MIRAE ASSET

S&P 500 TOP 50 ETF - (NSE Symbol : MASPTOP50, BSE Code: 543365)

(Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking S&P 500 Top 50 Total Return Index)

| Type of Scheme | Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking S&P 500 Top 50 Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the S&P 500 Top 50 Total Return Index, subject to tracking error and forex movement. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Mr. Siddharth Srivastava (since September 20, 2021) |

| Allotment Date | 20th September 2021 |

| Benchmark Index | S&P 500 Top 50 Index (TRI) |

| Minimum Investment Amount |

On exchange in multiple of 1 unit. With AMC: In multiples of 5,50,000 units |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MASPTOP50 in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on February 28, 2023 | 517.51 |

| Net AUM (₹ Cr.) | 503.13 |

| 1 Year Tracking Error is ~ | 13.6 bps |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on February 28, 2023 | 0.59% |

| **For experience of Fund Managers Click Here | |

| Portfolio Holdings | % Allocation |

| Technology Hardware, Storage & Peripherals | |

| Apple Inc | 12.72% |

| Systems Software | |

| Microsoft Corp | 10.73% |

| Interactive Media & Services | |

| Alphabet Inc A | 3.10% |

| Alphabet Inc | 2.76% |

| Meta Platforms Registered Shares A | 2.27% |

| Semiconductors | |

| Nvidia Corp Com | 3.33% |

| Broadcom Inc | 1.39% |

| Texas Instruments Inc | 0.90% |

| QUALCOMM INC | 0.80% |

| Advanced Micro Devices Inc | 0.73% |

| INTEL CORP | 0.59% |

| Pharmaceuticals | |

| Johnson & Johnson | 2.31% |

| Merck & Co. Inc | 1.55% |

| Eli Lilly & Co | 1.42% |

| PFIZER INC | 1.31% |

| BRISTOL MYERS SQUIBB ORD | 0.85% |

| Diversified Banks | |

| JP Morgan Chase & Co | 2.43% |

| BANK OF AMERICA CORP | 1.38% |

| Wells Fargo & Co | 1.03% |

| Internet & Direct Marketing Retail | |

| Amazon Com Inc | 4.83% |

| Integrated Oil & Gas | |

| Exxon Mobil Corporation Ltd | 2.61% |

| Cheveron Corp | 1.65% |

| Data Processing & Outsourced Services | |

| Visa Inc | 2.07% |

| Mastercard Incorporated | 1.74% |

| Automobile Manufacturers | |

| Tesla Inc | 3.18% |

| Multi-Sector Holdings | |

| Berkshire Hathaway Inc | 3.17% |

| Soft Drinks | |

| PEPSICO INC | 1.38% |

| Coca Cola Co. | 1.34% |

| Managed Health Care | |

| Unitedhealth Group Inc | 2.56% |

| Hypermarkets and Supercenters | |

| Costco Wholesale Corp | 1.23% |

| Walmart Inc | 1.16% |

| Life Sciences Tools & Services | |

| Thermo Fisher Scientific Inc | 1.23% |

| Danaher Corp | 0.93% |

| Household Products | |

| Procter & Gamble Co | 1.88% |

| Application Software | |

| Salesforce Inc | 0.94% |

| Adobe Inc | 0.87% |

| Home Improvement Retail | |

| Home Depot Inc | 1.75% |

| Integrated Telecommunication Services | |

| Verizon Communications Inc | 0.94% |

| AT&T Inc | 0.78% |

| Health Care Equipment | |

| ABBOTT LABORATORIES | 1.02% |

| Medtronic PLC | 0.63% |

| Biotechnology | |

| AbbVie Inc | 1.57% |

| Communications Equipment | |

| CISCO SYS INC COM | 1.15% |

| Restaurants | |

| MCDONALD'S CORPOPRATION | 1.11% |

| Movies & Entertainment | |

| The Walt Disney Company | 1.05% |

| Industrial Gases | |

| Linde PLC | 0.99% |

| IT Consulting & Other Services | |

| Accenture Plc-CL A | 0.97% |

| Cable & Satellite | |

| Comcast Corp - Class A | 0.93% |

| Tobacco | |

| Philip Morris International Ord | 0.87% |

| Footwear | |

| NIKE Inc | 0.86% |

| Railroads | |

| Union Pacific Ord | 0.74% |

| International Equity Holding Total | 99.74% |

| Cash & Other Receivables | 0.26% |

| Total | 100.00% |

| ₹ 26.8590 (Per Unit) |

| Returns (in%) | ||||

| 1 Yr | SI | |||

| MASPTOP50 | -4.99% |

-1.42% |

||

| Scheme Benchmark* | -3.91% |

-0.43% |

||

| Additional Benchmark** | 6.19% |

1.08% |

||

| NAV as on 28th February, 2023 | ₹ 26.8590 | |||

| Index Value (28th February, 2023) | Index Value of benchmark is 5,352.14 and S&P BSE Sensex (TRI) is 89,281.77 |

|||

| Allotment Date | 20th September, 2021 | |||

| Scheme Benchmark | *S&P 500 Top 50 Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

Fund manager : Mr. Siddharth Srivastava managing the scheme since September 20, 2021.

Note: Returns below or for 1 year are absolute returns, returns above 1 year are CAGR- Compounded Annualized Growth returns.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 27.418. The performance of other funds managed by the same fund manager is given in the respective page of the schemes

Different Plans under the scheme has different expense structure. The reference and details provided here in are of Regular Plan - Growth Option

Live iNav is updated on Mirae Asset Mutual Fund website

NSE Symbol : MASPTOP50

BSE Code: 543365

Bloomberg Code: MASPTOP50 IN Equity

Reuters Code: MIRA.NS

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

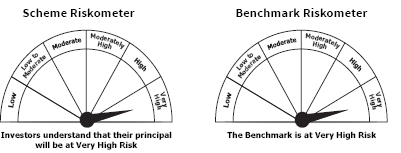

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of S&P 500 Top 50 Total Return Index subject to tracking error and foreign exchange movement

• Investments in equity securities covered by S&P 500 Top 50 Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.