SWP in Hybrid Aggressive Funds

What is Systematic Withdrawal Plan?

Systematic Withdrawal Plan (SWP) is an investment solution offered by mutual funds, whereby you can draw fixed amounts from your mutual fund investment at regular intervals (e.g. monthly). SWP works by redeeming the required number of units at prevailing NAVs to meet your SWP cash-flows. The SWP will continue as long you have sufficient unit balance to meet your cash-flows.

How does SWP work?

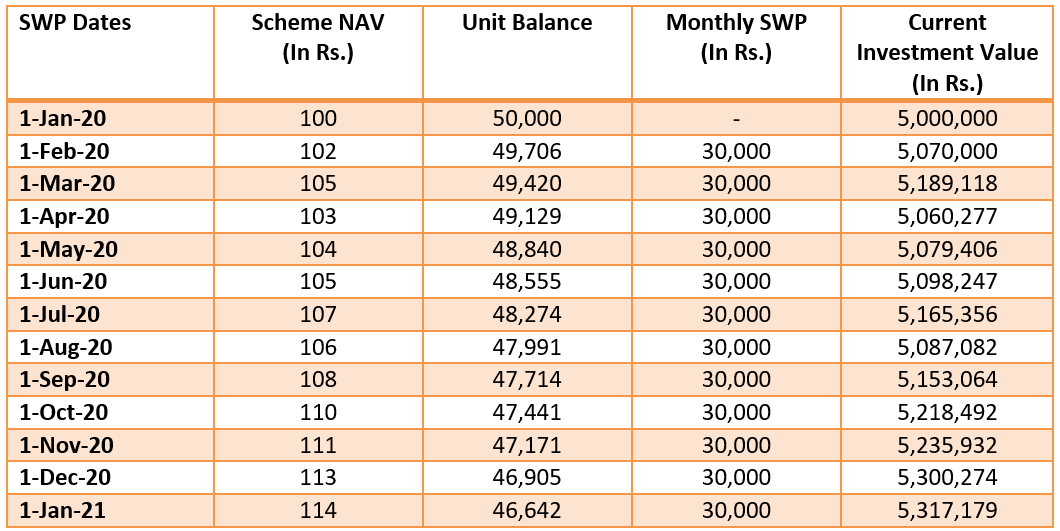

Suppose, you invested Rs 50 Lakhs in a mutual fund scheme at a NAV of Rs 100 per unit on 1st January 2020. You started a SWP of Rs 30,000 per month (SWP payment to be made on 1st day of the month) starting 1st February. The table below shows the cash-flows for the hypothetical NAV movement and the change in value of your investment. You can see that your unit balance will diminish over time. However, if the scheme return over the SWP period is higher than the withdrawal rate, the value of your investment can grow over time.

SWP versus Dividends

Mutual fund schemes, especially hybrid schemes, paying regular monthly dividends have been very popular with investors who want regular cash-flows for several years. However, investors should also consider SWP for the following reasons:-

- Investors should know that mutual fund dividends are not guaranteed. As per SEBI’s regulation, dividends must be paid from the accumulated profits of the scheme. The dividend payout rate may change at the discretion of the fund house. A fund house may also decide to stop paying dividends for a period of time if situation warrants.

- The Government abolished Dividend Distribution Tax (DDT) in the 2020 Union Budget and made dividends taxable in the hands of the investors. Dividends received by you (either from equity or debt funds) will be added to taxable income and taxed according to your income tax slab.

- In SWP, you will continue to receive fixed cash-flows irrespective of market conditions as long as you have sufficient unit balance.

- SWP is subject to capital gains taxation. If you make profits on units redeemed for SWP payments in equity or equity oriented funds within 12 months from the date of investment, the same will be taxed at 15% (short term capital gains tax). Profits on unit redeemed for SWP payments in equity oriented funds after 12 months from the date of investment are tax exempt for up to Rs 1 lakh of profit in a financial year and taxed at 10% thereafter (long term capital gains tax). From a taxation viewpoint, SWP enjoys a significant advantage of dividends for investors in the higher tax brackets.

Aggressive Hybrid Funds can be good investment options for SWP

- Aggressive Hybrid Funds are hybrid mutual fund schemes which invest 65 to 80% of their assets in equity and equity related securities and 20 to 35% of their assets in debt and money market instruments.

- Aggressive Hybrid Funds have wealth creation potential over long investment horizons. The chart below shows the growth of Rs 10,000 investment in aggressive hybrid portfolio comprising 65% of Nifty 50 TRI and 35% Nifty 10 year benchmark G-Sec Index, compared with Rs 10,000 investment in Nifty 10 year benchmark G-Sec Index over the last 10 years. In the last 10 years the aggressive hybrid portfolio gave 11.3% CAGR returns. In SWP, higher returns provide twin benefits of (a) regular fixed cash-flows) and (b) potential capital appreciation. We will discuss this with the help an example later in this article.

- The asset allocation of hybrid funds reduces volatility compared to equity funds. The chart below shows the growth of Rs 10,000 investment in aggressive hybrid portfolio comprising 65% of Nifty 50 TRI and 35% Nifty 10 year benchmark G-Sec Index, compared with Rs 10,000 investment in Nifty 50 TRI over the last 10 years. You can see that the hybrid aggressive portfolio gave comparable returns, its volatility was significantly lower than Nifty – smaller drawdowns. SWP withdrawals made during large drawdowns can result in redemptions of larger number of units. Lesser downside risks of aggressive funds make them more suited for SWPs compared to equity funds.

- Though Aggressive Hybrid Funds can be a more volatile than other equity oriented hybrid funds e.g. Dynamic Asset Allocation Funds, Equity Savings Funds etc, they have historically given significantly higher returns over sufficiently investment horizons. As mentioned earlier, higher returns can lead to higher capital appreciation for moderate SWP withdrawal rate.

- Aggressive Hybrid Funds are taxed as equity funds. Equity taxation is of great advantage in SWPs.

Example of SWP in Aggressive Hybrid Fund

Let us assume, you invested Rs 20 lakhs in a hypothetical Aggressive Hybrid Fund whose portfolio comprises of 65% Nifty 50 TRI and 35% Nifty 10 year benchmark G-Sec Index on 1st June 2010. You began a SWP of Rs 10,000 per month from 1st June 2011 and continued till 31st May 2021. We are starting our SWP a year after our investment to avoid exit load and short term capital gains tax. The results of the SWP are shown below. You can see that, despite substantial withdrawal, you were able to see significant capital appreciation.

Conclusion

SWP is a tax efficient investment option for getting regular fixed cash-flows from your investments. We have discussed in this article, why Aggressive Hybrid Funds may be well suited for SWP over long tenures. However, you must be prudent in planning your SWP and ensure that your withdrawal rate is reasonable. If your withdrawal rate is very high then you may not be able to continue your SWP for very long. Investors should consult with their financial advisors in planning SWPs for their regular cash-flow needs.

For information on one-time KYC (Know Your Customer) process, Registered Mutual Funds and procedure to lodge a complaint in case of any grievance Click here!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.