MIRAE ASSET

NIFTY INDIA MANUFACTURING ETF - (MTETF)$

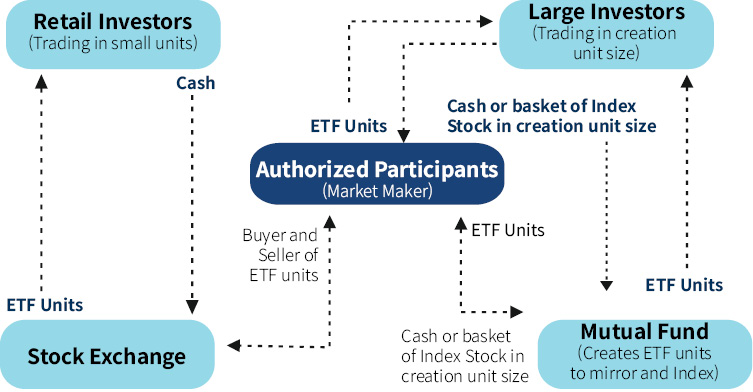

(Exchange Traded Fund - An open-ended scheme replicating/ tracking Nifty India Manufacturing ETF)

| Type of Scheme | Exchange Traded Fund - An open-ended scheme replicating/ tracking Nifty India Manufacturing ETF |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty India Manufacturing Total Return Index, subject to tracking error. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Ms. Ekta Gala (since January 27, 2022) |

| Allotment Date | 27th January 2022 |

| Benchmark Index | Nifty India Manufacturing Index (TRI) |

| Minimum Investment Amount |

On exchange: In multiples of 1 units; Directly with AMC ( in multiples of 100,000 units) |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MTETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on March 31, 2022 | 66.71 |

| Net AUM (₹ Cr.) | 67.81 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on March 31, 2022 | 0.40% |

| **For experience of Fund Managers Click Here | |

| ₹ 79.823 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

East India Securities Limited

Kanjalochana Finserve Private Limited

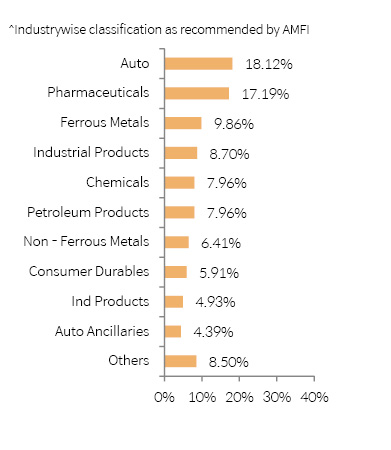

| Portfolio Holdings | % Allocation | |

| Auto | ||

| Maruti Suzuki India Ltd | 4.29% | |

| Tata Motors Ltd | 3.32% | |

| Mahindra & Mahindra Ltd | 3.30% | |

| Bajaj Auto Ltd | 2.03% | |

| Eicher Motors Ltd | 1.46% | |

| Ashok Leyland Ltd | 1.42% | |

| Hero MotoCorp Ltd | 1.27% | |

| Escorts Ltd | 1.02% | |

| Pharmaceuticals | ||

| Sun Pharmaceutical Industries Ltd | 4.53% | |

| Divi's Laboratories Ltd | 2.57% | |

| Cipla Ltd | 2.41% | |

| Dr. Reddy's Laboratories Ltd | 2.39% | |

| Laurus Labs Ltd | 1.06% | |

| Aurobindo Pharma Ltd | 0.86% | |

| Lupin Ltd | 0.83% | |

| Gland Pharma Ltd | 0.79% | |

| Biocon Ltd | 0.70% | |

| Torrent Pharmaceuticals Ltd | 0.63% | |

| Zydus Lifesciences Ltd | 0.41% | |

| Ferrous Metals | ||

| Tata Steel Ltd | 4.84% | |

| JSW Steel Ltd | 3.25% | |

| APL Apollo Tubes Ltd | 1.12% | |

| Steel Authority of India Ltd | 0.65% | |

| Industrial Products | ||

| Bharat Forge Ltd | 1.51% | |

| Astral Ltd | 1.50% | |

| Cummins India Ltd | 1.28% | |

| Supreme Industries Ltd | 1.12% | |

| Polycab India Ltd | 0.86% | |

| Grindwell Norton Ltd | 0.70% | |

| SKF India Ltd | 0.69% | |

| AIA Engineering Ltd | 0.54% | |

| Graphite India Ltd | 0.29% | |

| HEG Ltd | 0.20% | |

| Chemicals | ||

| SRF Ltd | 1.79% | |

| Pidilite Industries Ltd | 1.72% | |

| Aarti Industries Ltd | 0.89% | |

| Atul Ltd | 0.77% | |

| Deepak Nitrite Ltd | 0.76% | |

| Tata Chemicals Ltd | 0.71% | |

| Navin Fluorine International Ltd | 0.65% | |

| Linde India Ltd | 0.37% | |

| Solar Industries India Ltd | 0.31% | |

| Petroleum Products | ||

| Reliance Industries Ltd | 4.99% | |

| Bharat Petroleum Corporation Ltd | 1.57% | |

| Indian Oil Corporation Ltd | 1.39% | |

| Non - Ferrous Metals | ||

| Hindalco Industries Ltd | 3.82% | |

| Vedanta Ltd | 2.06% | |

| Hindustan Zinc Ltd | 0.36% | |

| Hindustan Copper Ltd | 0.17% | |

| Consumer Durables | ||

| Havells India Ltd | 1.32% | |

| Voltas Ltd | 1.32% | |

| Crompton Greaves Consumer Electricals Ltd | 1.02% | |

| Dixon Technologies (India) Ltd | 0.73% | |

| Bata India Ltd | 0.54% | |

| Kajaria Ceramics Ltd | 0.39% | |

| Relaxo Footwears Ltd | 0.35% | |

| Whirlpool of India Ltd | 0.23% | |

| Industrial Capital Goods | ||

| Siemens Ltd | 1.77% | |

| ABB India Ltd | 0.96% | |

| CG Power and Industrial Solutions Ltd | 0.93% | |

| Honeywell Automation India Ltd | 0.73% | |

| Bharat Heavy Electricals Ltd | 0.53% | |

| Auto Ancillaries | ||

| Balkrishna Industries Ltd | 0.74% | |

| Tube Investments of India Ltd | 0.68% | |

| MRF Ltd | 0.58% | |

| Sona BLW Precision Forgings Ltd | 0.56% | |

| Bosch Ltd | 0.53% | |

| Sundram Fasteners Ltd | 0.40% | |

| Minda Industries Ltd | 0.38% | |

| Exide Industries Ltd | 0.30% | |

| Amara Raja Batteries Ltd | 0.23% | |

| Aerospace & Defense | ||

| Bharat Electronics Ltd | 2.12% | |

| Hindustan Aeronautics Ltd | 1.04% | |

| Pesticides | ||

| UPL Ltd | 1.94% | |

| PI Industries Ltd | 1.04% | |

| Textile Products | ||

| Page Industries Ltd | 1.17% | |

| Trident Ltd | 0.31% | |

| Welspun India Ltd | 0.12% | |

| Fertilisers | ||

| Coromandel International Ltd | 0.44% | |

| Chambal Fertilizers & Chemicals Ltd | 0.32% | |

| Equity Holding Total | 99.92% | |

| Cash & Other Receivables Total | 0.08% | |

| Total | 100.00% | |

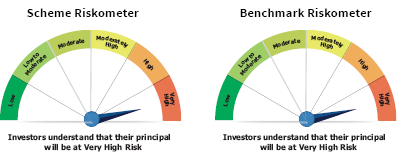

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of the Nifty India Manufacturing Total Return Index, subject to tracking error over long term

• Investment in equity securities coverd by Nifty India Manufacturing Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : Since the scheme is in existence for less than 6 Month, as per SEBI regulation performance of the scheme has not been shown. The performance of other funds managed by the same fund manager is given in the respective page of the schemes