MIRAE ASSET

S&P 500 TOP 50 ETF - (NSE Symbol : MASPTOP50, BSE Code: 543365)

(An open-ended scheme replicating/tracking S&P 500 Top 50 Total Return Index)

| Type of Scheme | An open-ended scheme replicating/tracking S&P 500 Top 50 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the S&P 500 Top 50 Total Return Index, subject to tracking error and forex movement. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Mr. Siddharth Srivastava (since September 20, 2021) |

| Allotment Date | 20th September 2021 |

| Benchmark Index | S&P 500 Top 50 Index (TRI) |

| Minimum Investment Amount^ |

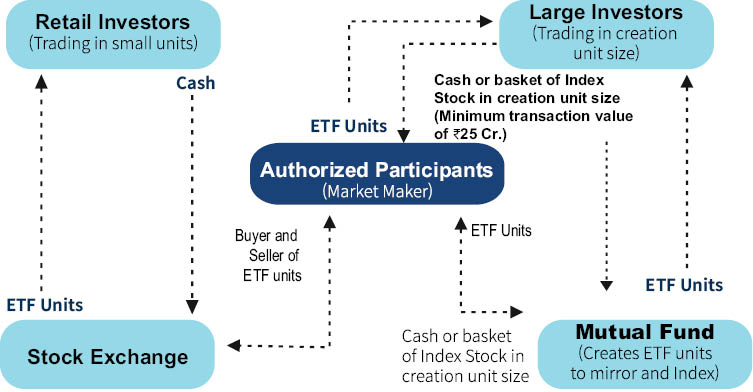

Market Maker: Application for subscription of Units directly with the Fund in Creation Unit Size at NAV based prices in exchange of Portfolio Deposit and Cash Component. Large Investors: Minimum amount of ₹25 crores for transacting directly with the AMC. Other investors (including Market Maker, Large Investors and Regulated Entities): Units of the Scheme can be subscribed (in lots of 1 Unit) during the trading hours on all trading days on the NSE and BSE on which the Units are listed. On exchange in multiple of 1 unit. With AMC: In multiples of 5,50,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MASPTOP50 in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on July 31, 2023 | 596.37 |

| Net AUM (₹ Cr.) | 600.86 |

| Tracking Error Value~ ~1 Year Tracking Error is |

0.12% |

| Monthly Total Expense Ratio (Including Statutory Levies) as on July 31, 2023 | 0.66% |

| **For experience of Fund Managers Click Here ^The said threshold limit shall not be applicable to the below mentioned investors and the AMC will allow direct transactions in ETF in Creation Unit size for below mentioned category of investors until October 31, 2023:- 1. Schemes managed by Employee Provident Fund Organisation, India. 2. Recognized Provident Funds, Approved Gratuity Funds and Approved Superannuation Funds under Income Tax Act, 1961. |

|

| ₹ 33.2473 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

Parwati Capital Market Private Limited$

$Pursuant to notice cum addendum no. 32/2023, addition of Parwati Capital Market Private Limited as Market Maker for all existing ETFs as well ETFs which shall be launched by Mirae Asset Mutual Fund Kanjalochana Finserve Private Limited

| Portfolio Holdings | % Allocation |

| Technology Hardware, Storage & Peripherals | |

| Apple Inc | 13.45% |

| Systems Software | |

| Microsoft Corp | 11.65% |

| Oracle Corporation | 0.83% |

| Interactive Media & Services | |

| Alphabet Inc A | 3.66% |

| Meta Platforms Registered Shares A | 3.29% |

| Alphabet Inc | 3.16% |

| Semiconductors | |

| Nvidia Corp Com | 5.34% |

| Broadcom Inc | 1.74% |

| Advanced Micro Devices Inc | 0.85% |

| Texas Instruments Inc | 0.75% |

| INTEL CORP | 0.70% |

| QUALCOMM INC | 0.67% |

| Pharmaceuticals | |

| Johnson & Johnson | 2.08% |

| Eli Lilly & Co | 1.67% |

| Merck & Co. Inc | 1.26% |

| PFIZER INC | 0.94% |

| BRISTOL MYERS SQUIBB ORD | 0.60% |

| Broadline Retail | |

| Amazon Com Inc | 5.49% |

| Diversified Banks | |

| JP Morgan Chase & Co | 2.11% |

| BANK OF AMERICA CORP | 1.02% |

| Wells Fargo & Co | 0.80% |

| Automobile Manufacturers | |

| Tesla Inc | 3.36% |

| Transaction & Payment Processing Services | |

| Visa Inc | 1.77% |

| Mastercard Incorporated | 1.52% |

| Integrated Oil & Gas | |

| Exxon Mobil Corporation Ltd | 1.96% |

| Cheveron Corp | 1.28% |

| Multi-Sector Holdings | |

| Berkshire Hathaway Inc | 2.90% |

| Soft Drinks & Non-alcoholic Beverages | |

| PEPSICO INC | 1.20% |

| Coca Cola Co. | 1.12% |

| Consumer Staples Merchandise Retail | |

| Costco Wholesale Corp | 1.15% |

| Walmart Inc | 1.04% |

| Managed Health Care | |

| Unitedhealth Group Inc | 2.18% |

| Application Software | |

| Adobe Inc | 1.12% |

| Salesforce Inc | 1.04% |

| Life Sciences Tools & Services | |

| Thermo Fisher Scientific Inc | 1.00% |

| Danaher Corp | 0.79% |

| Household Products | |

| Procter & Gamble Co | 1.70% |

| Movies & Entertainment | |

| Netflix Inc | 0.89% |

| The Walt Disney Company | 0.74% |

| Home Improvement Retail | |

| Home Depot Inc | 1.56% |

| Biotechnology | |

| AbbVie Inc | 1.23% |

| Restaurants | |

| MCDONALD'S CORPOPRATION | 1.00% |

| Communications Equipment | |

| CISCO SYS INC COM | 0.99% |

| IT Consulting & Other Services | |

| Accenture Plc-CL A | 0.92% |

| Health Care Equipment | |

| ABBOTT LABORATORIES | 0.90% |

| Industrial Gases | |

| Linde PLC | 0.89% |

| Cable & Satellite | |

| Comcast Corp - Class A | 0.87% |

| Tobacco | |

| Philip Morris International Ord | 0.72% |

| Electric Utilities | |

| NextEra Energy Inc | 0.67% |

| Integrated Telecommunication Services | |

| Verizon Communications Inc | 0.67% |

| Footwear | |

| NIKE Inc | 0.62% |

| International Equity Holding Total | 99.88% |

| Cash & Other Receivables | 0.12% |

| Total | 100.00% |

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MASPTOP50 | 18.98% |

10.27% |

||

| Scheme Benchmark* | 20.32% |

11.41% |

||

| Additional Benchmark** | 16.93% |

8.03% |

||

| NAV as on 31st July, 2023 | ₹33.2473 | |||

| Index Value (31st July, 2023) | Index Value of benchmark is 6,623.30 and S&P BSE Sensex (TRI) is 1,01,480.37 |

|||

| Allotment Date | 20th September, 2021 | |||

| Scheme Benchmark | *S&P 500 Top 50 Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Fund manager : Mr. Siddharth Srivastava managing the scheme since September 20, 2021.

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹27.397. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option

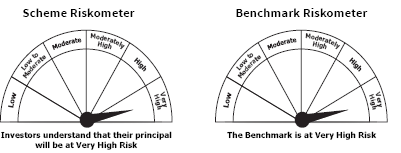

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of S&P 500 Top 50 Total Return Index subject to tracking error and foreign exchange movement

• Investments in equity securities covered by S&P 500 Top 50 Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol : MASPTOP50

BSE Code: 543365

Bloomberg Code: MASPTOP50 IN Equity

Reuters Code: MIRA.NS