MIRAE ASSET

NYSE FANG+ ETF - (MAFANG)

(Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking NYSE FANG+ Total Return Index)

| Type of Scheme | Exchange Traded Fund (ETF) - An open-ended scheme replicating/tracking NYSE FANG+ Total Return Index |

| Investment Objective | The investment objective of the scheme is to generate returns, before expenses, that are commensurate with the performance of the NYSE FANG+ Total Return Index, subject to tracking error and forex movement. The Scheme does not guarantee or assure any returns. |

Fund Manager** |

Mr. Siddharth Srivastava (since May 06, 2021) |

| Allotment Date | 06th May, 2021 |

| Benchmark Index | NYSE FANG+ Index (TRI) |

| Minimum Investment Amount |

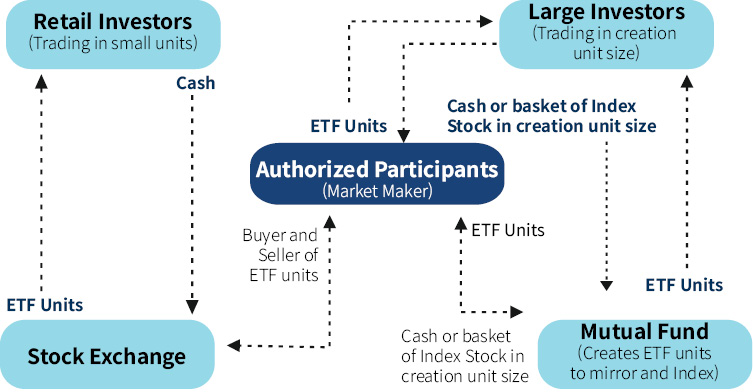

On exchange (in multiple of 1 units), Directly with AMC or Authorized Participant (in multiple of 2,00,000 units) |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

NA |

| Load Structure | Entry load: NA Exit load: For Creation Unit Size: No Exit load will be levied on redemptions made by Authorized Participants / Large Investors directly with the Fund in Creation Unit Size. For other than Creation Unit Size: Not Applicable -The Units of MAFANG in other than Creation Unit Size cannot ordinarily be directly redeemed with the Fund. These Units can be redeemed (sold) on a continuous basis on the Exchange(s) where it is listed during the trading hours on all trading days. |

| Plans Available Options Available |

The Scheme does not offer any Plans/Options for investment |

| Monthly Average AUM (₹ Cr.) as on December 31, 2021 | 1,349.09 |

| Net AUM (₹ Cr.) | 1,359.64 |

| Monthly Avg. Expense Ratio (Including Statutory Levies) as on December 31, 2021 | 0.53% |

| **For experience of Fund Managers Click Here | |

| ^Pursuant to Notice cum addendum dated March 27, 2021 the nomenclature of dividend option has been changed w.e.f. April 01, 2021. | |

| ₹ 55.292 (Per Unit) |

Mirae Asset Capital Markets (India) Private Limited

| Portfolio Holdings | % Allocation | |

| Tesla Inc | 10.94% | |

| Nvidia Corp Com | 10.21% | |

| Microsoft Corp | 10.03% | |

| Apple Inc | 10.02% | |

| Netflix Inc | 9.91% | |

| Alphabet Inc A | 9.87% | |

| Facebook Inc | 9.73% | |

| Amazon Com Inc | 9.47% | |

| International Equity Holding Total | 80.17% | |

| American Depository Receipt | ||

| Baidu Inc Spon ADR | 10.12% | |

| Alibaba Group Holding Ltd | 9.39% | |

| American Depository Receipt Total | 19.52% | |

| Cash & Other Receivables | 0.31% | |

| Total | 100.00% | |

| Returns (in%) | ||||

| Since Inception* | ||||

| MAFANG | 13.29 |

|||

| Scheme Benchmark* | 13.38 |

|||

| Additional Benchmark** | 22.66 |

|||

| NAV as on 31st December, 2021 | 55.292 | |||

| Index Value (31st December, 2021) | Index Value of benchmark is 9,206.94 and S&P BSE Sensex (TRI) is 86,926.99 | |||

| Allotment Date | 06th May, 2021 | |||

| Scheme Benchmark | *NYSE FANG+ Index (TRI) | |||

| Additional Benchmark | **S&P BSE Sensex (TRI) | |||

*Absolute Return (less than one year)

Note:Fund manager : Mr. Siddharth Srivastava managing the scheme since May 06, 2021.

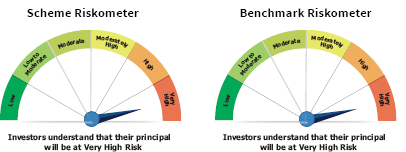

This product is suitable for investors who are seeking*

• Returns that are commensurate with the performance of NYSE FANG+ Total Return Index.subject to tracking error and foreign exchange movement

• Investments in equity securities covered by NYSE FANG+ Total Return Index

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

Past Performance may or may not be sustained in future.

Note : For computation of since inception returns (%) the allotment NAV has been taken as ₹ 22.305. The performance of other funds managed by the same fund manager is given in the respective page of the schemes