MIRAE ASSET

FLEXI CAP FUND - (MAFCF)$

(Flexi Cap Fund - An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks)

| Type of Scheme | Flexi Cap Fund - An open-ended dynamic equity scheme investing across large cap, mid cap, small cap stocks |

| Investment Objective | The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing predominantly in Indian equity and equity related instruments across market capitalization. However, there is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Mr. Vrijesh Kasera(since Feb 27, 2023) |

| Allotment Date | 24th Feb, 2023 |

| Benchmark Index | Nifty 500 Index (TRI) |

| Minimum Investment Amount |

₹ 5,000/- and in multiples of ₹ 1/-thereafter. Minimum Additional Application Amount: ₹ 1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹1,000/- (multiples of ₹1/- thereafter), minimum 5 in case of Monthly or 3 in case of Quarterly option. |

| Load Structure | Entry load: NA Exit load: If redeemed within 1 year (365 days) from the date of allotment: 1% If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on May 31, 2023 | 801.31 |

| Net AUM (₹ Cr.) |

845.92 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on May 31, 2023 |

Regular Plan: 2.27% Direct Plan: 0.72% |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 10.768 | ₹ 10.720 |

| IDCW | ₹ 10.768 | ₹ 10.723 |

| New Position Bought |

| Stock |

| Auto Components |

| Balkrishna Industries Limited |

| Banks |

| IndusInd Bank Limited |

| Finance |

| Can Fin Homes Limited |

| Positions Increased |

| Stock |

| Aerospace & Defense |

| MTAR Technologies Limited |

| Agricultural, Commercial & Construction Vehicles |

| Ashok Leyland Limited |

| Auto Components |

| Schaeffler India Limited |

| Banks |

| Canara Bank |

| HDFC Bank Limited |

| ICICI Bank Limited |

| State Bank of India |

| Cement & Cement Products |

| JK Cement Limited |

| UltraTech Cement Limited |

| Consumer Durables |

| Kajaria Ceramics Limited |

| Diversified FMCG |

| ITC Limited |

| Ferrous Metals |

| Tata Steel Limited |

| Fertilizers & Agrochemicals |

| Paradeep Phosphates Limited |

| Finance |

| Bajaj Finserv Limited |

| Fusion Micro Finance Limited |

| Housing Development Finance Corporation Limited |

| Gas |

| Gujarat State Petronet Limited |

| Insurance |

| Max Financial Services Limited |

| IT - Software |

| Infosys Limited |

| MphasiS Limited |

| Petroleum Products |

| Reliance Industries Limited |

| Pharmaceuticals & Biotechnology |

| Biocon Limited |

| Sun Pharmaceutical Industries Limited |

| Power |

| NTPC Limited |

| Retailing |

| Go Fashion (India) Limited |

| Zomato Limited |

| Telecom - Services |

| Bharti Airtel Limited |

| Transport Services |

| Delhivery Limited |

| Positions Decreased |

| Stock |

| Aerospace & Defense |

| Bharat Electronics Limited |

| Auto Components |

| Apollo Tyres Limited |

| Sona BLW Precision Forgings Limited |

| Banks |

| Axis Bank Limited |

| Kotak Mahindra Bank Limited |

| Consumer Durables |

| Havells India Limited |

| Healthcare Services |

| Apollo Hospitals Enterprise Limited |

| Krishna Institute Of Medical Sciences Limited |

| Industrial Products |

| Cummins India Limited |

| Pharmaceuticals & Biotechnology |

| Torrent Pharmaceuticals Limited |

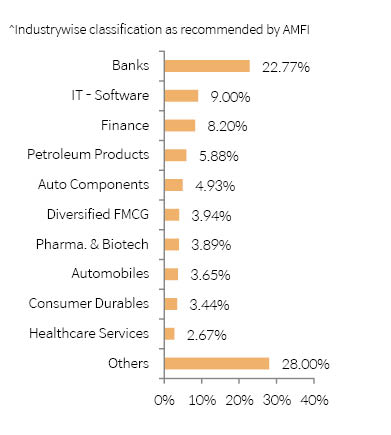

| Portfolio Holdings | % Allocation |

| Banks | |

| ICICI Bank Ltd | 6.34% |

| HDFC Bank Ltd | 4.43% |

| State Bank of India | 4.00% |

| Axis Bank Ltd | 3.38% |

| The Federal Bank Limited | 1.33% |

| Canara Bank | 1.22% |

| Kotak Mahindra Bank Ltd | 1.08% |

| IndusInd Bank Ltd | 0.99% |

| IT - Software | |

| Infosys Ltd | 4.30% |

| Tata Consultancy Services Ltd | 1.96% |

| HCL Technologies Limited | 1.49% |

| MphasiS Limited | 1.24% |

| Finance | |

| Housing Development Finance Corporation Ltd | 4.30% |

| Fusion Micro Finance Limited | 1.13% |

| Bajaj Finserv Limited | 1.06% |

| Can Fin Homes Limited | 1.02% |

| Shriram Finance Limited | 0.70% |

| Petroleum Products | |

| Reliance Industries Ltd | 5.88% |

| Auto Components | |

| Schaeffler India Limited | 1.63% |

| Sona BLW Precision Forgings Limited | 1.33% |

| Apollo Tyres Limited | 1.00% |

| Balkrishna Industries Ltd | 0.97% |

| Diversified FMCG | |

| ITC Ltd | 3.00% |

| Hindustan Unilever Ltd | 0.95% |

| Pharmaceuticals & Biotechnology | |

| Sun Pharmaceutical Industries Ltd | 1.99% |

| Biocon Ltd | 1.01% |

| Torrent Pharmaceuticals Ltd | 0.89% |

| Automobiles | |

| Tata Motors Limited | 1.37% |

| Maruti Suzuki India Ltd | 1.18% |

| TVS Motor Company Ltd | 1.09% |

| Consumer Durables | |

| Kajaria Ceramics Ltd | 1.39% |

| Titan Company Ltd | 1.07% |

| Havells India Ltd | 0.98% |

| Healthcare Services | |

| Syngene International Limited | 1.46% |

| Krishna Institute Of Medical Sciences Limited | 0.99% |

| Apollo Hospitals Enterprise Limited | 0.22% |

| Cement & Cement Products | |

| JK Cement Limited | 1.56% |

| UltraTech Cement Limited | 0.92% |

| Construction | |

| Larsen & Toubro Ltd | 2.46% |

| Aerospace & Defense | |

| Bharat Electronics Ltd | 1.27% |

| MTAR Technologies Limited | 1.18% |

| Telecom - Services | |

| Bharti Airtel Ltd | 2.34% |

| Retailing | |

| Zomato Limited | 1.33% |

| Go Fashion (India) Limited | 0.97% |

| Power | |

| NTPC Ltd | 1.92% |

| Insurance | |

| Max Financial Services Ltd | 1.07% |

| ICICI Lombard General Insurance Company Limited | 0.82% |

| Ferrous Metals | |

| Jindal Steel & Power Limited | 1.24% |

| Tata Steel Ltd | 0.65% |

| Industrial Products | |

| Cummins India Limited | 1.09% |

| Prince Pipes And Fittings Limited | 0.75% |

| Gas | |

| Gujarat State Petronet Limited | 1.55% |

| Transport Services | |

| Delhivery Limited | 1.17% |

| Leisure Services | |

| Sapphire Foods India Limited | 1.07% |

| Non - Ferrous Metals | |

| Hindalco Industries Limited | 0.98% |

| Personal Products | |

| Dabur India Ltd | 0.79% |

| Capital Markets | |

| Indian Energy Exchange Ltd | 0.76% |

| Food Products | |

| Nestle India Limited | 0.56% |

| Agricultural, Commercial & Construction Vehicles | |

| Ashok Leyland Limited | 0.52% |

| Textiles & Apparels | |

| Page Industries Ltd | 0.50% |

| Fertilizers & Agrochemicals | |

| Paradeep Phosphates Limited | 0.50% |

| Equity Holding Total | 96.37% |

| Cash & Other Receivables | 3.63% |

| Total | 100.00% |

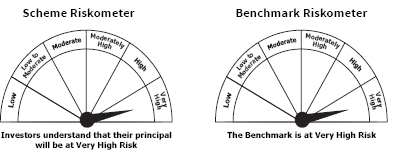

This product is suitable for investors who are seeking*

• To generate long term appreciation / income

• Investment in equity and equity related instruments across market capitalization spectrum of large cap, mid cap, small cap companies.

*Investors should consult their financial advisers if they are not clear about the suitability of the product.