0.42% |

| Gateway Distriparks Limited | 0.22% |

| Container Corporation of India Limited | 0.07% |

| Agricultural Food & other Products | |

| Balrampur Chini Mills Limited | 0.32% |

| Marico Limited | 0.19% |

| Tata Consumer Products Limited | 0.14% |

| Fertilizers & Agrochemicals | |

| PI Industries Limited | 0.58% |

| Healthcare Services | |

| Krishna Institute Of Medical Sciences Limited | 0.47% |

| Chemicals & Petrochemicals | |

| Deepak Nitrite Limited | 0.38% |

| Navin Fluorine International Limited | 0.08% |

| SRF Limited | 0.00% |

| Entertainment | |

| Zee Entertainment Enterprises Limited | 0.29% |

| Sun TV Network Limited | 0.15% |

| Capital Markets | |

| KFin Technologies Limited | 0.24% |

| Indian Energy Exchange Limited | 0.19% |

| Personal Products | |

| Dabur India Limited | 0.27% |

| Emami Limited | 0.13% |

| Realty | |

| DLF Limited | 0.36% |

| Industrial Products | |

| Prince Pipes and Fittings Limited | 0.32% |

| Food Products | |

| Nestle India Limited | 0.22% |

| Beverages | |

| United Spirits Limited | 0.13% |

| Transport Infrastructure | |

| Adani Ports and Special Economic Zone Limited | 0.08% |

| Textiles & Apparels | |

| Page Industries Limited | 0.01% |

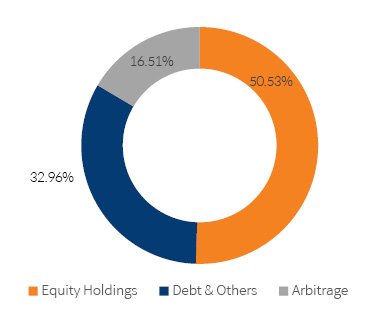

| Equity Holding Total | 67.04% |

| Government Bond | |

| 7.38% GOI (20/06/2027) | 5.06% |

| 6.54% GOI (17/01/2032) | 3.43% |

| 7.18% GOI (14/08/2033) | 3.22% |

| 7.26% GOI (06/02/2033) | 0.72% |

| Government Bond Total | 12.43% |

| Corporate Bond | |

| 7.38% Cholamandalam Inv&Fin (31/07/24)**# | 1.79% |

| 7.4% HDFC Bank (02/06/2025)**# | 1.78% |

| 7.25% SIDBI (31/07/2025)**# | 1.78% |

| 5.23% NABARD (31/01/2025)**# | 1.75% |

| 7.86% Nexus Select Tra A (16/06/26)**# | 0.72% |

| 7.90% Jamnagar Uti & Pow Pvt (10/08/2028)**# | 0.72% |

| 7.85% Bajaj Hsg Fin Ltd (01/09/2028)**# | 0.54% |

| 9.0% Shriram Fin Ltd (24/06/2024)**# | 0.54% |

| 7.68% Bank of Baroda (01/12/33)**# | 0.50% |

| 6.92% REC Ltd (20/03/2032)**# | 0.34% |

| Corporate Bond Total | 10.46% |

| Certificate of Deposit | |

| Axis Bank Ltd (11/03/2024)**# | 0.99% |

| Certificate of Deposit Total | 0.99% |

| Cash & Other Receivables Total | 9.08% |

| Total | 100.00% |

| Name of the Instrument | % to Net Assets |

| Derivatives | |

| Index / Stock Futures | |

| Canara Bank | (0.01)% |

| UltraTech Cement Ltd | (0.04)% |

| Hero MotoCorp Ltd | (0.06)% |

| Container Corporation of India Ltd | (0.07)% |

| Adani Ports and Special Economic Zone Ltd | (0.09)% |

| LIC Housing Finance Ltd | (0.10)% |

| RBL Bank Ltd | (0.10)% |

| ACC Ltd | (0.11)% |

| IndusInd Bank Ltd | (0.12)% |

| United Spirits Ltd | (0.14)% |

| Tata Consumer Products Ltd | (0.15)% |

| Sun TV Network Ltd | (0.16)% |

| The Federal Bank Ltd | (0.19)% |

| Cholamandalam Investment and Finance Company Ltd | (0.27)% |

| Dr. Reddy's Laboratories Ltd | (0.27)% |

| Biocon Ltd | (0.30)% |

| Balrampur Chini Mills Ltd | (0.31)% |

| Tech Mahindra Ltd | (0.31)% |

| Torrent Pharmaceuticals Ltd | (0.31)% |

| Zee Entertainment Enterprises Ltd | (0.33)% |

| ITC Ltd | (0.35)% |

| DLF Ltd | (0.36)% |

| Reliance Industries Ltd | (0.38)% |

| Deepak Nitrite Ltd | (0.38)% |

| Titan Company Ltd | (0.38)% |

| Tata Communications Ltd | (0.39)% |

| Bandhan Bank Ltd | (0.40)% |

| Tata Consultancy Services Ltd | (0.40)% |

| Hindustan Unilever Ltd | (0.42)% |

| Larsen & Toubro Ltd | (0.42)% |

| Mahindra & Mahindra Ltd | (0.42)% |

| Tata Steel Ltd | (0.42)% |

| Grasim Industries Ltd | (0.43)% |

| JSW Steel Ltd | (0.44)% |

| Tata Motors Ltd | (0.45)% |

| Hindalco Industries Ltd | (0.45)% |

| SBI Life Insurance Company Ltd | (0.45)% |

| HDFC Bank Ltd | (0.46)% |

| Ambuja Cements Ltd | (0.47)% |

| Sun Pharmaceutical Industries Ltd | (0.49)% |

| Jindal Steel & Power Ltd | (0.52)% |

| ICICI Bank Ltd | (0.57)% |

| PI Industries Ltd | (0.58)% |

| Kotak Mahindra Bank Ltd | (0.68)% |

| Bharti Airtel Ltd | (0.82)% |

| Coal India Ltd | (0.82)% |

| Maruti Suzuki India Ltd | (1.02)% |

| Total | (16.79)% |

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MABAF | 12.65% |

12.48% |

||

| Scheme Benchmark* | 7.67% |

9.29% |

||

| Additional Benchmark** | 8.47% |

11.66% |

||

| NAV as on 30th November, 2023 | ₹ 11.657 | |||

| Index Value ( 30th November, 2023) | Index Value of benchmark is 13,392.08 and Nifty 50 Index (TRI) is 29,585.36 | |||

| Allotment Date | 11th Aug, 2022 | |||

| Scheme Benchmark | *Nifty 50 Hybrid Composite Debt 50:50 Index | |||

| Additional Benchmark | **Nifty 50 Index (TRI) | |||

Fund managers: Mr. Harshad Borawake & Mr. Mahendra Jajoo both managing the scheme since 11th August, 2022 respectively

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

Latest available NAV has been taken for return calculation wherever applicable

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.00. The performance of other funds managed by the same fund managers are given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option

| Period | Total Amount Invested | Mkt Value as on 30-November-2023 |

SI |

1,50,000 | 1,66,781 |

1 Yr |

1,20,000 | 1,31,794 |

Returns (%) |

Period |

|

SI |

1yr |

|

Fund Return& (%) |

17.08 | 18.78 |

Benchmark Return& (%) |

11.40 | 11.90 |

Add. Benchmark Return& (%) |

16.23 | 17.59 |

& The SIP returns are calculated by XIRR approach assuming investment of ₹ 10,000/- on the 1st working day of every month.

| Portfolio Turnover Ratio | 2.83 times |

@The Volatility, Beta, R Squared, Sharpe Ratio & Information Ratio are calculated on returns from last three years Monthly data points. # Risk free rate: FBIL OVERNIGHT MIBOR as on 30th November, 2023. ^Basis last rolling 12 months. |

|

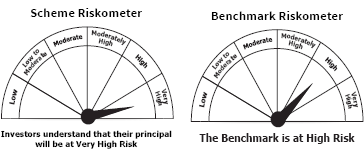

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income.

• Investments in equity, equity related securities & debt, money market instruments while managing risk through active allocation

*Investors should consult their financial advisers if they are not clear about the suitability of the product.