MIRAE ASSET

NIFTY 100 ESG SECTOR LEADERS FUND OF FUND# (Formerly Known as Mirae Asset ESG Sector Leaders Fund of Fund) - (MAESGSLF)

(Fund of Fund - An open ended fund of fund scheme predominantly investing in Nifty 100 Mirae Asset ESG Sector Leaders ETF)

| Type of Scheme | Fund of Fund - Domestic (FOF) An open ended fund of fund scheme predominantly investing in Mirae Asset Nifty 100 ESG Sector Leaders ETF |

| Investment Objective | The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in units of Mirae Asset Nifty 100 ESG Sector Leaders ETF. There is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Ms. Ekta Gala (since December 28, 2020) |

| Allotment Date | 18th November 2020 |

| Benchmark Index | NIFTY 100 ESG Sector Leaders Index (TRI) |

| Minimum Investment Amount |

₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹ 1000/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: if redeemed or switched out within 5 calendar days from the date of allotment: 0.05% if redeemed or switched out after 5 days from date of allotment: Nil |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on July 31, 2023 | 118.68 |

| Net AUM (₹ Cr.) | 117.91 |

| Monthly Total Expense Ratio (Including Statutory Levies) as on July 31, 2023 |

Regular Plan: 0.47%

Direct Plan: 0.07% Investors may note that they will bear recurring expenses of the underlying scheme in addition to the expenses of this scheme |

| Investors may note that they will bear recurring expenses of the underlying scheme in addition to the expenses of this scheme. The TER of underlying scheme i.e Mirae Asset Nifty 100 ESG Sector Leaders ETF is 0.59% | |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 14.101 | ₹ 13.976 |

| IDCW | ₹ 14.098 | ₹ 13.948 |

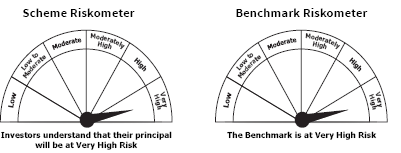

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income

• Investments predominantly in units of Mirae Asset Nifty 100 ESG Sector Leaders ETF

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

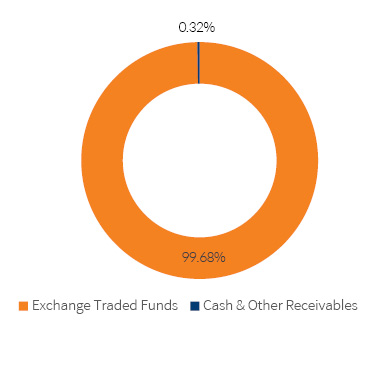

| Portfolio Holdings | % Allocation | |

| Exchange Traded Funds | ||

| Mirae Asset Nifty 100 ESG Sector Leaders ETF | 99.68% |

|

| Exchange Traded Funds Total | 99.68% |

|

| Cash & Other Receivables Total | 0.32% |

|

| Total | 100.00% |

|

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MAESGSLF | 9.49% |

13.21% |

||

| Scheme Benchmark* | 10.74% |

14.68% |

||

| Additional Benchmark** | 16.93% |

17.78% |

||

| NAV as on 31st July, 2023 | ₹ 13.976 | |||

| Index Value (31st July, 2023) | Index Value of benchmark is 3,570.07 and S&P BSE Sensex (TRI) is 1,01,480.37 | |||

| Allotment Date | 18th November, 2020 | |||

| Scheme Benchmark | *Nifty 100 ESG Sector Leaders Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Fund manager : Ms. Ekta Gala managing the scheme since November 18, 2020.

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 10.00. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option