MIRAE ASSET

NIFTY FINANCIAL SERVICES ETF - (MANFSETF)$

(Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking Nifty Financial Services Total Return Index)

| Type of Scheme | Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking Nifty Financial Services Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the Nifty Financial Services Total Return Index, subject to tracking error. The Scheme does not guarantee or assure any returns |

Fund Manager** |

Ms. Ekta Gala (since July 30, 2021) |

| Allotment Date | 30th July 2021 |

| Benchmark Index | Nifty Financial Services (TRI) |

| Minimum Investment Amount |

On exchange ( in multiple of 1 units), Directly with AMC ( in multiple of 3,00,000 units) |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

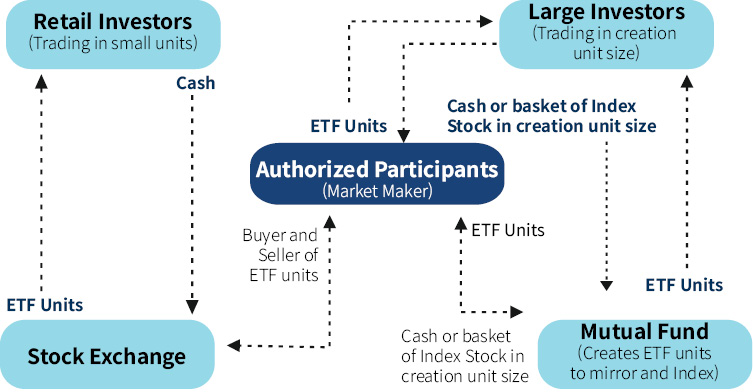

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MANFSETF in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on December 31, 2021 | 93.72 |

| Net AUM (₹ Cr.) | 96.62 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on December 31, 2021 | 0.13% |

| **For experience of Fund Managers Click Here | |

| ₹ 17.319 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

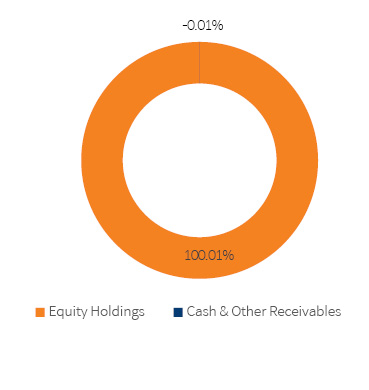

| Portfolio Holdings | % Allocation | |

| Banks | ||

| HDFC Bank Ltd | 22.75% | |

| ICICI Bank Ltd | 18.05% | |

| Kotak Mahindra Bank Ltd | 9.26% | |

| State Bank of India | 6.21% | |

| Axis Bank Ltd | 6.14% | |

| Finance | ||

| Housing Development Finance Corporation Ltd | 16.43% | |

| Bajaj Finance Ltd | 6.51% | |

| Piramal Enterprises Ltd | 1.24% | |

| Shriram Transport Finance Company Ltd | 0.86% | |

| Cholamandalam Investment and Finance Company Ltd | 0.72% | |

| Muthoot Finance Ltd | 0.57% | |

| Power Finance Corporation Ltd | 0.49% | |

| REC Ltd | 0.44% | |

| Mahindra & Mahindra Financial Services Ltd | 0.31% | |

| Insurance | ||

| Bajaj Finserv Ltd | 3.48% | |

| HDFC Life Insurance Company Ltd | 2.13% | |

| SBI Life Insurance Company Ltd | 1.85% | |

| ICICI Lombard General Insurance Company Ltd | 1.26% | |

| ICICI Prudential Life Insurance Company Ltd | 0.76% | |

| Capital Markets | ||

| HDFC Asset Management Company Ltd | 0.57% | |

| Equity Holding Total | 100.01% | |

| Cash & Other Receivables Total | -0.01% | |

| Total | 100.00% | |

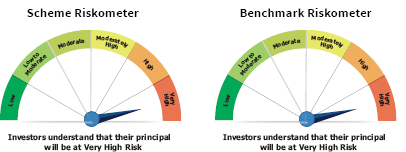

This product is suitable for investors who are seeking*

• Return that are commensurate with the performance of nifty financial service Total return Index,subject to tracking error over long term

• Investments in equity securities covered by Nifty Financial Services Total Return index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : Since the scheme is in existence for less than 6 Month, as per SEBI regulation performance of the scheme has not been shown. The performance of other funds managed by the same fund manager is given in the respective page of the schemes